Latest Posts

rssHumour Time -But It's Naked Truth

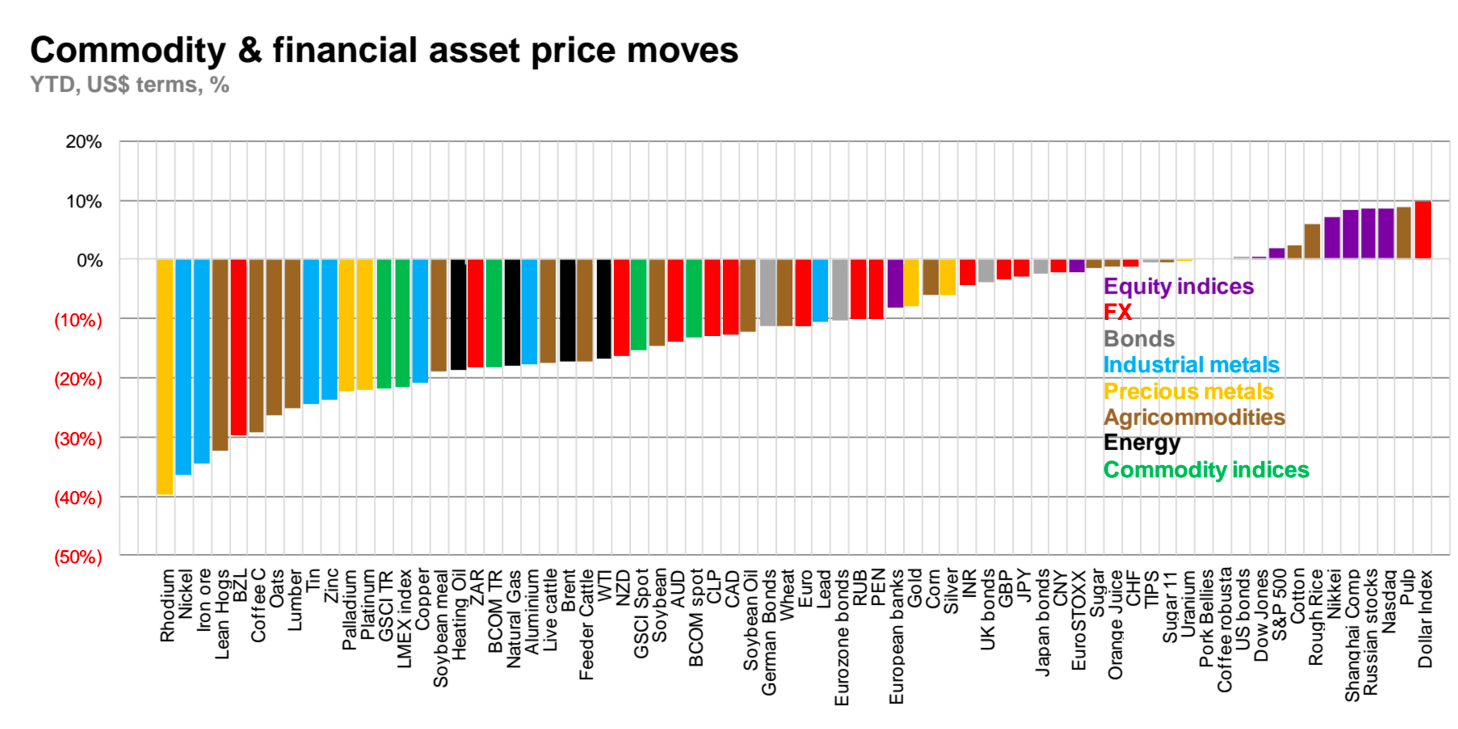

Collapse of Commodities in One Simple Chart

Losses

Losses are a simple cost of doing business. Don’t try to justify a bad trade by convincing yourself that it will sooner or later turn into a good trade. Accept losses easily! Successful traders are able to ride through downturn periods. The confidence in their methods reassures them about their future success.

Losses are a simple cost of doing business. Don’t try to justify a bad trade by convincing yourself that it will sooner or later turn into a good trade. Accept losses easily! Successful traders are able to ride through downturn periods. The confidence in their methods reassures them about their future success.

The markets offer endless and plentiful possibilities. Missed opportunities exist only in your mind. Prices keep changing and generate other opportunities. The goal of trading is make a net profit after a sequence of trades. It is, therefore, necessary to accept some losses and to look forward without punishing oneself.

See Power of US Fed

Number one Manipulators in World :Central Bankers

2nd :Corporates (ACROSS GLOBE )

3rd :Insiders + Fund Managers 4) Media -BLUE CHANNELS !!

Traders: When to be Flexible & when to be Rigid

- raders should have a very flexible mindset about which way a trade can go when they enter it, but be very rigid about taking their stop loss when it is hit.

- Traders should be very flexible on profit expectations during each market cycle but very rigid about following their robust method during each cycle.

- Traders must be very flexible about allowing a winner to run but very rigid on cutting losses short.

- Traders must be flexible about their opinions and change them when proven wrong but they must be rigid about their risk management and never risk more than planned.

- Traders should be flexible about their watch list but rigid about their trading plan.

- Traders should be flexible about what will happen next in the market but rigid about their rules.

- Traders should be flexible about the direction of the trend when it changes but rigid about positions sizing.

- Traders should be flexible about profit targets but rigid about entering with a minimum risk/reward plan.

- Trades should be flexible about entries and exits as the market action develops but rigid about managing the risk of ruin at all times.

- Traders should be flexible about expectations on when they will have a huge winning streak that will change their financial lives but rigidly pursue success in the markets until it does happen.

I Wish I Could Quit You

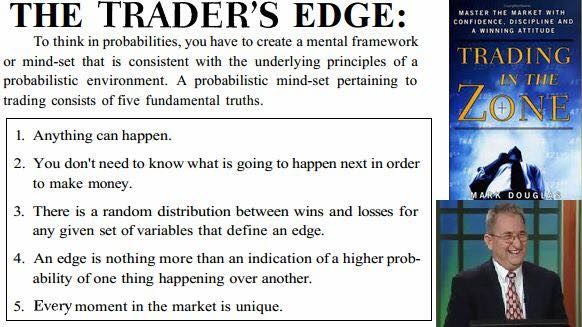

Mark Douglas' Trading Truths

Being right vs. being profitable (Being Profitable in important in Trading ,Nothing else )

Mastering the Trade, quotes by John F. Carter

The quotes below are provided by John F. Carter, master day trader; pulled directly from his new book Mastering the Trade.

The quotes below are provided by John F. Carter, master day trader; pulled directly from his new book Mastering the Trade.

I had just completed this book today evening and this is 2nd time read this book.

This may be the best quote of all:

“The financial markets are naturally set up to take advantage of and prey upon human nature. As a result, markets initiate major intraday and swing moves with as few traders participating as possible. A trader who does not understand how this works is destined to lose money”

“The financial markets are truly the most democratic places on earth. It doesn’t matter if a trader is male or female, white or black, American or Iraqi, Republican or Democrat. It’s all based on skill.”

“A trader, once in a position, can deceive himself or herself into believing anything that helps reinforce the notion that he or she is right”

“…professional traders understand this all too well, and they set up their trade parameters to take advantage of these situations, specifically preying on the traders who haven’t figured out why they lose”

“…markets don’t move because they want to. They move because they have to.”

“After all, the money doesn’t just disappear. It simply flows into another account – an account that utilizes setups that specifically take advantage of human nature.” (more…)