If omicron continues to be the more widespread strain of COVID-19 infections (which should be the case) by then, expect vaccine makers to steadfastly roll out a specific vaccine for it in March to April. The world should then look towards that being the “main” vaccine unless another more potent and infectious variant comes around.

Latest Posts

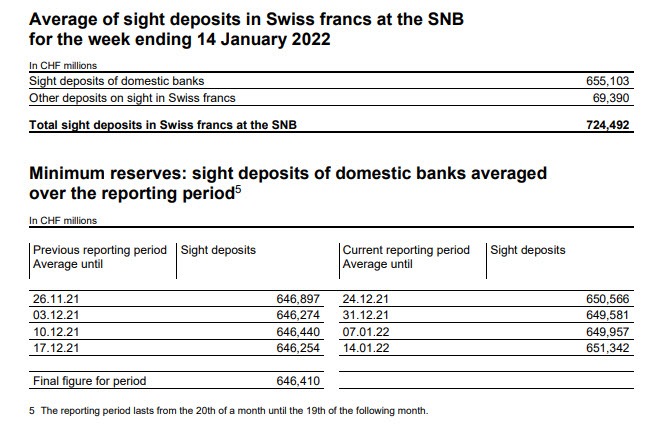

rssSNB total sight deposits w.e. 14 January CHF 724.5 bn vs CHF 724.6 bn prior

- Domestic sight deposits CHF 655.1 bn vs CHF 650.6 bn prior

Prior week’s release can be found here. Little change in overall sight deposits after what has been a rather conspicuous start to the new year from the SNB in getting EUR/CHF to 1.0500 last week.

. @elonmusk after getting invitations from various politicians in India.

Balanced emotions are crucial to intuitive decision-making.

Consistency is what transforms average into excellence.

China, China, China

I’ve mentioned quite a few times already in the past few weeks, that I just don’t see any bigger risk to the global recovery than China. The omicron risks there are something that will percolate to global supply chains, inflation, and thus central bank outlook as well. And with Beijing being hit now, there’s more scrutiny than ever for China to try and control the situation.

I’m not trying to be a fear monger, but I reckon broader markets are severely underestimating the potential impact of the actions that Chinese authorities may take in relation to this. As such, keep an eye out for the headlines in the days ahead. They may not gather much immediate traction but the fallout can be massive. From last week:

Japan has raised its assessment on machinery orders after solid November data

Japan Core Machinery Orders for November 2021

+11.6% y/y

expected 6.1%, prior 2.9% y/y

+3.4% m/m

expected 1.4%, prior 3.8% m/m

The data point is used as a capex indicator for Japan in the months ahead

More:

Japan’s government has raised it machine orders assessment, says the orders are showing signs of a pickup.

Vitol says oil prices could head even higher – tight supply

Via Bloomberg (may be gated) :

- prices could go up higher

- supplied are tight

Cited gas:

- What’s happening with gas “serves to remind us that people will abstain from buying expensive energy at some point,” he said on a webinar hosted by Dubai-based consultancy Gulf Intelligence. “The question is at what point that affects the oil market.”

Also, on China (this via Platts (may be gated) ):

- “It doesn’t look like China is going to shrink its [oil] demand,” Mike Muller told an online conference organized by Dubai-based Gulf Intelligence. “The fabric of society is still heavily oriented towards manufacturing and energy-consuming businesses,”

- “Yes there have been some very high profile cases of people moving around China transmitting omicron from one place to another….but we are nowhere near seeing a major demand hit,”

PBOC deputy governor warns China is facing growing supply chain risk

- Liu Guiping, deputy governor of the People’s Bank of China, spoke to the Global Asset Management Forum in Beijing on Saturday.

Highlighted a number of concerns:

- Covid-19 has sped up the shift in the global distribution of production … In addition to the influence of geopolitical contests, China’s industrial sectors are facing double pressure – industries moving into Southeast Asia and back to developed countries

- Chip shortages and supply chain stoppages threaten supply chain security and competitiveness

- increasingly unpredictable course of the Covid-19 pandemic

- rising inflation and tightening monetary policies

- growing anti-globalisation and nationalist sentiment that could have an impact on international trade

—

Goldman Sachs slash their US economic growth forecast for 2022 to 3.4%

Goldman Sachs cite:

- diminishing expectations for fiscal stimulus

- the spread of the Omicron variant

Forecast now is for GDP growth in 2022 significantly downgraded to 3.4%

- from 5-6% pace in 2021

- However, above the GS 1.75% estimate of trend growth