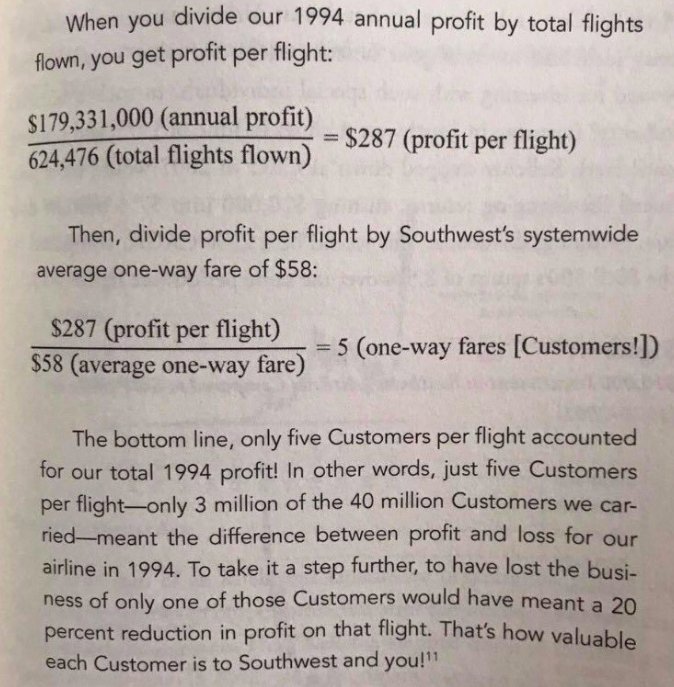

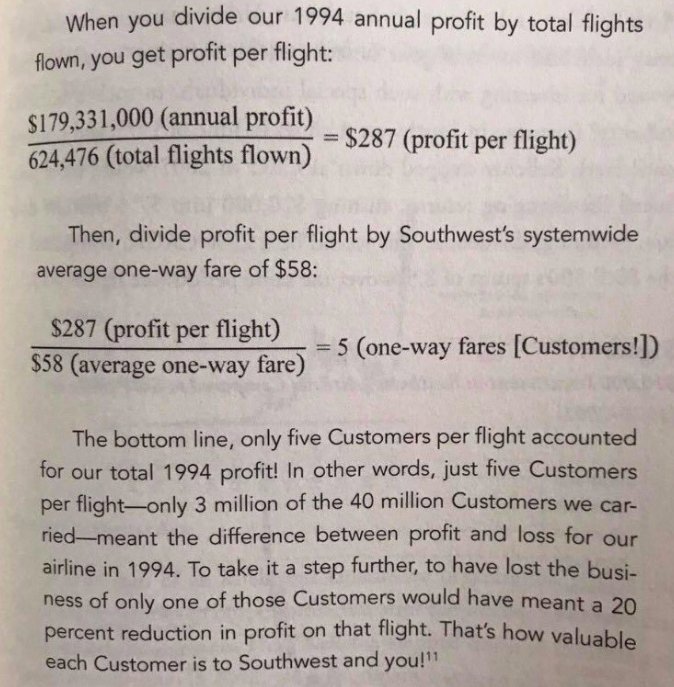

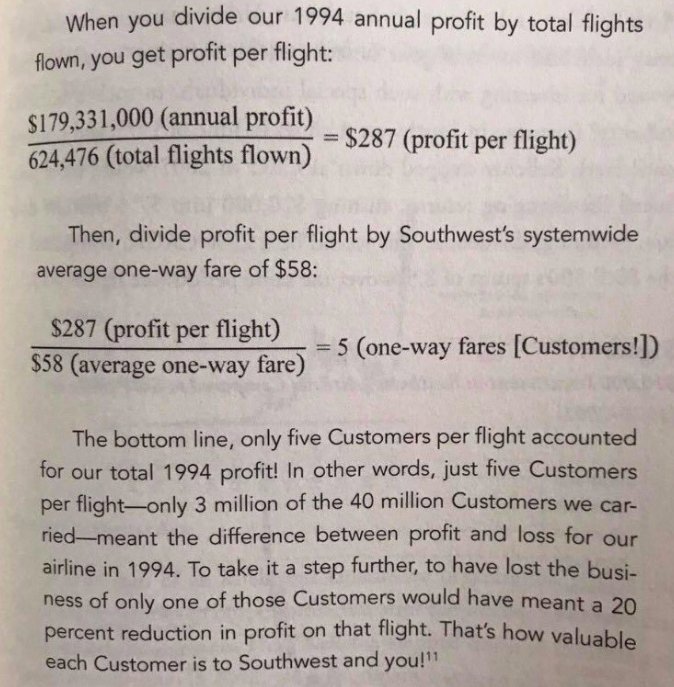

Herb Kelleher of Southwest Airlines on the importance of every customer.

Fragile- “Easily broken, shattered, or damaged; delicate; brittle; frail.”

Robust- “Strong and healthy; hardy; vigorous.”

Anti-Fragile- “A postulated antithesis to fragility where high-impact events or shocks can be beneficial. Anti-fragility is a concept developed by professor, former trader and former hedge fund manager Nassim Nicholas Taleb. Taleb coined the term “anti-fragility” because he thought the existing words used to describe the opposite of “fragility,” such as “robustness,” were inaccurate. Anti-fragility goes beyond robustness; it means that something does not merely withstand a shock but actually improves because of it.”