17 equations that changed the world:

Imagine the market as the totality of possibility. Unlimited in potential in any direction at any time. Potential for profit. Potential for loss. Potential beyond your capacity to ever comprehend. What you know is that the market goes up and down. Rarely does it stay unchanged for any length of time. Then imagine you as an observer watching the market. The market is an ocean of possibility, while you, the observer, represent someone in a small boat navigating in this infinite sea of possibility. What do you, as a buyer or seller, see? The tide goes in, the tide goes out. Storms come and go. There is no telling what this ocean of possibility is really going to do at any given time.

Yet, depending on the skill of the navigator of the boat in this ocean of infinite possibility, he either harvests what the ocean is willing to give him or he keeps looking for what he wants from the ocean. If his vision is locked on finding what he is looking for, he becomes blind to other possibility that the ocean presents. The ocean, as well as the market, does not know the fisherman is there. It is incapable of wanting to help or hurt the fisherman. Possibility opens and possibility closes irrelevant to the fisherman. The ocean simply is.

Opportunity and disaster both exist as possibility to the navigator of the boat in the sea of possibility. It is the discernment of the navigator, beyond fear, that opens or closes possibility in the market. Until fear is taken off-line, the fisherman of possibility sees through the eyes of fear and can not see the potential of a long term beneficial relationship with the ocean of possibility called the market.

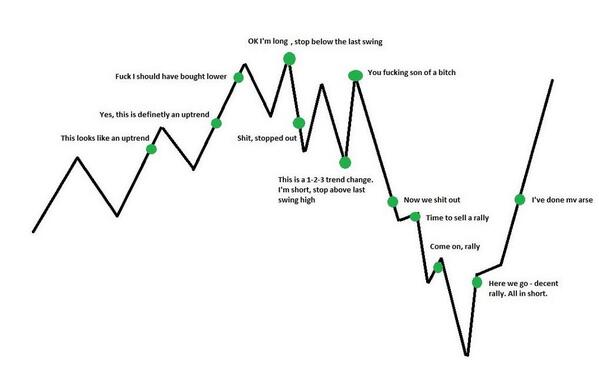

As a trader you have to learn how to take losses. Period. Don’t be a crybaby. Learn how to take losses.

As a trader you have to learn how to take losses. Period. Don’t be a crybaby. Learn how to take losses.

Learning how to take losses is one of the most important lessons you must learn if you want to survive as a trader. Nobody is 100% right all the time. Losses are inevitable. Even Michael Jordan and Tiger Woods lose sometimes and they’re considered the best in their field.

There will be trading streaks where you’ll have a number of successful consecutive trades, but that will eventually come to an end you will take a loss.

As that point it’s very important not to lose your head, you must remain in control of yourself. Don’t have a cow man.

Take a break. Calm down and relax. Take a chill pill dude.

Until you’ve regained a clear mind and an ability to think logically again, stay out of the market.

Don’t whine about your loss and never carry a prejudice against a loss.

The key to manage losses is to cut them quickly before a small loss becomes a large one.

I repeat. The key to manage losses is to cut them quickly before a small loss becomes a large one.

Never ever think that you will never lose. That’s just ludicrous. Losses are just like profits, it’s all part of the trader’s universe.

Losses are unavoidable. Get over the loss and move on to the next trade.

The point is that from our own individual perspective as observers of the market, anything can happen, and it takes only one trader to do it. This is the hard, cold reality of trading that only the very best traders have embraced and accepted with no internal conflict. How do I know this? Because only the best traders consistently pre-define their risks before entering a trade. Only the best traders cut their losses without reservation or hesitation when the market tells them the trade isn’t working. And only the best traders have an organized, systematic, money-management regimen for taking profits when the market goes in the direction of their trade.

Not predefining your risk, not cutting your losses, or not systematically taking profits are three of the most common—and usually the most costly—trading errors you can make. Only the best traders have eliminated these errors from their trading. At some point in their careers, they learned to believe without a shred of doubt that anything can happen, and to always account for what they don’t know, for the unexpected.