To learn and develop as a trader, it is important to have a solid understanding of the markets and the assets in which you plan to trade. This can be achieved through education and research, such as reading books, taking online courses, and studying market data. It is also important to have a trading plan and to stick to it, as well as to practice risk management techniques to minimize losses. Additionally, it can be helpful to seek mentorship or guidance from experienced traders and to actively engage in a community of traders to learn from others and stay up to date on market developments.

Latest Posts

rssEmotional Intelligence in trading -#AnirudhSethi

Emotional intelligence (EI) refers to the ability to recognize, understand, and manage one’s own emotions, as well as the emotions of others. In the context of trading, EI is important because it can help traders make more informed and rational decisions, rather than basing their decisions on emotions such as fear or greed.

Traders with high emotional intelligence are typically better able to:

- Remain calm under pressure: EI helps traders to remain level-headed and avoid making impulsive decisions when the markets become volatile.

- Control their emotions: EI helps traders to manage their emotions, such as fear and greed, and to avoid letting them cloud their judgment.

- Take responsibility for their actions: EI helps traders to take ownership of their decisions and to learn from their mistakes.

- Communicate effectively: EI helps traders to communicate with others, such as colleagues and clients, in a way that is respectful and productive.

- Adapt to change: EI helps traders to be more flexible and adapt to changes in the market.

- Develop a trading plan: Traders with EI are better able to set clear objectives and develop a trading plan that aligns with those objectives.

- Understand market trends: Traders with EI are better able to understand the market trends and make informed decisions based on the data they have.

Traders can improve their emotional intelligence by practicing mindfulness, learning stress management techniques, and seeking feedback from others. Additionally, many traders find it helpful to work with a coach or therapist to develop their emotional intelligence skills.

Behavioural patterns in trading- #AnirudhSethi

There are several behavioral patterns that traders may exhibit that can negatively impact their trading performance. Some of the most common behavioral patterns include:

- Overconfidence: Many traders believe they have a better understanding of the market than they actually do, leading them to make overly aggressive trades.

- Anchoring: Traders may fixate on a specific price or level and refuse to adjust their expectations, even when market conditions change.

- Herd mentality: Traders may follow the actions of others without considering the underlying fundamentals of the market.

- Loss aversion: Traders may be more focused on avoiding losses than on making profits, which can lead to missed opportunities.

- Emotional decision making: Traders may make decisions based on fear, greed, or other emotions rather than on logic and analysis.

- Over-trading: Traders may trade too frequently, leading to increased costs and reduced profits.

- Impatience: Traders may want to see quick returns and may enter or exit trades too soon.

- Confirmation bias: Traders may look for information that confirms their existing beliefs and ignore information that contradicts their beliefs.

It’s important for traders to be aware of these behavioral patterns and to take steps to overcome them, such as developing a trading plan, setting clear rules and sticking to them, and avoiding emotional decision making.

Crucial Update : #Bitcoin #BTCUSD #ETHUSD #XRPUSD #BNBUSD -#AnirudhSethi

To read more enter password and Unlock more engaging content

Crucial Update : #WTI #BRENT #NaturalGas —#AnirudhSethi

To read more enter password and Unlock more engaging content

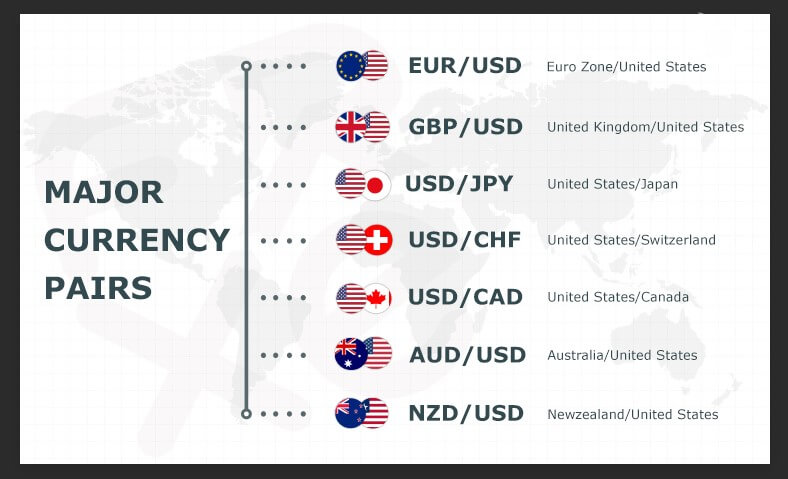

Crucial Update : #USDOLLARINDEX $USD #EUROINDEX #USDINR #GBPINR #EURUSD #USDJPY #GBPUSD #AUDUSD -#AnirudhSethi

An Update : #COPPER #ZINC #LEAD #ALUMINUM #NICKEL #IRONORE #STEEL —#AnirudhSethi

To read more enter password and Unlock more engaging content

Crucial Update : #GOLD #SILVER #PALLADIUM #PLATINUM –#AnirudhSethi

To read more enter password and Unlock more engaging content

Thought For A Day

You Don’t Trade the Markets: You Trade Your Beliefs About the Markets -#AnirudhSethi

The statement “You don’t trade the markets, you trade your beliefs about the markets” highlights the fact that our beliefs and perceptions about the markets can greatly influence our trading decisions and outcomes. Our beliefs are shaped by past experiences, emotions, and biases and these factors can lead to self-sabotaging behaviors and decision-making.For example, a trader who has a belief that the market is unpredictable and unreliable, may make impulsive trades or avoid taking trades altogether, while a trader who believes that the market is predictable, may become overconfident and take on too much risk.Traders who are aware of their beliefs and how they influence their actions, can work to overcome limiting beliefs and develop a more positive and productive mindset. This can be done through self-reflection and self-awareness, by seeking out new perspectives and information, and by challenging one’s own assumptions about the markets.Additionally, it’s important to understand that the markets themselves do not have any inherent meaning, it’s the interpretation and meaning we give to them that shapes our beliefs and perceptions. By being aware of this, traders can take a more objective and less emotional approach to the markets and make more informed and rational decisions.In summary, the statement “You don’t trade the markets, you trade your beliefs about the markets” is a reminder that our beliefs and perceptions about the markets can greatly influence our trading decisions and outcomes, and that traders should be aware of their beliefs and how they shape their actions. By developing a more positive and productive mindset, traders can increase their chances of success in the markets.