It’s all a matter of perspective.

Ten hours later and I would wager that most of the market is still trying to wrap their heads around the Fed communique yesterday and what does that all mean moving forward. The market reaction has been less straightforward and that is making for a tougher time to digest everything so far.

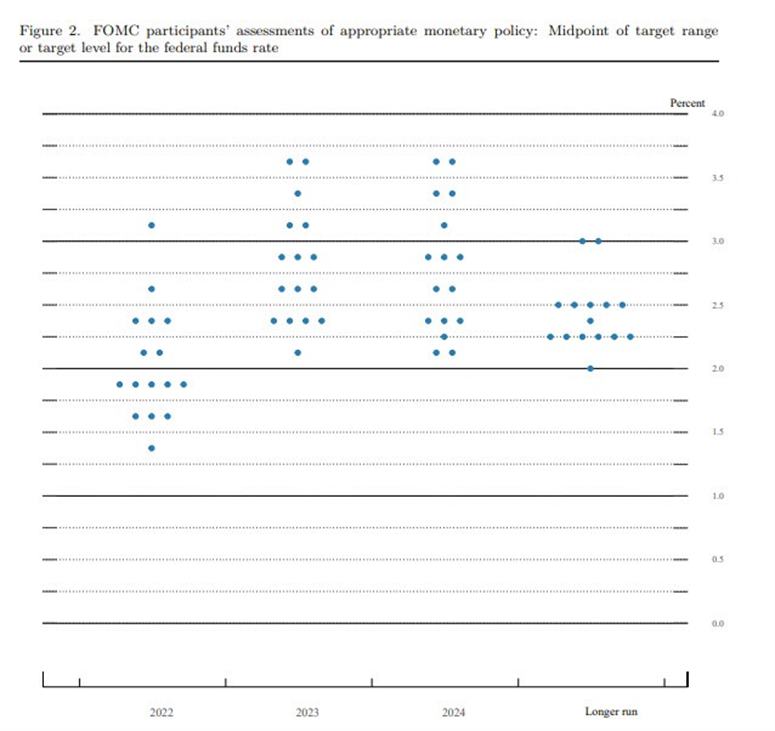

The Fed hiked by 25 bps as expected, with Bullard the only dissenter (wanting a 50 bps move). The dot plots showed 7 rate hikes for this year with 4 more to follow in 2023. But the Fed did lower growth projections and upped its inflation forecast. And Powell’s press conference was not too assuring I would say, though at least the door for QT is open for either May or June.

The UNSC has five permanent members:

and ten non-permanent members elected for two-year terms (end of term year):

Earlier reports were that the Indian Oil Corporation (IOC) bought 3 million barrels of Russian Urals from trader Vitol for May delivery.

Earlier this week White House Press Secretary Jen Psaki told reporters, in response to the possibility that India could take up the Russian offer of discounted crude oil

On the downside,

For the day, the major indices are all sharply higher:

Of note technically, the S&P index moved up close to its 200 hour moving average at 4360.54. The high price today reached 4358.90. On March 3, the price moved up to test that moving average only to find sellers leaning against the level. That makes the open and trading day tomorrow a key event technically for the broad market index. Move above and stay above will be more bullish.

The Dot Plot for March 2022 shows the median rate at the end of 2022 at 1.9% vs 0.9% in December. That is seven hikes in 2022 which is congruent with the market but above expectations from the Fed.

In 2023 the expectations are for 2.8% vs 1.6% median (and 11 of 18 at 1.9%) in December.. They also see 2.8% in 2024.

The Dot Plot in December showed:

The table of the central tendencies from March 2022 now shows:

Indicators of economic activity and employment have continued to strengthen. Job gains have been strong in recent months, and the unemployment rate has declined substantially. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Esther L. George; Patrick Harker; Loretta J. Mester; and Christopher J. Waller. Voting against this action was James Bullard, who preferred at this meeting to raise the target range for the federal funds rate by 0.5 percentage point to 1/2 to 3/4 percent. Patrick Harker voted as an alternate member at this meeting.