Fed strategy from Bank of America

Bank of America Global Research discusses its expectations for tomorrow’s FOMC policy meeting.

“The Fed is likely to announce tapering at the upcoming November FOMC meeting, reducing TSY purchases by $10bn and MBS by $5bn, while noting asset purchases are not on a pre-set course. We think Chair Powell will likely separate taper and rate hikes as two distinct decisions; the latter will depend on realized and future inflation at 2% or above coupled with achievement of maximum employment. Rate hikes are “a ways off” but Chair Powell is unlikely to push back on the market timing of rate hikes, which have been brought forward materially ,” BofA notes.

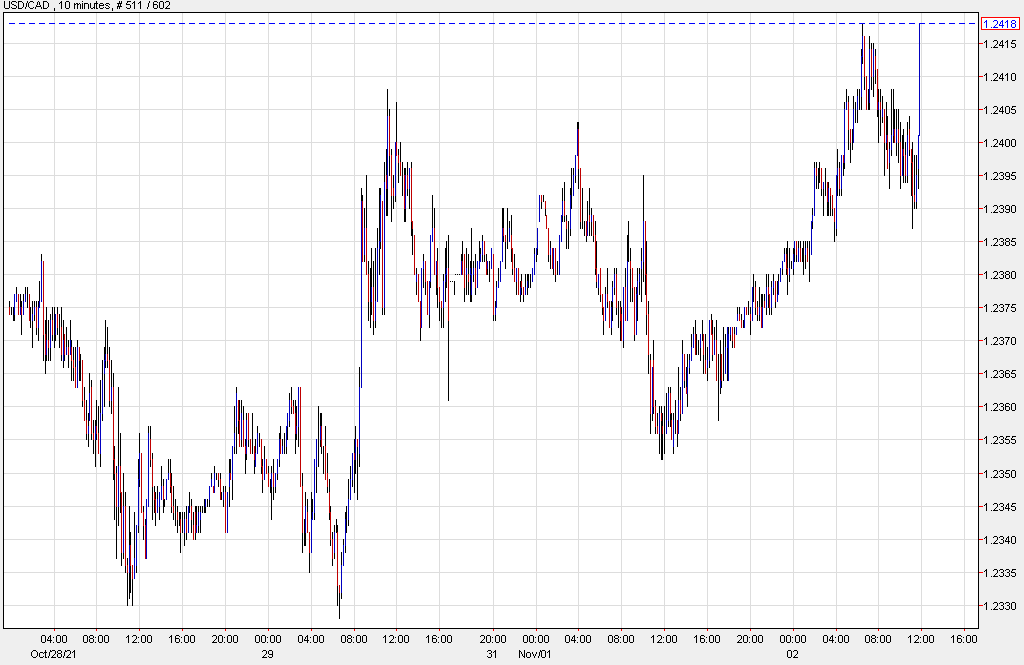

“We see risks Fed comments are interpreted as hawkish due to (1) recognition of upside inflation risks, (2) faster taper pace, and (3) potential future balance sheet reduction. This could sustain or extend the recent UST curve flattening trend. Similarly, risks to the US dollar are skewed to the upside around this week’s Fed meeting, in our view,” BofA adds.