- Education: The first step to becoming a successful trader is to educate yourself about the markets and the different strategies and techniques used by traders. This includes learning about technical analysis, fundamental analysis, and risk management.

- Planning: Once you have a solid understanding of the markets, it is important to develop a trading plan. This includes setting clear goals, identifying your risk tolerance, and determining your entry and exit points.

- Simulation: Next, you should practice trading in a simulated environment. This allows you to test your strategies and get a feel for the markets without risking real money.

- Execution: Once you are comfortable with your trading plan, it is time to execute it in the real market. This is where discipline and risk management become critical, as emotions can often cloud judgment.

- Continual learning: Successful traders never stop learning. They continually monitor their performance and adapt their strategies to changing market conditions. They also stay up-to-date with the latest financial news and market developments.

It’s important to note that becoming a successful trader requires time, patience, discipline, and a lot of hard work. There is no shortcut or easy way. It takes consistent effort and learning to become successful in trading.

A sniper’s mindset can be applied to trading in several ways:

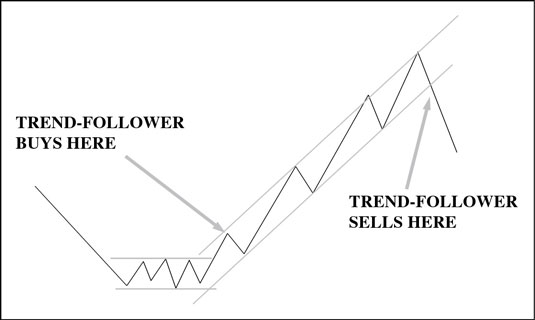

A sniper’s mindset can be applied to trading in several ways: Trend following is a trading strategy that involves identifying and following the direction of market trends. Some advantages of trend following include:

Trend following is a trading strategy that involves identifying and following the direction of market trends. Some advantages of trend following include: