Its almost 2016 and this is still relevant to our society

There is no place for arrogance on the trading floor. The stock market has the uncanny ability to identify and humble arrogant traders. The best traders respect the market at all times. Traders are most susceptible to arrogance after an extended winning streak. It’s amazing how weeks of disciplined trading can be wiped out by one bad day. Arrogance is a virus in your trading, as it eats away at the edges of your discipline. Without proper discipline, the market will eat you for lunch.

Trade Management

Trading Quotes :

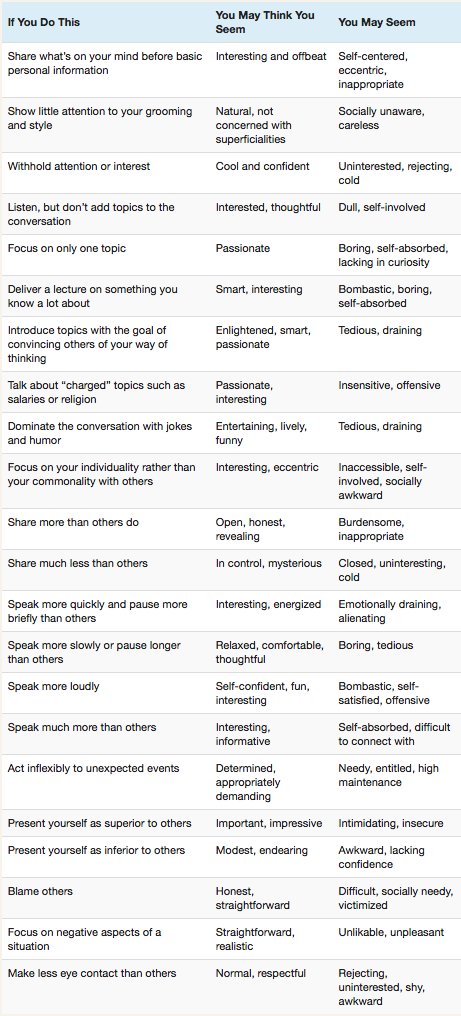

Traders must have rules and trading plans because in the heat of trading when emotions flare up that is when greed, fear, and ego can easily hijack the trader. Traders all have many different conflicting parts that can interfere with trading execution. The need to be right, the need to make money, the fear of loss, and the greed of making a lot of money can take over any trader that does not have a disciplined approach that is created before the day begins. Mechanical systems, trading rules, along with positions sizing and risk management factors can keep a trader safe from making huge mistakes.

Here are the top 10 Questions Traders must ask to protect them from themselves.

1. Where does the price of my trading vehicle have to go to prove I was wrong about my entry?

2. How much is the maximum I will lose on the trade if I am wrong?

3. What are my rules for entries?

4. How will I exit my winner to bank profits?

5. What is the current trend of the time frame I trade in?Where is my best entry point to trade in this direction? (more…)