Latest Posts

rssFederal Reserve FOMC Minutes are due Wednesday 24 November 2021 – preview

Now that speculation about who will be the Chair of the Federal Reserve over the coming four years is over, its back to regular scheduling!

- Biden picks Powell

Next on the Fed agenda is the release of the minutes to the November 2nd-3rd meeting.

Via Scotia (in brief from a longer piece):

- a watchful eye toward discussions around timing lift-off for the policy rate. The meeting concluded that the FOMC “is prepared to adjust the pace of purchases if warranted by changes in the economic outlook” and so watch for a discussion around the criteria for doing so. A fuller discussion is likely at the December meeting.

- It’s unlikely that the minutes will reveal a further dialogue on broader plans for the balance sheet.

- There may be a limited discussion around lift-off timing, but here too the December meeting and its fresh dot plot will likely be more revealing.

Apparently, Brainard would’ve been more of a dove than Powell. Sheesh. Powell’s middle name is Dovey McDoveface!

Some guy with a dove:

Oil update – Biden’s SPR release plans and the expected OPEC+ response

Updating the latest on oil from Monday US time, in brief:

The talk on the oil reserve release is US President Biden is said to be preparing to announce a strategic petroleum reserve release alongside similar from other countries ( India, Japan and South Korea included)

- amount released is expected to around 35mbbl over time,

OPEC said such a release is not justified given current conditions in the market

- and would reconsider plans to add more oil production when they meet next week

On the demand side, rising coronavirus cases in Europe and associated movement-limiting restrictions weigh.

US Treas Sec Yellen says again that the US will have a recession if debt ceiling is not raised

Never mind this reiteration, the big comment from US Treasury Secretary Yellen was on Monday in the US:

- We do have to be concerned about inflation

That shunted US stocks lower at the close

More from Yellen now:

- says sees inflation pressure diminishing in the second half of next year

- sees monthly CPI around 0.2% to 0.3% in H2 of 2022

US stocks close near lows for the day as rates move higher

NASDAQ index falls -1.26%. Dow snapped a three day losing streak but closes near it’s lows

The major US indices are closing near lows for the day as higher rates hurt investor sentiment.

The NASDAQ index – which closed at a record level on Friday and also made new all-time intraday highs today – turned around and was the biggest decliner. The S&P index also made new intraday highs, but is closing lower on the day (and at the lows).

A snapshot of the closing levels shows:

- Dow industrial average +17.28 points or 0.05% at 35619.26. The high level took the index up 327.68 points or 0.92%. The low for the day reached 35615.55, just off the closing level

- S&P index fell -15.73 points or -0.33% at 4682.23. It’s high price stalled at a gain of 45.78 points up 0.97%. The low for the day reached 4681.98 (also just off the closing level)

- NASDAQ index closed down 202.7 points or -1.26% at 15854.80 after reaching a high change of 154.70. The pair close just off it’s lows for the day at 15851.00 (just off the closing level)

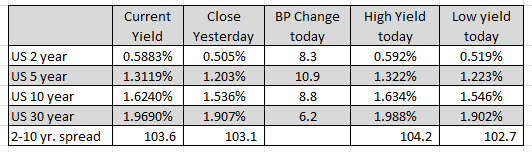

Higher rates took its toll on the more riskier NASDAQ index. The five year yield rose 10.9 basis points.

The U.S. Treasury sold both two and five year notes with less than stellar demand from both domestic and international investors.

Thought For A Day

US dollar presses further as commodity currencies stumble

Softness in the risk trades adds another leg to the move

The loonie and New Zealand dollar are carving out fresh lows against the US dollar after the Nasdaq dive weighed on broader sentiment. The loonie is also navigating a possible US SPR release.

The driving force behind the dollar strength today is the re-nomination of Jerome Powell as Fed chair. That’s pushed US 2-year yields up 6.9 bps to 0.574% on expectations he will be more hawkish than Brainard would have been.

That belief will be tested in time but it fits nicely into the current theme of US dollar. It’s been a one-way march higher in the dollar for weeks as the market prices in divergence with the ECB, BOJ and others.

In terms of today’s move, NZD/USD has fallen to a fresh low since October 12 and a minor uptrend is going to be tested soon. Beyond that are the Sept and Aug lows.

Sen. Warren says she will vote against Powell’s renomination

Powell will need at least one Republican vote

Warren came out against Powell in public comments before he was re-nominated so this isn’t a surprise. She had called him a ‘dangerous man’.

“It’s no secret I oppose Chair Jerome Powell’s renomination, and I will vote against him. I will support the President’s nomination of Lael Brainard as Vice Chair. Powell’s failures on regulation, climate, and ethics make vice chair spot critically important.”

I’m fairly certain that Biden will throw the progressives a bone by allowing them to pick someone who is unfriendly to Wall Street (or less friendly) as the vice chair for supervision. That pick will come in early December.

As for Powell’s confirmation, virtually all Republican Senators voted for him last time and it would be quiet a switcheroo for all of them to vote against the guy that Trump nominated.

European equity close: UK stocks start the week strong

Closing changes for the main European bourses:

- UK FTSE 100 +0.6%

- German DAX -0.1%

- French CAC +0.2%

- Italy MIB +0.2%5

- Spain IBEX +0.95%

The FTSE 100 struggled last week but the weak pound and compelling valuation is attractive.