Latest Posts

rss28 Ways 'They' Rig The Market

Rigged – Financial Word of the Year

What do people mean when they say the Stock Market is rigged? Below is a definition along with many examples that would lead reasonable people to conclude that the market is rigged.

DefinitionRig

rigged, past tense of rig

1. Used to describe situations where unfair advantages are given to one side of a conflict.

2. Describes the side of a conflict that holds an unfair advantage.

Use in a Sentence

Despite costing taxpayers billions of dollars during the financial crisis, Wall Street decided to change nothing about the rigged market. In fact, Wall Street is known to have rigged the equity market, FX market, Libor, and the Commodities market since the financial crisis.

Introvert Bingo

George Soros :Great Investor & The Ultimate Trader

On September 16, 1992, Soros’ fund sold short more than $10 billion in pounds, profiting from the UK government’s reluctance to either raise its interest rates to levels comparable to those of other European Exchange Rate Mechanism countries or to float its currency.

Finally, the UK withdrew from the European Exchange Rate Mechanism, devaluing the pound. Soros’s profit on the bet was estimated at over $1 billion. He was dubbed “the man who broke the Bank of England”.

Stanley Druckenmiller, who traded under Soros, was the genius behind the idea. Soros just pushed him to take a bigger size. In this case, the bigger size was one of the reasons why this trade worked. What is more important here is to highlight their position size. They risked their entire YTD gain (they were up 12%).

Just to give you a perspective of how ballsy it is to risk 12% of your capital on one trade, consider the following simplified example:

Let’s assume that your trading capital is 200k and you want to buy a stock at $50 with a stop at 47; hence you risk $3 per share.

Risking 12% of your capital, means 12% * 200k = 24,000.

Divide 24,000 by the amount you risk per share ($3) to get the total number of shares you could afford to buy, which in this case is 8000 shares. (more…)

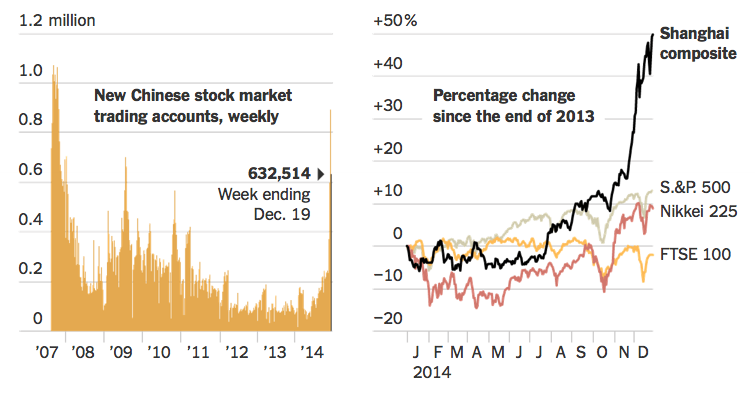

Seeking to Ride on China’s Stock Market Highs

Key was to be patient. They grinded me the past week but stayed alive waiting for the opportunity to strike back

Trading Quote

“The ability to change one’s mind is probably a key characteristic of successful traders. Dogmatic and rigid personalities rarely succeed in markets. The markets are a dynamic process and sustained trading success requires the ability to modify and even change strategies as markets evolve. Successful traders have the ability to adapt to the changing dynamics of the market and in the process maintain their consistency of performance.”

“The ability to change one’s mind is probably a key characteristic of successful traders. Dogmatic and rigid personalities rarely succeed in markets. The markets are a dynamic process and sustained trading success requires the ability to modify and even change strategies as markets evolve. Successful traders have the ability to adapt to the changing dynamics of the market and in the process maintain their consistency of performance.”

Survival of the Fattest

Why is Jim Rogers Sceptical of India's Future?

Investor and Adventure Capitalist Jim Rogers remains deeply sceptical of India’s future. In an interview with Forbes India, he argues the country is sitting on a fiscal time bomb.

Investor and Adventure Capitalist Jim Rogers remains deeply sceptical of India’s future. In an interview with Forbes India, he argues the country is sitting on a fiscal time bomb.The finance minister has changed the direction of India’s budget deficit by reducing the target for 2010-11 to 5.5 percent.

You really believe it will happen? Go back over the years and see their previous claims.

He has got a lot of praise for that in India. Still you are not impressed. Why?

Even if it happens, it is not being done by sound budgeting. It is from selling off the family jewels if it happens.

Don’t you think a high deficit was justified last year when the government had to spend and help the economy revive?

No. They are just trying to push the problems out into the future rather than solving the underlying problems. Do you really think the solution for a problem of too much debt and too much consumption is more debt and more consumption?

Are we not living in extraordinary times when we have to follow such flexible policies?

We are indeed. They are making the problems worse in extraordinary times which require tough measures to correct decades of abuse.

The finance minister rolled back some of the economic stimulus measures he had announced last year. Would you have preferred to see a complete rollback than a partial one?

Yes. And more.

If you were to set an agenda for the government, what would that be?

Cut spending and subsidies dramatically. Many studies have shown that countries start having serious growth problems when debt is 90 percent of GDP (gross domestic product). India is now [at] 80 percent and will be [at] 90 percent soon under this budget. The subsidies distort the economy in less productive areas.

4 Elements Required to Trade Successfully

There are 4 elements you must master:

- Idenifying support and resistance. If you are trading in the middle of the range, you will be more suseptible to what seem to be reversals, but are actually just noise in between a trading range. Do not enter if your stock has moved more than 5 percent above support or the breakout point.

- Identifying volume patterns. If you buy a dip on high volume, there’s a higher probability of getting caught in the midst of a reversal. Same goes for low volume breakouts.

- Set appropriate stops, based on support, resistance and percentage of your trading portfolio. Even if you take the appropriate cautions, you can still get reversed. It shouldn’t hurt when you do.

- Do not trade scared. Trust your analysis and risk parameters.

It has taken me time to master these four elements to trading, and at times I still fall into my old habits. The key is to constantly assess both the technical and mental aspects of your game. There are 4 elements you must master:

- Idenifying support and resistance. If you are trading in the middle of the range, you will be more suseptible to what seem to be reversals, but are actually just noise in between a trading range. Do not enter if your stock has moved more than 5 percent above support or the breakout point.

- Identifying volume patterns. If you buy a dip on high volume, there’s a higher probability of getting caught in the midst of a reversal. Same goes for low volume breakouts.

- Set appropriate stops, based on support, resistance and percentage of your trading portfolio. Even if you take the appropriate cautions, you can still get reversed. It shouldn’t hurt when you do.

- Do not trade scared. Trust your analysis and risk parameters.

It has taken me time to master these four elements to trading, and at times I still fall into my old habits. The key is to constantly assess both the technical and mental aspects of your game.