S&P index down near 2%

the major stock indices are moving to the downside going into the close. The Dow industrial average is down 561 points or -1.61% at 34310.54. The S&P index is down 88 points or -1.99% 4354.66. The NASDAQ is index is down -408 points or -2.73% 14559.

For the S&P index is getting close to its 100 day moving average at 4342.11. A move in close below that level would be more bearish going forward.

In the forex, the US dollar remains the strongest of the majors with the moves against the GBP, NZD and AUD the biggest movers (1.17%, 0.84% and 0.65%). The GBP is the weakest of the major currency pairs today. The dollar index moved to a new year high today and is up 4.18% on the year.

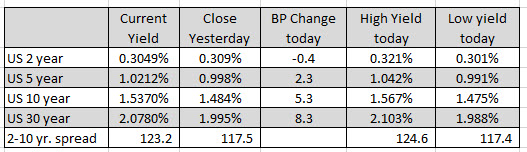

In the US debt market, the 10 year yields are up 5.3 basis points while the 30 year yield is up 8.3 basis point and trades comfortably above the 2.0% level at 2.078%. The 2– 10 year spread has widened from 117.5 basis points to 123.2 basis points today.