The victim wonders why nothing ever goes their way.

The conquerer wonders how lucky they are.

The victim wishes things were different.

The conquerer makes things different.

The victim passes blame and points fingers.

The conquerer accepts blame and moves on.

The victim argues minutiae.

The conquerer understands what matters.

The victim accepts reality and waits for for someone to create their own utopia.

The conquerer rejects reality and chooses to create their own.

The victim whimpers.

The conquerer roars.

The victim complains of unchanging impossibility.

The conquerer relishes the challenge of the impossible. (more…)

Latest Posts

rssInternational Math Olympiad 2015.Final Ranking -India at 37th Position

Final ranking

China 2

N.Korea 4

Vietnam 5

Iran 7

Bangladesh 33

India 37

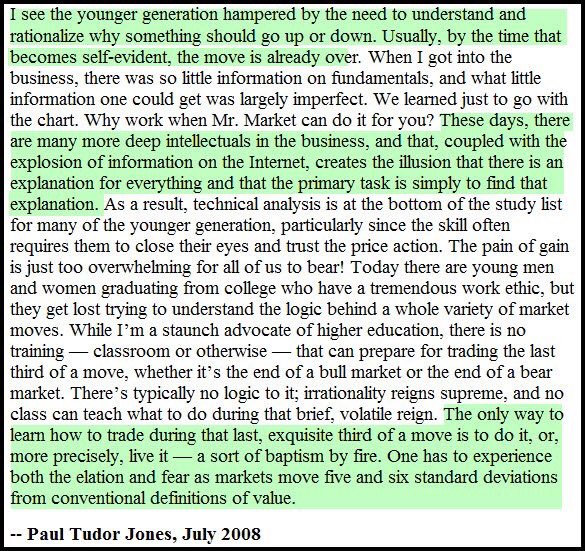

Paul Tudor Jones on going with the chart

Build Your Trading Confidence

What is the definition of confidence? I define confidence as positive thoughts, feelings and actions reflecting your self-belief and expectations of your ultimate success. Success is never guaranteed, but self-doubt and negativity can ensure failure. When you believe in yourself, you move away from harmful distractions such as anxiety and fear, and you move toward a more effective performance focus. Today, we’ll take a look at how to make sure you’re confident enough to survive the trading game.

What is the definition of confidence? I define confidence as positive thoughts, feelings and actions reflecting your self-belief and expectations of your ultimate success. Success is never guaranteed, but self-doubt and negativity can ensure failure. When you believe in yourself, you move away from harmful distractions such as anxiety and fear, and you move toward a more effective performance focus. Today, we’ll take a look at how to make sure you’re confident enough to survive the trading game.

Aside from the obvious benefits, confidence also bolsters your internal security during trading slumps and gives you additional fuel to persevere through challenging periods. Self-belief promotes traders to create more ambitious performance targets, allowing for greater accomplishment. Traders who display low confidence tend to worry excessively about mistakes, lose focus on what’s driving results, quit trading at the wrong times and get overly worked up about each new trade. Excess confidence can also be dangerous in causing a trader to overcommit capital and be subjected to too much risk when a position goes bad. So your goal should be to promote the internal confidence while still showing the external disciplines to prevent the ego from taking over the consistent execution of a trading method.

Here are seven tips to encourage greater confidence:

1. Frequently visualize a successful trading process. What goes into good trading for you? Make sure you see the preparation required, the focus you have during the trading day, and the continous learning from both winning and losing trades to keep getting more effective.

2. Increase your level of physical fitness, as this will enhance both your trading alertness and give a boost to your self-image simultaneously. Both of these elements make you a more confidence trader.

3. Make a list of your strengths. Review this list regularly to remind yourself of how successful you really are.

4. Eliminate negative thoughts and memories. When they occur, replace them with positive self-statements (for example, “I create my own luck” or “I have a good written plan of how I will execute my trades”).

5. Have a general strategy going into each trading day. When you prepare the day before, you position yourself to be proactive and gain confidence as you implement your plan. How aware are you of what you’re experiencing in your mind, body and soul at any moment? You need to set up a monitoring system at the end of each trading day, to summarize what you executed according to your rules and what you did not. Look for patterns in your behavior, that you can copy if they work for you, or minimize if they are costing you.

6. Create positive body language regardless of the gain or loss on that trading day. The way you act will often influence the way you feel for future trades. The more confident you feel, the more confidence you will show in your trading.

7. Improve on areas of weakness during preparation time and you’ll create more confidence and belief during the trading day.

Focus on one of these seven tips at a time, until you can build that area as a habit in your routine. This will service to greatly improve your trading confidence over time.

Good trading is just like Surfing.

7 Crucial Points for Traders

- You don’t choose the stock market; it chooses you. A little bit of early trading success can have a profound effect on a person’s soul. If it does choose you, you’ll have to accept that your life and investing will become forever connected.

- Your methodology must provide an unshakeable foundation that you believe in totally, and you must have the conviction to trade based upon it. If your belief is tentative or if you don’t have complete faith in your methodology, then a few bad trades will destabilize and erode your confidence.

- A calm mindset that can focus on the execution and not on the outcome is what produces profits. It takes total emotional control. You must maintain your balance, rhythm and patience. You need all three to stay in the game.

- The markets are always conniving with ingenious techniques to get you to lose your patience, to get you frustrated or mad, to bait you to do the wrong thing when you know you shouldn’t. A champion doesn’t allow the markets to get under his skin and take him out of his game.

- Like a great painting, all good trades start with a blank canvas. Winning traders first paint the trade in their mind’s eye so that their emotional selves can reproduce it accurately with clarity and consistency, void of emotions as they play it out in the markets. (more…)

Over trading; knife-catching; valuation shrts; not taking losses; impatience,Watching Blue Channels

Following Fundamentals ,Thinking & Discussing about Economy ,Growth…………..Then ?

Denmark now gets 40% of its electricity from wind farms, far more than any other country.

Chose a job you love, and you will never have to work a day in your life!

Pakistan Army -One Picture Says Everything.