Latest Posts

rssI thought insider trading was illegal ???

https://t.co/MUarqfP6pz?amp=1

10 year yield test the swing highs from August and September, but stalls the

Yield up from 1.344% a week ago

The 10 year yield closed last Friday at 1.344%. The current yield is around 1.372%. So for the week, the yield is up a little less than three basis points. That’s not all that much.

Looking at the week, the yield move down on Monday and Tuesday bottoming near the September low around 1.267% (the low yield reach 1.263%). The last three trading days has seen a move to the upside on each successive day. Today the high yield reached 1.385%. That equaled the high for the month of September at the same level. The price has not traded above that yield since July 14.

Also being tested at the highs is the 38.2% retracement at 1.375%, and at that same level sits the 200 hour moving average.

Next week, if the yield can get above the recent swing highs up to 1.385%, the next target would be the falling 100 hour moving average at 1.415%. The price has not traded above its 100 day moving average since June 17. If the yield is to move higher, getting above that moving average would be a bullish tilt.

The aforementioned 200 hour moving average has seen the price trading above and below that moving average level on a number of occasions over the last three calendar months. The first close below the 200 day moving average was back on July 19. Since then, there have been 16 trading days that have seen the price trade above and below (or just above) that moving average including today (44 total bars). From the low yield of 1.129%, the price has moved up a total of 25.6 basis point over 43 trading days, but there has been a number of up and down swing moves.

So next week will be dependent on what happens at 1.385%. Move above and then above the 100 hour moving average and the yield trend should see more upside momentum. Stay below, and we have a potential to rotate back toward the 1.267% low yield for the month of September.

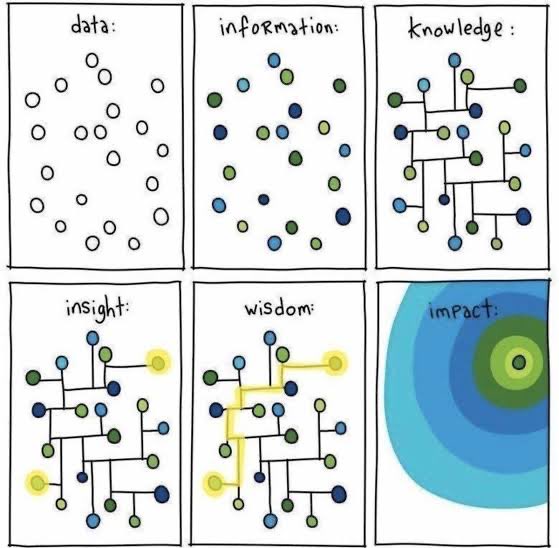

data → info → knowledge → insight → wisdom → impact

Major indices close lower for the day and lower for the week

Both the NASDAQ index and S&P index declined by -0.91% in trading today

The major indices are closing lower for the day and also lower for the week. Both the NASDAQ index and S&P index fell by equal -0.91%. The Dow industrial average fell by -0.48%.

The final numbers are showing:

- Dow industrial average -166.44 points or -0.48% at 34584.87

- S&P index -40.78 points or -0.91% at 4432.98

- NASDAQ is down 137.95 points or -0.91% at 15043.98

For the week,

- Dow, -0.07%

- S&P index -0.56%

- NASDAQ index -0.47%.

The strongest currency today was the US dollar. The weakest was the Canadian dollar. The US session saw the dollar moved to the highs help by rising interest rates.

Thought For A Day

Major European indices close the week mostly lower

Spain’s Ibex the one exception

Spain’s Ibex the one exception

The major European indices are closing the the week mostly lower. The exception is the Spain’s Ibex which rose 0.35%.

The provisional closes are showing:

- German DAX, -1.1%

- France’s CAC, -0.9%

- UK’s FTSE 100, -1.1%

- Spain’s Ibex, +0.50%

- Italy’s FTSE MIB -0.75%

For the week, the major indices or showing mixed results:

- German DAX, -0.8%

- France’s CAC -1.5%

- UK’s FTSE 100 -1.1%

- Spain’s Ibex +0.9%

- Italy’s FTSE MIB +0.3%

In other markets as European/London traders look to exit shows:

- Spot gold unchanged at $1753.80.

- Spot silver $-0.38 or -1.69% at $22.50.

- Crude oil futures $1.11 or -1.5% at $71.53

- Bitcoin $-240 and $47,520

In the US stock market, the NASDAQ index is down over 1% and leading the way to the downside. The S&P index and Dow industrial average also lower:

- Dow -202 points or -0.58% at 34549.39

- S&P index -37.35 points or -0.83% 4436.50

- NASDAQ index -161 points or -1.06% at 15021.50

USDCAD trades to new week highs

Crude oil lower. Dollar buying. Yields higher. Stocks lower.

The USDCAD is moving to a new week high as crude oil moves lower, the dollar moved higher as yields move higher and stocks move lower. The combination is a negative for the CAD and a positive for flights into the USD.

The pair is currently up testing the September 9 high price of 1.27269 after moving above its 50% retracement at 1.27204 of the move down from the August 20 high to the September 3 low. A move above 1.27269, opens the door for a move toward the September 8 high at 1.27607. 61.8% retracement of the move down comes in at 1.27742.

The swing high from Wednesday at 1.270781 is now a risk level. Stay above is more bullish

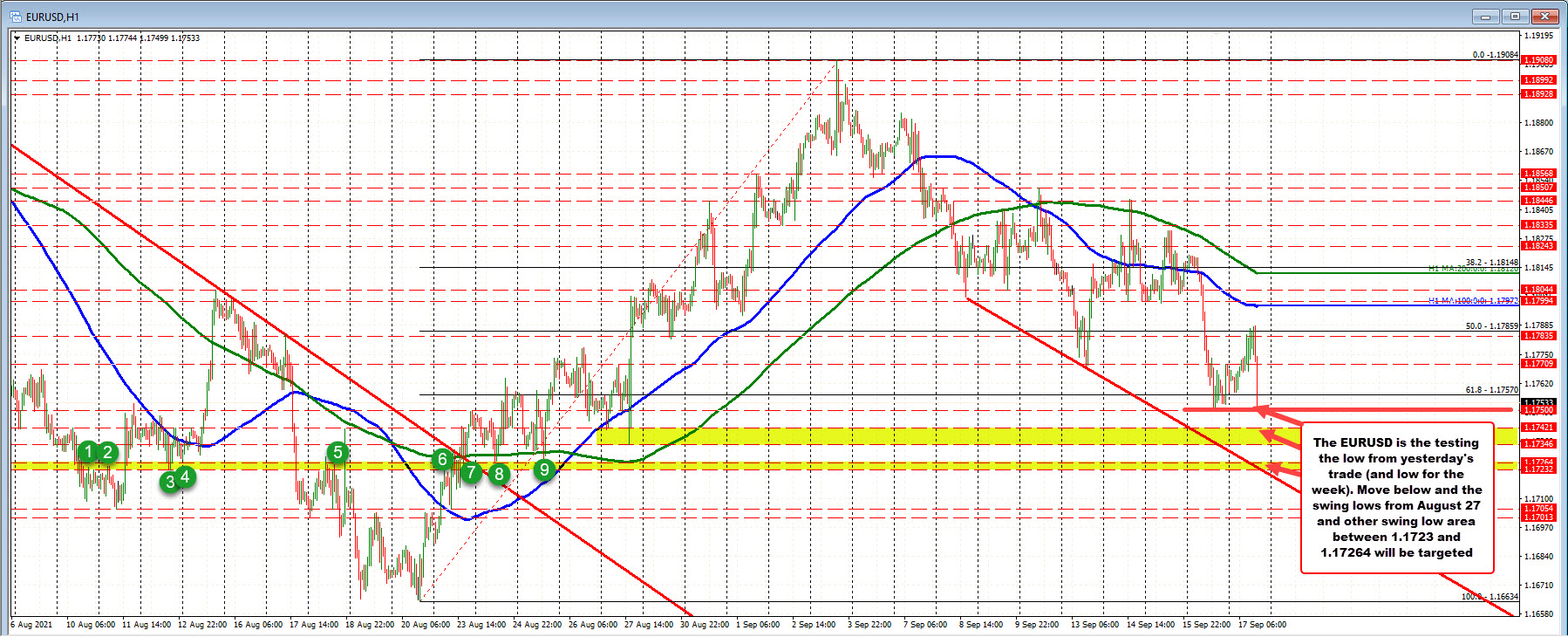

EURUSD tests the lows for the week

Dollar buying as yields move higher and stocks move lower

The EURUSD it is testing the lows for the week reached yesterday at 1.1750 as US yields move higher and stocks move lower. The NASDAQ index and S&P index are now down -0.54%. The 10 year yield is up 3.9 basis points at 1.3700%.

The pair is now below the 61.8% retracement at 1.1757. The next targets are the swing lows from August 27 at 1.1742 and 1.17346. Below that the the pair will target the swing area between 1.1723 and 1.17264.

US 10-year yields rise to the highest in 10 days

Rates move up

If you keep on knocking, eventually they’ll let you in.

US 10-year yields are up 4.4 bps today and once again threatening the Sept/Aug highs.

I struggle to see this breaking ahead of the weekend and ahead of the FOMC but keep a close eye on it.

Spain’s Ibex the one exception

Spain’s Ibex the one exception