Practice does not make perfect in trading or anything else; perfect practice makes perfect. Training must gradually build competencies and correct deficiencies in a manner that sustains a positive mindset and optimal concentration and motivation.

Practice does not make perfect in trading or anything else; perfect practice makes perfect. Training must gradually build competencies and correct deficiencies in a manner that sustains a positive mindset and optimal concentration and motivation.

Latest Posts

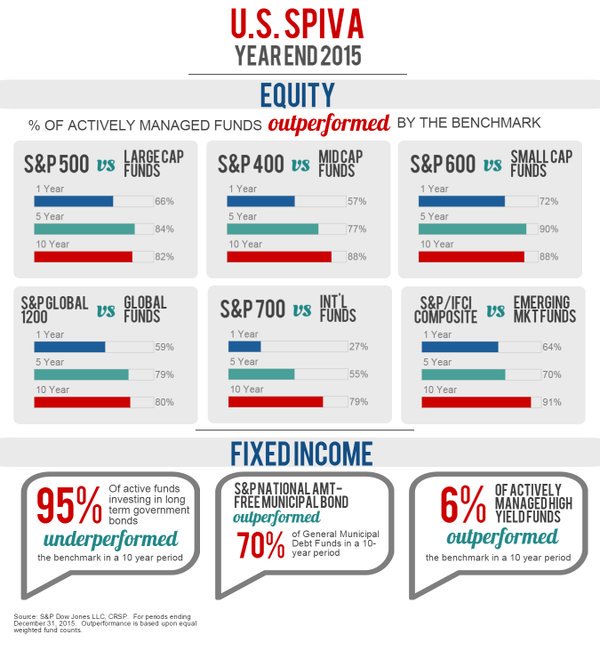

rssHow Many Active Managers Outperform Their Benchmarks?

Trading Discipline

Emotions are probably the biggest obstacle any trader has to overcome. Many traders become losers because they can’t follow a plan. They see a couple of losses, get excited, abandoned the plan and start to take wild shots at the market.

Emotions are probably the biggest obstacle any trader has to overcome. Many traders become losers because they can’t follow a plan. They see a couple of losses, get excited, abandoned the plan and start to take wild shots at the market.

Traders who develop a sound set of trading rules that match their financial situation with their objectives, and then stick with those rules, increase their chances of becoming big winners. Trading discipline can be more important than your trading system.

Discipline means you must become mechanical in making trades when certain price actions occur. You must shut off your emotions, and not accept one trading signal over another. Disciplined traders let profits run and keep losses short by following rigid guidelines. (more…)

If your trade is losing money:

Positive Emotions Transform Us -Video

There will always be people judging you.

Political Economy

Discipline is the key -But 95% Traders Don't care

Five market scenarios that place you at the most risk.

- 1.Bad Markets – A good pattern won’t bail you out of a bad market, so move to the sidelines when conflict and indecision take hold of the tape. Your long-term survival depends on effective trade management. The bottom line: don’t trade when you can’t measure your risk, and stand aside when you can’t find your edge.

- Bad Timing – It’s easy to be right but still lose money. Financial instruments are forced to negotiate a minefield of conflicting trends, each dependent on different time frames. Your positions need to align with the majority of these cycles in order to capture the profits visualized in your trade analysis.

- Bad Trades – There are a lot of stinkers out there, vying for your attention, so look for perfect convergence before risking capital on a questionable play, and then get out at the first sign of danger. It’s easy to go brain dead and step into a weak-handed position that makes absolutely no sense, whether it moves in your favor or not. The bottom line: it’s never too late to get out of a stupid trade.

- Bad Stops – Poor stops will shake you out of good positions. Stops do their best work when placed outside the market noise, while keeping risk to a minimum. Many traders believe professionals hit their stops because they have inside knowledge, but the truth is less mysterious. Most of us stick them in the same old places.

- Bad Action – Modern markets try to burn everyone before they launch definable trends. These shakeouts occur because most traders play popular strategies that have been deconstructed by market professionals. In a sense, the buy and sell signals found in TA books are turned against the naïve folks using them.

Financial Journalist