Latest Posts

rssChina’s state planner threatens coal market intervention

The National Development and Reform Commission of the People’s Republic of China (NDRC) is China’s ‘state planner’

ICYMI, overnight the NDRC said it was looking at ways to intervene in coal markets, seeking to bring record high prices down to a “reasonable range”. The NDRC also said it has zero tolerance for those spreading false information. The NDRC held meetings Tuesday with coal producers, the industry association and the China Electricity Council.

Additionally, Zhengzhou’s Commodity Exchange said it will adjust the trading limits on coal futures to 10% effective 20 October.

Prices for coal futures have dropped in response during overnight trade.

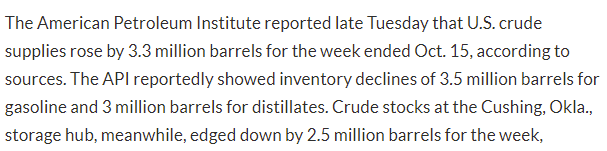

Private oil survey data shows build in crude oil inventory

Estimates were:

- Crude +1.9m bbls

- Gasoline -1.3m

- Distillate -3m

US major indices close higher. S&P and NASDAQ close higher for the 5th day

Dow industrial average bounces back from declines yesterday

The major indices are closing higher with the S&P and NASDAQ now up for the fifth consecutive day.

- The NASDAQ index is trading less than the 2% from its all-time high

- The S&P index is less than 1% from its all-time high

- S&P and NASDAQ post the longest win streak since August

The final numbers are showing:

- Dow industrial average up 199.1 points or 0.56% at 35,457.71

- S&P index up 33.2 points or 0.74% at 4519.66

- NASDAQ index +107 points or 0.71% at 15129.10

Netflix reported higher earnings with higher revenues after the close

- earnings-per-share $3.19 versus $2.56

- revenues $7.48 billion which is as expected

- Net subscriber additions 4.38 million versus 3.8 million estimate

Netflix shares are trading up $10 or 1.72% at around $650.

Thought For A Day

Global Dairy Trade price index rises by 2.2%

The index has been up or unchanges for 5 consecutive releases

The most recent global dairy trade price index rose by 2.2%.

The index has been up or unchanged for five consecutive releases (the last release was unchanged). However, it had been down for a number of releases before the run to the upside.

European major indices end mostly higher

France’s CAC unchanged on the day

The European major indices are ending mostly higher. The France’s CAC is unchanged to down marginally.

The provisional closes are showing:

- German DAX, +0.33%

- France’s CAC, unchanged

- UK’s FTSE 100, +0.25%

- Spain’s Ibex, +0.65%

- Italy’s FTSE MIB, +0.5%

in other markets as London/European traders look to exit:

- Spot gold is trading up $6.08 or 0.34% $1770.40

- Spot silver is up $0.69 or is 3.0% at $23.87

- WTI crude oil futures are trading up $1.16 or 1.42% at $83.44

- The price of bitcoin is back positive at plus $600 or 0.96% at $62,628. The high for the day did reach $63,337.54

In the US stock market, the major indices remain higher on the day. The NASDAQ and S&P are working on their fifth consecutive day to the upside.

- Dow industrial average +157 points or 0.45% at 35416.32

- S&P index up 26.48 points or 0.59% at 4513

- NASDAQ index up 88.58 points or 0.59% at 15111

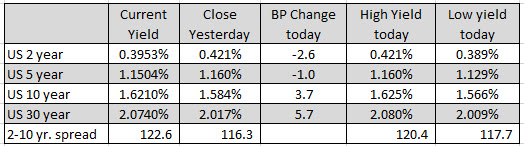

In the US debt market, the longer end yields are higher while the short run yields are lower increasing the yield spread. The two – 10 year spread is up to 122.6 basis points from 116.3 basis points at the close yesterday.

When emotions rise, intellect drops.

Bitcoin ETF set to start trading

I expect this will be one of the best ETF debuts ever

Welcome to the BITO era in bitcoin trading.

That’s the ticker for the Bitcoin futures ETF that’s set to debut at the bottom of the hour. I would have loved to see multiple bitcoin ETFs approved at the same time so we could see a horse race and have the market decides. As we saw in Canada, the first out of the gate gets all the volume and the race is pretty much over after that.