US GDP, RBN zero rate decision

Next week in the US will have the Thanksgiving day holiday on Thursday, November 25 which extends into Friday, November 26, and will have traders leaving early on Wednesday, November 24. As a result, releases are limited and expectations are the same.

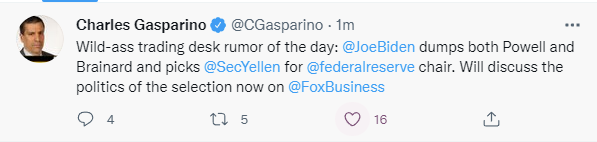

Of note is that the Pres. Biden has said that he will announce his decision for the Fed chairmanship before Thanksgiving. A time and date is yet to be determined.

Below are the key releases and events that should shape the market price action.

Tuesday November 23rd:

On Tuesday, flash manufacturing/service PMI data will be released out of Europe including out of France, Germany, EU. France bought get things started with the release at 3:15 AM ET/0815 GMT. Germany will follow at 3:30 AM ET/0830 GMT. EU at 4 AM ET and UK at 4:30 AM ET/0930 GMT will finish the European releases.

In the US, the flash manufacturing PMI will be released at 9:45 AM with expectations of 59.0 versus 58.4 last month. The services PMI is expected to come in at 59.1 versus 50.7

Wednesday, November 24

(more…)

Dow and S&P close lower

Dow and S&P close lower

Changes for the week are mixed

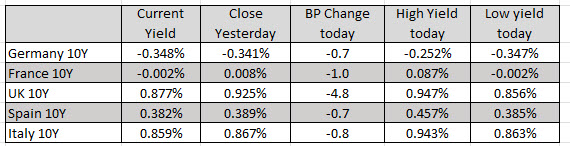

Changes for the week are mixed In the European debt market, the 10 year yields are lower with the UK yields down the most at -4.8 point basis points.

In the European debt market, the 10 year yields are lower with the UK yields down the most at -4.8 point basis points.