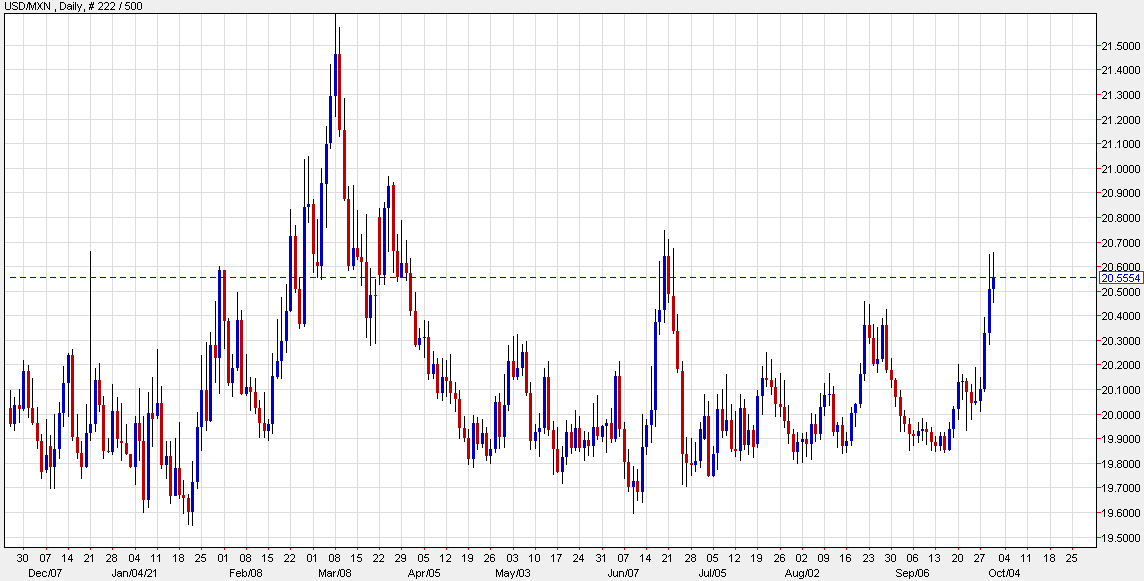

Hong Kong markets are closed, as is China for National Day.

For major FX centres in HK’s absence, all open:

- New Zealand

- Australia

- Japan

- Singapore

China is out for Golden Week October 1 through October 7

Markets:

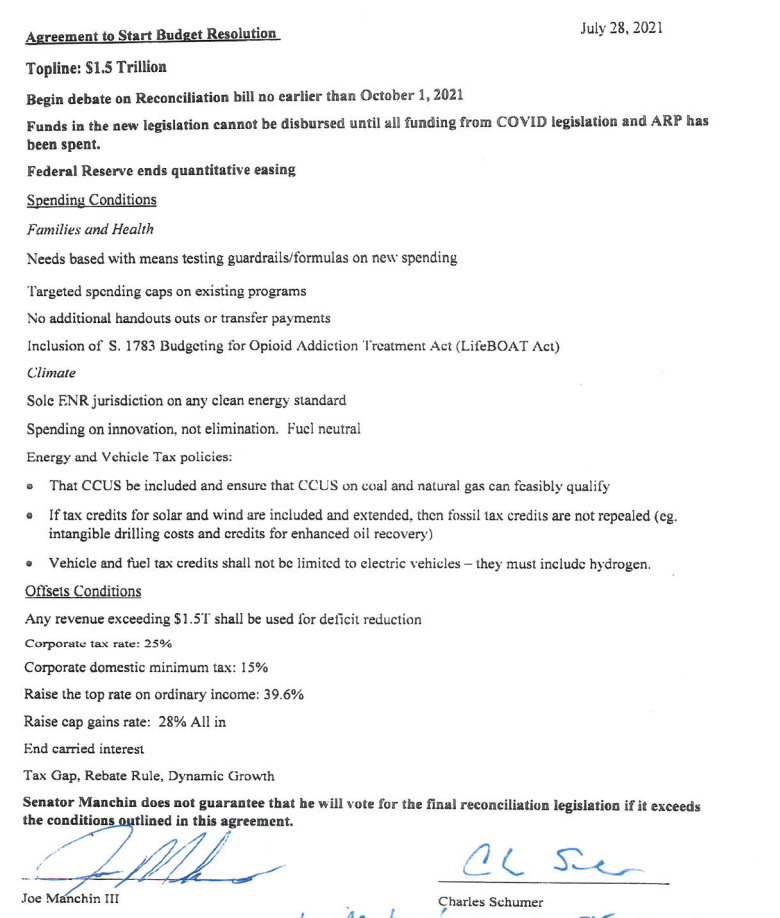

Manchin proposes raising the corporate tax rate to 25%, the top tax rate on income to 39.6%, raising the capital gains tax rate to 28% and says that any revenue from the bill “exceeding” $1.5T will go to deficit reduction. Also asks Fed to stop quantitative easing program Additionally, Manchin is calling for means testing on as many new programs as possible, “targeted spending caps on existing programs” and “no additional handouts or transfer programs.” Manchin also asks his committee have sole jurisdiction over any clean energy standard

Biden and the White House have been engaging in breakneck negotiations with Sen. Kyrsten Sinema (D-Ariz.), the other prominent holdout in the Senate. She’s generally aligned with Manchin on the spending number, but has expressed more concerns with Democrats’ tax plans than Manchin has.

The major European indices are closing the day (and the month) in the red.