Profits resulting from the violation of one’s own system or methodology constitute the most treacherous mirage of success. We’ve all been tempted at one time or another to suspend our collection of pre-defined rules (so painstakingly accumulated, yet so easily put aside) for the possibility that for this one particular moment, distinguished from all others, things might be different. And perhaps we were right — this time — and the register rung. Yet for those of us who have chosen the way of the System, the momentary suspension of discipline is a transgression beyond profit or loss. For no matter the what the outcome of the trade executed, the damage has already been done — any gains secured in such a manner will only serve as future tuition until that particular lesson is learned. This must be understood before forward progress can occur, for unless process takes precedence over result, the cycle repeats ad infinitum.

Profits resulting from the violation of one’s own system or methodology constitute the most treacherous mirage of success. We’ve all been tempted at one time or another to suspend our collection of pre-defined rules (so painstakingly accumulated, yet so easily put aside) for the possibility that for this one particular moment, distinguished from all others, things might be different. And perhaps we were right — this time — and the register rung. Yet for those of us who have chosen the way of the System, the momentary suspension of discipline is a transgression beyond profit or loss. For no matter the what the outcome of the trade executed, the damage has already been done — any gains secured in such a manner will only serve as future tuition until that particular lesson is learned. This must be understood before forward progress can occur, for unless process takes precedence over result, the cycle repeats ad infinitum.

Latest Posts

rss10 Points for Traders

Capital flows from those who fight trends to those who follow them.

- In the long term money flows to those who manage risk and are able to hold on to their profits from those who don’t manage risk.

- Traders that persevere through the learning curve stick around long enough to make money from those that just trade with no understanding of what they are doing.

- Robust systems take money from traders with no edge over the markets.

- Traders that trade price action take money from those that trade opinions.

- Traders that enter a trade based on a reversal signal make money form those that stubbornly hold on to a losing trade and hope.

- Money flows to those who let winners run from those that hold losing trades and hope.

- Capital flows from those that trade a winning methodology from those that trade on emotions.

- Those with big egos pay a price to try to prove they are right by holding a losing trade those that admit they are wrong quickly keep hard earned profits.

Money flows from those who do not know how to trade to those who do.

Six Positive Trading Behaviors

1) Fresh Ideas – I’ve yet to see a very successful trader utilize the common chart patterns and indicator functions on software (oscillators, trendline tools, etc.) as primary sources for trade ideas. Rather, they look at markets in fresh ways, interpreting shifts in supply and demand from the order book or from transacted volume; finding unique relationships among sectors and markets; uncovering historical trading patterns; etc. Looking at markets in creative ways helps provide them with a competitive edge.

1) Fresh Ideas – I’ve yet to see a very successful trader utilize the common chart patterns and indicator functions on software (oscillators, trendline tools, etc.) as primary sources for trade ideas. Rather, they look at markets in fresh ways, interpreting shifts in supply and demand from the order book or from transacted volume; finding unique relationships among sectors and markets; uncovering historical trading patterns; etc. Looking at markets in creative ways helps provide them with a competitive edge.

2) Solid Execution – If they’re buying, they’re generally waiting for a pullback and taking advantage of weakness; if they’re selling, they patiently wait for a bounce to get a good price. On average, they don’t chase markets up or down, and they pick their price levels for entries and exits. They won’t lift a market offer if they feel there’s a reasonable opportunity to get filled on a bid.

3) Thoughtful Position Sizing – The successful traders aren’t trying to hit home runs, and they don’t double up after a losing period (more…)

Paul Tudor Jones: The Secret To Successful Trading

“The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge. Because I think there are certain situations where you can absolutely understand what motivates every buyer and seller and have a pretty good picture of what’s going to happen. And it just requires an enormous amount of grunt work and dedication to finding all possible bits of information.

“The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge. Because I think there are certain situations where you can absolutely understand what motivates every buyer and seller and have a pretty good picture of what’s going to happen. And it just requires an enormous amount of grunt work and dedication to finding all possible bits of information.

You pick an instrument and there’s whole variety of benchmarks, things that you look at when trading a particular instrument whether it’s a stock or a commodity or a bond. There’s a fundamental information set that you acquire with regard to each particular asset class and then you overlay a whole host of technical indicators and that’s how you make a decision. It doesn’t make any difference whether it’s pork bellies or Yahoo. At the end of the day, it’s all the same. You need to understand what factors you need to have at your disposal to develop a core competency to make a legitimate investment decision in that particular asset class. And then at the end of the day, the most important thing is how good are you at risk control. 90% of any great trader is going to be the risk control.”

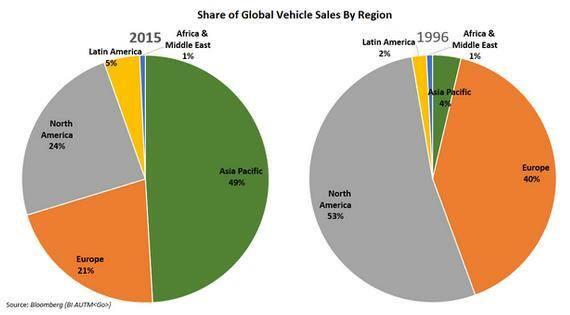

Want to see Asia Rising? Try 20 Years of Global Vehicle Sales

One of the most important things in stock trading

W.D Gann on Intuition -Said in Year 1923

Greece's Biggest Mistake Explained (In 1 Cartoon)

Credit Suisse Global Investment Returns Yearbook 2018

Elroy Dimson, Paul Marsh, and Mike Staunton of London Business School and authors of Triumph of the Optimists(Princeton University Press, 2002) are responsible for the marvelous Credit Suisse Global Investment Returns Yearbook, now in its nineteenth annual edition. The yearbook was distributed to Credit Suisse clients and is not for sale to the general public, but a 40-page summary of the 251-page yearbook is available online.

Elroy Dimson, Paul Marsh, and Mike Staunton of London Business School and authors of Triumph of the Optimists(Princeton University Press, 2002) are responsible for the marvelous Credit Suisse Global Investment Returns Yearbook, now in its nineteenth annual edition. The yearbook was distributed to Credit Suisse clients and is not for sale to the general public, but a 40-page summary of the 251-page yearbook is available online.

The authors worked with 118 years’ worth of data. So this is no year in review; it’s 118 years in review, complete with myriad tables and graphs. Divided into five chapters, the yearbook covers long-run asset returns, risk and risk premiums, factor investing, private wealth investments, and 26 individual markets (23 countries plus world, world ex-USA, and Europe).

One of the questions the authors ask is whether equity premium is predictable. Using their long-run global database, they “adopt three approaches, each of which involves analyzing whether the equity risk premium (ERP) relative to bills in a particular year can help us to predict the annualized ERP over the subsequent five years.” They found, as one might expect, that “for strategic asset allocation, we learn relatively little (and nothing statistically significant) from recent annual performance about future equity premiums.” They conclude that “to forecast the long-run equity premium, it is hard to beat extrapolation that takes into account the longest history available when the forecast is being made.”

The authors also assess various forms of factor investing. Both over the long run and across different countries, size, value, income, momentum, and volatility have generated sizable premiums. But the authors write that “the theory of why such premiums should exist, or what types of risk they are rewarding, is admittedly weak. Furthermore, if they are generated by behavioral traits, behavior can change, especially as awareness of these factors—and their popularity—increases.”

Found On A Volkswagen In Portland