Latest Posts

rssSolve this stock chart riddle

Pictured above are two charts over a trading year. Chart 1 starts at 100 and ends at 200. Chart 2 also starts at 100 and ends at the very same 200. Which chart is BETTER and WHY? Post what you think in the comments section if you want.

When Newton called the bubble in South Sea stock in 1720, but had to get back in anyway, & got broke?

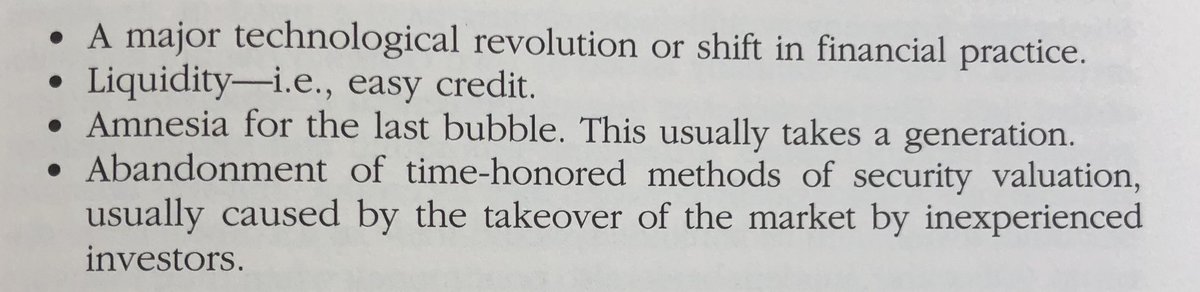

The necessary conditions for a bubble (from William Bernstein’s The Four Pillars of Investing)

Greece not alone among countries with debt problems

Post market POOL PARTY -Yes One of The Best Weeks

Greece 10-Year Bond Oversubscribed

LONDON—The Greek government’s offering for a 10-year bond attracted around €14.5 billion ($19.86 billion) in bids and the books have closed, the head of the country’s debt-management agency said Thursday.

LONDON—The Greek government’s offering for a 10-year bond attracted around €14.5 billion ($19.86 billion) in bids and the books have closed, the head of the country’s debt-management agency said Thursday.

“We are very happy with the bid because the re-entry into the market is always challenging. It went very well,” Petros Christodoulou said. The government aimed to raise €5 billion from the offering but it was heavily oversubscribed.

The offering—timed to coincide with an improving market for Greek government debt in the wake of tough budget cuts announced a day earlier—is a move to help cover short-term funding gaps.

Lead managers are Barclays Capital, HSBC Holdings, National Bank of Greece, Nomura and Piraeus Bank SA, one of the lead managers on the deal said.

Adjusted price guidance for the new issue is now 3.00 percentage points over the benchmark risk-free mid-swaps rate, reflecting the market’s demand for a premium.

An issue size of €5 billion for Greece’s new 10-year bond “would be a good result” but not enough to fully cover Greece’s near-term funding needs, said UniCredit strategist Luca Cazzulani.

Greek bond yields in secondary markets moved up on the news. The yield spread between Greek 10-year government bonds over equivalent German government bonds widened to around 3.03 percentage points from Wednesday’s close at 2.92 percentage points.

The cost of insuring Greek sovereign debt against default also rose slightly. The price of Greece’s five-year sovereign credit default swaps increased to 3.05 percentage points, from 2.945 percentage points, representing a €10,500 increase in the annual cost of insuring €10 million of debt for five years.

Greece, the European Union’s most indebted country, will face its biggest challenge in April and May this year, when more than €20 billion of debt comes due for repayment. So far, Greece has raised €13.6 billion via the sale of Treasury bills and an €8 billion bond syndication, the Public Debt Management Agency said. Greece plans to issue a total of €54 billion in debt this year.

While Greece has been encouraged by its ability so far to raise funds from public markets, the cost of issuing new bonds remains high. The yield on 10-year Greek government bonds has risen to as high as 3.40 percentage points over equivalent German bunds, from low-double-digits before the start of the financial crisis.

Greece’s latest set of spending cuts and tax increases aims to cut the country’s gaping budget deficit by €4.8 billion or about 2% of gross domestic product, and follows pressure from the European Commission, the EU’s executive arm, which said last week that Greece’s previously announced measures weren’t tough enough.

Greek officials worry that its budget cuts won’t be enough to restore investor confidence in Greek debt unless the government receives detailed financial backing from the European Union.

Greek Finance Minister George Papaconstantinou said in Athens Wednesday that if Greece can’t rule out turning to the International Monetary Fund for assistance if Greece needs help and euro-zone partners won’t give it.

IMF financing would need approval by European countries on the IMF’s board. Most euro-zone governments have made clear they want a European solution to the Greek crisis rather than IMF intervention, to show the euro zone can handle its own problems.

Greece is rated A2 by Moody’s Investors Service and BBB+ by Standard & Poor’s Corp. and Fitch Ratings Inc.

A Rich Man's Pearl of Wisdom "Two Little Words "

“When I was a young man, I had the opportunity to meet one of Wall Street’s legends, Arnold Bernhard, founder of Value Line Investment Survey, called “the most trusted name in investment research.” Bernhard pioneered Value Line, famous for its one-page assessment of publicly traded companies.

“When I was a young man, I had the opportunity to meet one of Wall Street’s legends, Arnold Bernhard, founder of Value Line Investment Survey, called “the most trusted name in investment research.” Bernhard pioneered Value Line, famous for its one-page assessment of publicly traded companies.

We had lunch together at his offices on 3rd Avenue in mid-Manhattan, and I shall never forget the occasion. He was in his late eighties by then and had only a year or two to live. Bernhard wanted to talk about his offshore properties in the Bahamas (I lived in Nassau for two years, 1984-85), but I had a more philosophical interest.

I asked, ‘Mr. Bernhard, you have lived a long, successful career on Wall Street. If you could reduce your approach to investing to one sentence, what would it be?” He reached for his cane, stood up, and walked slowly toward the window overlooking 42nd Street. “Young man,” he said deliberately, “the secret to successful investing can be reduced to two simple words: know value.” (more…)