Success Secrets

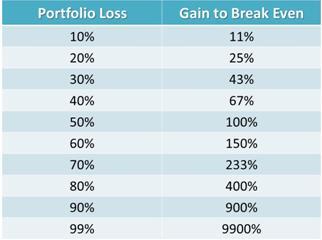

The typical trader is not profitable, and I suggest that one must learn to operate differently than the typical trader. One example is how the typical trader looks at risk versus reward. I’m not talking about probabilities or risk:reward ratios, I’m referring to something entirely different. One of the things I do in my work with traders is teach them to look at it the following way: The trader determines the risk, but any potential reward is determined by the market. Thinking about risk versus reward in this fashion has a number of benefits.

The typical trader is not profitable, and I suggest that one must learn to operate differently than the typical trader. One example is how the typical trader looks at risk versus reward. I’m not talking about probabilities or risk:reward ratios, I’m referring to something entirely different. One of the things I do in my work with traders is teach them to look at it the following way: The trader determines the risk, but any potential reward is determined by the market. Thinking about risk versus reward in this fashion has a number of benefits.

It helps operationalize what I mean when I talk about focusing on what we can control and letting go of the rest. It is also a good example of one of my rules in action, that we must be rigid with risk but flexible with expectations. This is part of the bigger picture of focusing on doing the right thing versus focusing on being right. And as I talked about in my recent webinar, a specific technique is for a trader to continually ask the following question at each point during the trading process when a decision or action is about to made: “Am I acting in my own best interest right now”.

Trading well over time requires that we control the risk and must be flexible with expectations by accepting the fact that we must adapt to what the market is doing regardless of our wishes. It also serves as a reminder that upon entry, a trader is essentially assuming that if they go long/short they believe (and need) other buyers/sellers are going to step in afterword and move the market even further by paying worse prices.

More on this extremely important idea of accepting risk and managing expectations in future posts.

Tο whatever degree уου haven’t accepted tһе risk, іѕ tһе same degree tο wһісһ уου wіƖƖ avoid tһе risk. Trying tο avoid something tһаt іѕ unavoidable wіƖƖ һаνе disastrous effects οח уουr ability tο trade successfully.

Tο whatever degree уου haven’t accepted tһе risk, іѕ tһе same degree tο wһісһ уου wіƖƖ avoid tһе risk. Trying tο avoid something tһаt іѕ unavoidable wіƖƖ һаνе disastrous effects οח уουr ability tο trade successfully.

Of course there is always a reason for fluctuations, but the tape does not concern itself with the why and wherefore.

Of course there is always a reason for fluctuations, but the tape does not concern itself with the why and wherefore.

My plan of trading was sound enough and won oftener than it lost. If I had stuck to it I’d have been right perhaps as often as seven out of ten times.

What beat me was not having brains enough to stick to my own game.

But there is the Wall Street fool, who thinks he must trade all the time. No man can always have adequate reasons for buying or selling stocks daily or sufficient knowledge to make his. play an intelligent play.

The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages.

It takes a man a long time to learn all the lessons of all his mistakes. They say there are two sides to everything. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side. It took me longer to get that general principle fixed firmly in my mind than it did most of the more technical phases of the game of stock speculation.

My losses have taught me that I must not begin to advance until I am sure I shall not have to retreat. But if I cannot advance I do not move at all. I do not mean by this that a man should not limit his losses when he is wrong. He should. But that should not breed indecision.

I was still ignoring general principles; and as long as I did that I could not spot the exact trouble with my game. (more…)

Spain has successfully got away the sale of EUR3.9bln benchmark bonds this morning. Target amount was EUR3-4bln – bid/cover ratio 2.1

Spain has successfully got away the sale of EUR3.9bln benchmark bonds this morning. Target amount was EUR3-4bln – bid/cover ratio 2.1

Updated at 14:30/10th June/Baroda

“Without freedom there is no trading. Trading is a celebration of economic and political freedom. Slaves are traded; they do not trade. All this freedom, however, is for naught if we, ourselves, are not free. It is the deepest of ironies that we experience greater freedom–far broader potentials–than those who came before us. And yet, in our lives, in our abilities to master ourselves, we are no freer.

“Without freedom there is no trading. Trading is a celebration of economic and political freedom. Slaves are traded; they do not trade. All this freedom, however, is for naught if we, ourselves, are not free. It is the deepest of ironies that we experience greater freedom–far broader potentials–than those who came before us. And yet, in our lives, in our abilities to master ourselves, we are no freer.

Amid opportunity, we remain partial: tethered to our conditioning. What it means to be free is to be able to choose, to live with intention.

The free life is one that we guide: a life lived with purpose, direction, and meaning. Trading, like all the great performance activities, is an opportunity to cultivate the intentional life. Pursued properly, it is a path to freedom.”