Latest Posts

rssAvoid this mistake.

Instead of having Enter and Target Price, Have regions and zones. You should be taking Profits at multiple zones and not at a certain fixed price. This avoids free market participation and missed Profits. Eg. Entry 2 Targets 5,6,7,8 instead of just 7.

Key week for earnings with many of the top companies reporting

Facebook, Apple, Alphabet (Google), Amazon, Microsoft, Boeing, McDonald’s, Starbucks, Exxon Mobil all scheduled to report

The new week will have a number of key earnings releases with some of the top companies reporting. Below is a look at the major names on the calendar:

- Kimberly-Clark

- 3M

- Alphabet

- GE

- Lockheed Martin

- Raytheon technologies

- Microsoft

- Corning

- Aflac

- Apple

- Bristol-Myers Squibb

- Boston Scientific

- Boeing

- Coca-Cola

- Ford

- McDonald’s

- General Dynamics

- Hess corporation

- eBay

- ServiceNow

- Spotify

- Amazon

- Merck

- Stryker

- US Steel Corporation

- Starbucks

- Caterpillar

- Comcast

- Gilead Sciences

- Sirius XM

- MasterCard

- VeriSign

- Shopify

- Phillips 66

- Exxon Mobil

- Colgate-Palmolive

Remember this…

S&P index snaps a seven day winning streak

NASDAQ index lower for the second time in three trading days

NASDAQ index lower for the second time in three trading days

The S&P index snapped a seven day winning streak with a modest decline of around five points or -0.11%.

- The Dow industrial average posts a record close and is up for the third day in a row. The Dow’s record close was the first since August 16

- The NASDAQ index was the big loser with a decline of -0.82%

- The major indices close higher for the third week in a row

- Dow industrial average up 73.94 points or 0.21% at 35677.02

- S&P index down 4.84 points or -0.11% at 4544.95

- NASDAQ index -125.50 points or -0.82% at 15090.20

- Dow industrial average rose by 1.08%

- S&P index rose by 1.64%

- NASDAQ index rose by 1.29%

Thought For A Day

7 Deadly Sins on Social Media

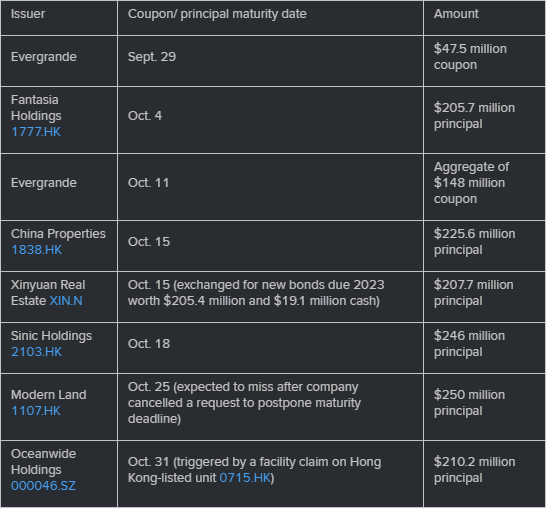

Evergrande main unit says cannot guarantee that financial obligations will continue to be met

A statement released by Evergrande main unit, Hengda Real Estate

Eurozone October flash services PMI 54.7 vs 55.5 expected

Latest data released by Markit – 22 October 2021

- Prior 56.4

- Manufacturing PMI 58.5 vs 57.0 expected

- Prior 58.6

- Composite PMI 54.3 vs 55.2 expected

- Prior 56.2

Softer readings across the board, with overall business activity growth weakening to its slowest in six months. The details reveal that supply bottlenecks are a key issue, weighing on manufacturing output as it slumps to its weakest in 16 months.

Evergrande makes bond payment but be mindful that there are other names in a tough spot too

NASDAQ index lower for the second time in three trading days

NASDAQ index lower for the second time in three trading days