UK release will be a voluntary one of 1.5 million barrels

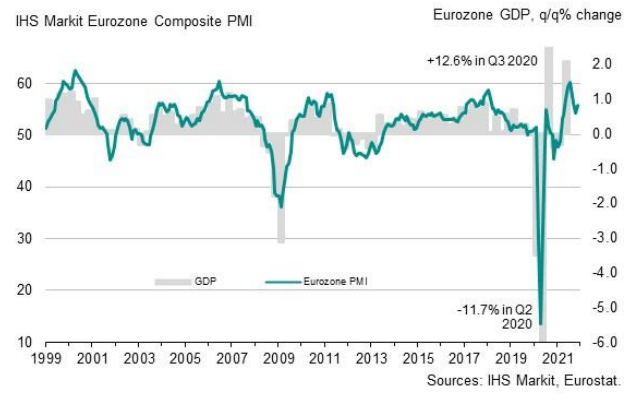

The French and German readings earlier served as a prelude to the beats in the overall Eurozone report here, reaffirming a modest improvement in business activity in both the services and manufacturing sector this month.

“A stronger expansion of business activity in November defied economists’ expectations of a slowdown, but is unlikely to prevent the eurozone from suffering slower growth in the fourth quarter, especially as rising virus cases look set to cause renewed disruptions to the economy in December.

“The manufacturing sector remains hamstrung by supply delays, restricting production growth to one of the lowest rates seen since the first lockdowns of 2020. The service sector’s improved performance may meanwhile prove frustratingly short-lived if new virus fighting restrictions need to be imposed. The travel and recreation sector has already seen growth deteriorate sharply since the summer.

“With supply delays remaining close to record highs and energy prices spiking higher, upward pressure on prices has meanwhile intensified far above anything previously witnessed by the surveys.

“Not surprisingly, given the mix of supply delays, soaring costs and renewed COVID-19 worries, business optimism has sunk to the lowest since January, adding to near-term downside risks for the eurozone economy.”

Central bank policy

The Bank of Japan has a strong bearish bias. WIth Japan struggling with deflationary pressures for years and a large QE program the outlook for the Bank of Japan remains tilted to the downside.

COT report

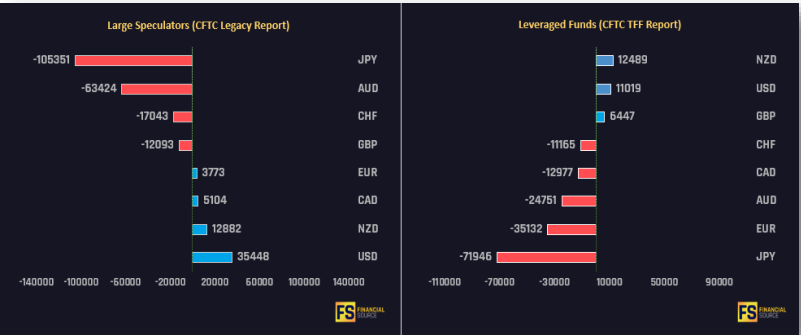

The fact that the BoJ is likely to remain on hold with their interest rates, while the rest of the world is expected to hike rates has recently resulted in some high levels of selling from asset managers and leveraged funds. Check out the table below:

US10Y correlation

With the BoJ so bearish the rate differentials between the Japanese 10y and the US 10 y are usually just seen in the ebbs and flows of the US 10 y. Remember that the BoJ has yield curve control on their bond yields. So, the key point to note is this:

A falling US10Y = a rising JPY

A rising US10Y = a falling JPY

This correlation is not always perfect as it can ebb and flow, but it is a correlation to be aware of when trading the JPY and in particular the USDJPY. Look at the USDJPY chart below and its close correlation with US10y.

Oil prices

Rising oil prices is a negative for the JPY as pricier crude take JPY out of Japan. Japan buys most of its oil from overseas and a weak Yen will make those imports more expensive. If oil starts gaining to the upside watch out as this can weaken the JPY