It is the first week of the new month which means purchasing managers data along with the US and Canada jobs report are on tap

The month of October has come and gone, and with it the major economic releases for the new month restart their cycle. Traditionally, PMI data kicks off the key releases for the month. Then on Friday, US and Canada jobs reports will end the week.

- Japan final manufacturing PMI, 0030 GMT. Estimate 53 versus 53 preliminary

- German retail sales 3 AM ET/0700 GMT. Estimate 0.5% versus 1.1% last month

- Swiss manufacturing PMI, 4:30 AM ET/0830 GMT. Estimate 65.9 versus 68.1 last month

- UK final manufacturing PMI, 5:30 AM ET/0930 GMT. Estimate 57.7 versus 57.7 pulmonary

- US ISM manufacturing PMI, 10 AM ET/1400 GMT. Estimate 60.4 versus 61.1 last month

- Canada manufacturing PMI, 10:30 AM ET/1430 GMT. Last month 57.0

- RBA rate decision 11:30 PM ET/0330 GMT. No change expected

- Swiss retail sales 3:30 AM ET/0730 GMT. Estimate 1.4% versus 0.5%

- Swiss CPI, 3:30 AM ET/0730 GMT. Estimate 0.2% versus 0.0% last month

- German final manufacturing PMI. 4:55 AM ET/0855 GMT. 50.2 versus 50.2 preliminary

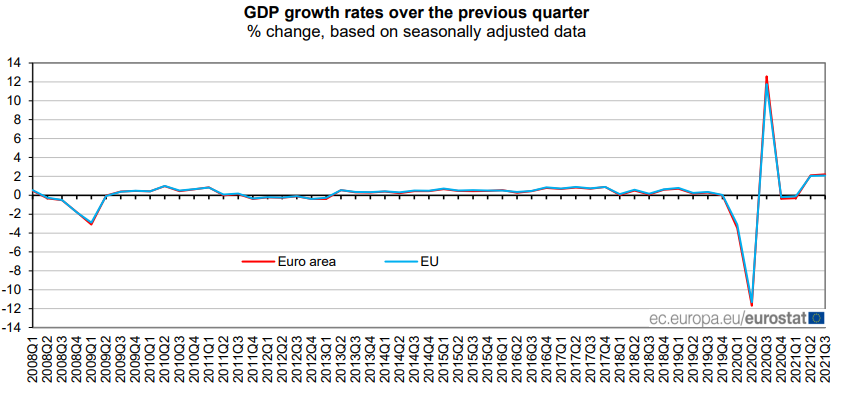

- EU final manufacturing PMI 5 AM ET/0900 GMT. 58.5 versus 50.5 preliminary

- New Zealand employment change quarter on quarter. 5:45 PM ET/0945 GMT Esme 0.4% versus 1.0%. Unemployment rate 3.9% versus 4.0%. Labor costs index 0.8% versus 0.9% last quarter

- EU unemployment rate 6 AM ET/1000 GMT. 7.4% versus 7.5% last month

- ADP nonfarm payroll employment estimate. 8:15 AM ET/1215 GMT. Estimate 400 K versus 568K last month

- US ISM services PMI. 10 AM ET/1400 GMT. 61.9 versus 61.9 preliminary

- US factory orders. 10 AM ET/1400 GMT. -0.2% versus 1.2% last month

- FOMC rate decision. 2 PM ET/1600 GMT. No change expected. The market will be looking for the Fed to start the taper. Press conference at 2:30 PM ET/1630 GMT

- Australia retail sales. 8:30 PM ET/0030 GMT. Estimate 1.3% versus 1.3% last

- Australia trade balance. 8:30 PM ET/0030 GMT. Estimate 12.22 billion versus 15.08 billion last month

- OPEC meeting. All day

- BOE rate decision and monetary policy report. 8 AM ET/1200 GMT.

- US jobless claims. 8:30 AM ET/1230 GMT. 285K versus 281K last week

- US jobs report. 8:30 AM ET/1230 GMT: nonfarm payroll 397K versus 194K last month. Unemployment rate 4.7% versus 4.8%. Average hourly earnings 0.4% versus 0.6%

- Canada jobs report. 8:30 AM ET/1230 GMT. Employment change 157.1 K last month. Unemployment rate 6.9% last month