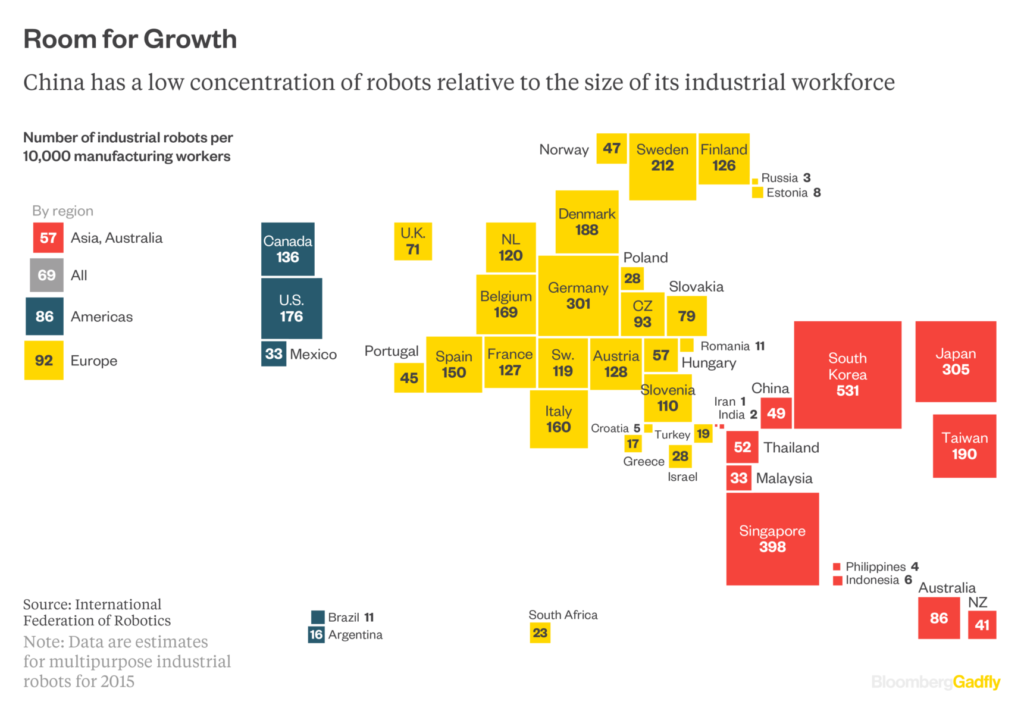

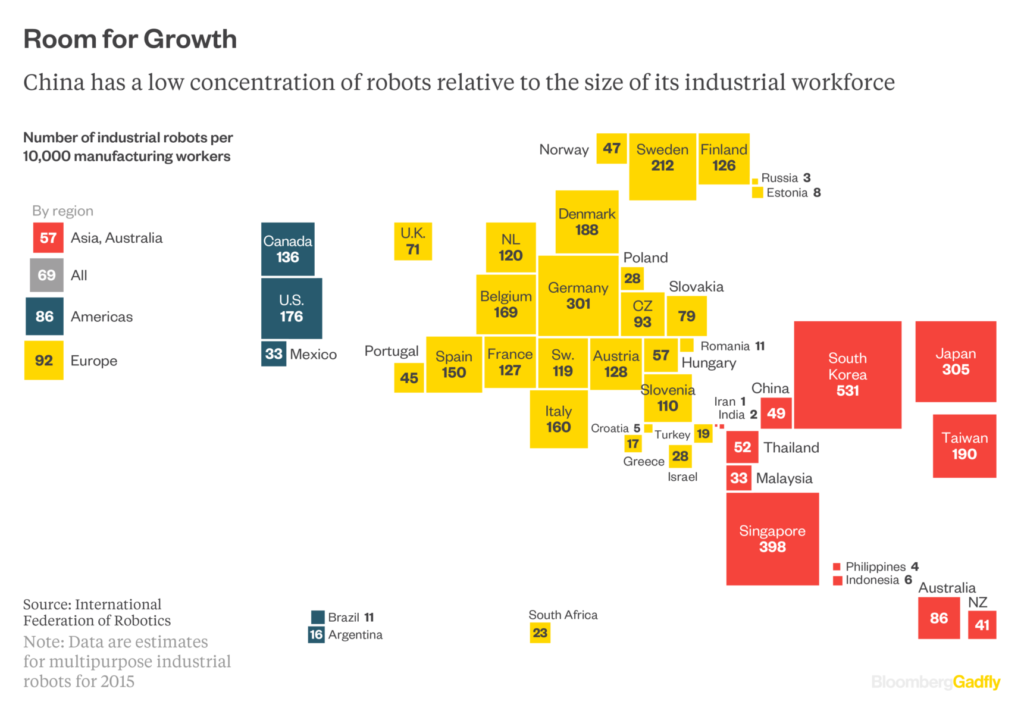

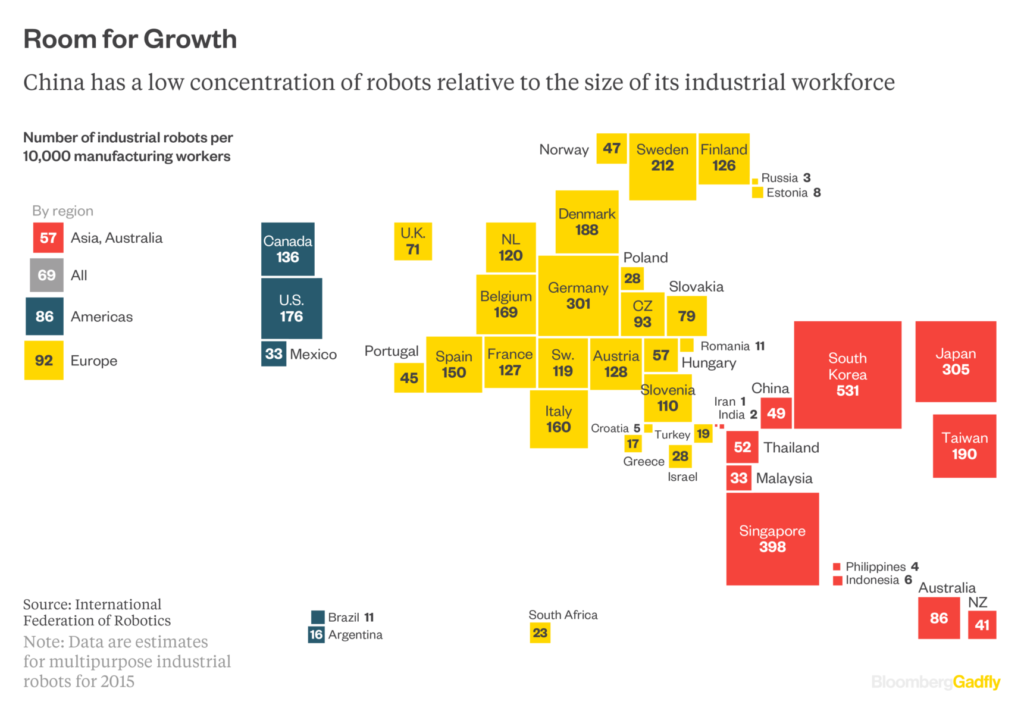

Concentration of Robots by Country

Really Great ,Just watch it…………!!!

Some wise views from Larry Hite:

“We don’t really trade silver…we don’t trade the S&P…we trade the differences. We really are risk managers. We take on risks, try to exploit them and we leave when they turn against us. That is what we get paid for. Basically we are in the risk transfer business. We take on what people want to sell, sell what people want to buy and hope to make a profit. The reason why one goes to a portfolio is because there are real limits to perfect knowledge. I’ll give you an example. Say you knew which commodity, stock or currency would appreciate the most in the following year, and you knew exactly what its price would be. We did this experiment looking backwards in fact in our database. The question of when you take a position is how are you going to trade the line…how much of a position are you going to leverage. Now, if you have perfect knowledge, would you leverage 5 to 1, would you leverage 10 to 1, 2 to 1? Well it turns out that if you leverage more than 3 to 1 that you are a loser. Because we found that if you did 3 to 1 you would have, even with perfect knowledge, you could go down a third. So that, the only perfect knowledge you could have, would be if you knew every wiggle on the line. Then you would know exactly how much to leverage. But you don’t.”

I hate to think how many years of successful investing experience are encapsulated in this volume. Probably somewhere in the neighborhood of 2,000. There aren’t too many resources that can claim this much collective experience.

Herewith a tiny sampling of some of the rules, minus the often much more insightful explanation that follows each of them.

Diversify, but not to mediocrity.

Concentrate, but not too much.

Hedge when the market’s expensive and falling.

Unless you are a genius use a system.

Don’t rely too heavily on models.

Beware of geeks bearing formulas.

Demographics are destiny.

Price is the paramount trading signal.

Be happy doing nothing.

Question the persistency of anomalies.

Understand your edge and why it is sustainable.

Review past stupidities, but don’t let them make you timid.

Only bet on one variable at a time.

It’s important that your process does not work in every market environment.

Don’t chop and change too much.

Be patient—fortune sometimes take a while to favor the bold.

Time, not timing, is the key to investment success. The best time to invest, therefore, is now.

Always remember that investing is hard.

1. Refusing to define a loss.

1. Refusing to define a loss.

2. Not liquidating a losing trade, even after you have acknowledged the trade’s potential is greatly diminished.

3. Getting locked into a specific opinion or belief about market direction. From a psychological perspective this is equivalent to trying to control the market with your expectation of what it will do: “I’m right, the market is wrong.”

4. Focusing on price and the monetary value of a trade, instead of the potential for the market to move based on its behavior and structure.

5. Revenge-trading as if you were trying get back at the market for what it took away from you.

6. Not reversing your position even when you clearly sense a change in market direction.

7. Not following the rules of the trading system.

8. Planning for a move or feeling one building, but then finding yourself immobilized to hit the bid or offer, and therefore denying yourself the opportunity to profit.

9. Not acting on your instincts or intuition.

10. Establishing a consistent pattern of trading success over a period of time, and then giving your winnings back to the market in one or two trades and starting the cycle over again.