We can assume that from this point forward hedge funds are no longer hedged and will be forced sellers on any downside follow-through.

Latest Posts

rssMajor indices claw back some of the losses from Friday’s trade

NASDAQ index leads the way

The major indices clawed back some of the losses from Friday’s trade with the NASDAQ index taking back the most. The Dow industrial average lagged.

- Dow industrial average +236.47 points or 0.68% at 35135.99

- S&P index +60.61 points or 1.32% at 4655.25

- NASDAQ index up 291.19 points or 1.88% at 15782.84.

- Russell 2000 fell -3.95 points or -0.18% at 2241.97

- Dow Jones up 388.57 points or 1.11%

- S&P index up 78.45 points or 1.71%

- NASDAQ index up 341.5 points or 2.2%

- Moderna, +11.71%

- Goodrx, +8.85%

- Rivian automotive, +6.98%

- Nvidia, +5.96%

- Lam research, +5.95%

- Roblox, +5.47%

- Tesla, +5.11%

- AMD, +4.55%

- Salesforce, +4.36% (Salesforce will announce earnings after the close tomorrow).

- Novavax, -11.08%

- Merck, -5.41%

- Worthington industries, -3.77%

- Crowdstrike, -3.55%

- Bed Bath & Beyond, -3.44%

- Bristol-Myers Squibb, -3.4%

- Wynn resorts, -3.16%

- RobinHood, -3.01%

- Pfizer, -2.96%

- Beyond Meat, -2.83%

- Twitter, -2.8%

Thought For A Day

Hospitalizations rise in the epicenter of omicron

A look at the latest Guanteng data

Oil retraces 50% of the omicron rout. Does OPEC really have the barrels?

Oil now above $72.50

13 Insights From Paul Tudor Jones

1. Markets have consistently experienced “100-year events” every five years. While I spend a significant amount of my time on analytics and collecting fundamental information, at the end of the day, I am a slave to the tape (and proud of it).

2. Younger generation are hampered by the need to understand (and rationalize) why something should go up or down. By the time that it becomes self-evident, the move is over.

3. When I got into the business, there was so little information on fundamentals, and what little information one could get was largely imperfect. We learned just to go with the chart. (Why work when Mr. Market can do it for you?)

4. There are many more deep intellectuals in the business today. That, plus the explosion of information on the Internet, creates an illusion that there is an explanation for everything. Hence, the thinking goes, your primary task is to find that explanation.

As a result of this poor approach, technical analysis is at the bottom of the study list for many of the younger generation, particularly since the skill often requires them to close their eyes and trust price action. The pain of gain is just too overwhelming to bear. (more…)

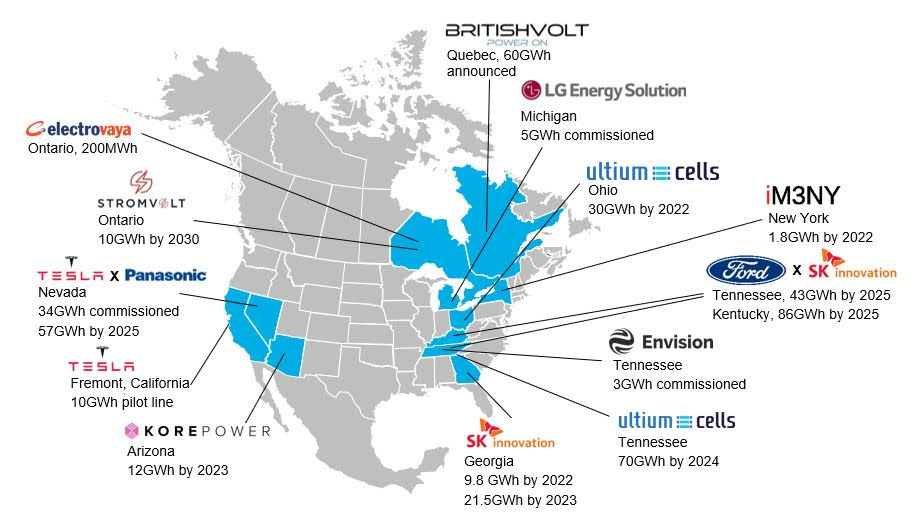

North America’s EV Battery Network

Saudi energy minister confirms delay to OPEC+ meetings this week

The meeting times are delayed by two days

Moderna CEO says data on vaccine efficacy of Omicron variant could be known in 2-6 weeks

Moderna CEO, Stéphane Bancel, remarks to CNBC

- Believes that this virus strain is highly infectious

That leaves plenty of time for markets to flail around and stay on edge, especially more so if the Omicron variant becomes more widespread – not to mention that the key headlines noted above may only come when we get to the year-end holiday period.

WHO assesses overall global risk related to Omnicron variant as “very high”

WHO urges member states to accelerate vaccination coverage

Adding that “the likelihood of potential further spread of Omnicron at the global level is high”, in a technical briefing to its 194 member states.