“One of the most difficult things to get investors and traders to understand is that no matter how much they investigate an investment, they will probably do better if they did less. This is certainly counter-intuitive, but the way that our brains function almost guarantees that this will happen. This kind of failure also happens to those investors frequently regarded as the smartest. In essence, the more information that investors have, the more opportunity that they have to choose the misinformation that suits their emotional purposes.

Speculation is observation, pure and experiential. Thinking isn’t necessary and often just gets in the way. Yet everywhere we turn, we read and hear opinion after opinion and explanation on top of explanation which claim to connect the dots between economic cause and market effect. Most of the marketplace is long on rationale and explanation and short on methods.

A series of experiments to examine the mental processes of doctors who were diagnosing illnesses found little relationship between the thoroughness of data collection and accuracy of the resulting diagnosis. Another study was done with psychologists and patient information and diagnosis. Again, increasing knowledge yielded no better results but did significantly increase confidence, something which the smartest among us are most prone to have in abundance. Unfortunately, in the markets, only the humble survive.

The inference is clear and important. Experienced analysts have an imperfect understanding of what information they actually use in making judgments. They are unaware of the extent to which their judgments are determined by just a few dominant factors, rather than by the systematic integration of all of their available information. Analysts use much less available information than they think they do. (more…)

Latest Posts

rssWhat Do You Learn as a Trend Follower?

The mechanics of trend following:

The mechanics of trend following:

– know what to trade

– know when to enter the trade

– know what to do once in the trade

– know when to exit the trade

The timelessness of greed, fear, and bad decisions -1936

India Ranked 11th Highest National Debt Out of G 20 Nations

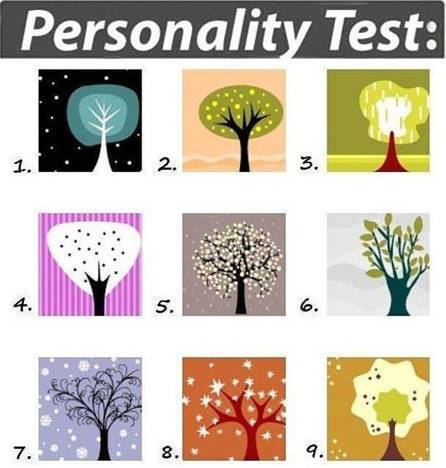

Trees & Personality Test

Don’t think about it too long, just choose, and find out

what your choice says about your personality. (more…)

There is a Difference Between What People Say and What They Think

For many, there is a difference between how you think you will act in certain conditions and how you actually act when the time comes. The term used to describe this condition is called empathy gap.

There are two basic scenarios in which empathy gap can impact your performance as a trader/investor:

– you don’t cut your losses when they hit your pre-established exit level. This is the single biggest reason, so many people struggle in the capital markets. One solution to the issue is to enter exit orders, immediately after you initiate an opening order (caution: it does not work with illiquid names, where market makers can easily shake you out);

– you don’t take the signals from your watchlist when they are triggered. Some stocks can really move fast after they pass their tipping point. When that happens, many traders feel like a deer in headlights and are not willing to pay the market price. They’ll put a limit order, hoping that the desired stock will come back and their order will be filled. The best stocks don’t come back. Don’t be afraid to pay the market price for proper breakouts.

In today’s information overloaded world, evidence suggests that 95 per cent of our decisions are made without rational thought. So consciously asking people how they will behave unconsciously is at best naïve and, at worst, can be disastrous for a business. (more…)

Logic > Emotion in Trading

Trade outcome process

Good Traders & Great Traders

Trouble with a Rat race is even if u win, ur still a Rat.So always run with Lions. Even if defeated, ur still a lion