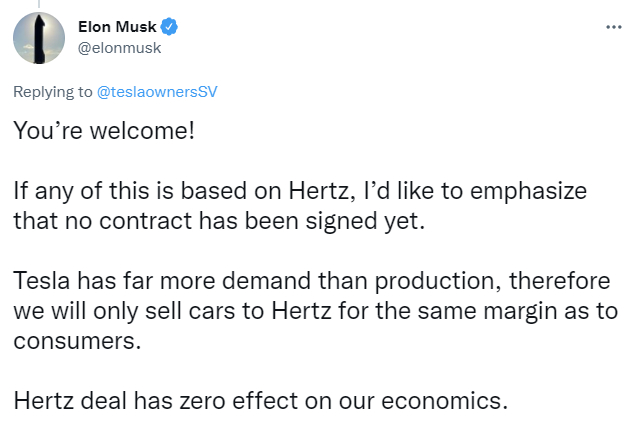

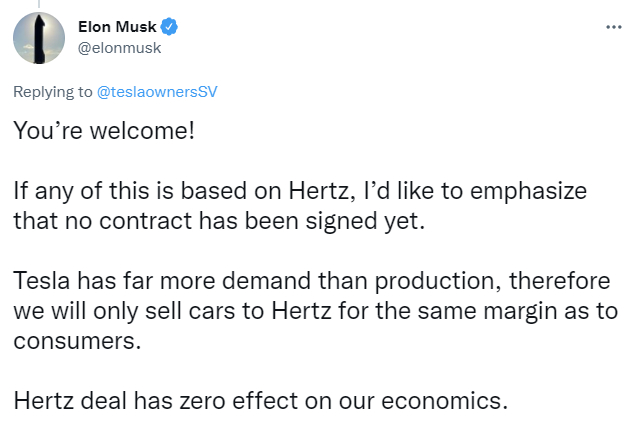

Musk on Tesla and Hertz, reply tweting:

“We estimate that oil demand is nearing 100 million b/d, its pre-COVID level, with winter seasonality and the recovery in international jet demand set to bring demand to record highs by early next year,” they wrote today.

How liveable will earth be in 2070?

Up to a third of the projected global population of 9bn could be exposed to temperatures on a par with the hottest parts of the Sahara, according to research by scientists from China, US and Europe https://t.co/r2yQhpb1Gg pic.twitter.com/RmH6kGp1Tt

— Financial Times (@FinancialTimes) November 1, 2021

39th record close for the Nasdaq, 40th for the Dow and 60th for the S&P

39th record close for the Nasdaq, 40th for the Dow and 60th for the S&PThe three major indices closed at record levels once again. For the year, the

The biggest winner was the small-cap Russell 2000. It rose 60.93 points or 2.65% at 2358.12. The Russell 2000 is up 5.2% over the last month

“What is going to compel the shippers and carriers to invest in the needed infrastructure? The owners of these companies can theoretically not change anything and their business will still be at full capacity because of the backlog of containers. The backlog of containers doesn’t hurt them. It hurts anyone paying shipping costs – that is, manufacturers selling products and consumers buying products. But it doesn’t hurt the owners of the transportation business.”

There has been some exhaustion to the upside momentum but buyers are not exactly letting up either, keeping a defense at the recent lows around $80.79 last week before seizing back near-term control now on a push above its key hourly moving averages: