Latest Posts

rssEuropean stocks end the week with solid gains

All major indices are higher

- German Dax, +0.85%

- France’s CAC rose 1.04%

- UK FTSE, +0.6%

- Spain’s Ibex +1.44%

- Italy’s FTSE MIB, +0.8%

- Portugals PSI20 bucked the trend by falling -0.60%

- German Dax, +1.99%

- France’s CAC +3.33%

- UK FTSE +1.74%

- Spain’s Ibex, +2.33%

- Italy’s FTSE MIB +2.74%

- Portugal’s PSI 20 rose 1.14%

US stocks, dollar post biggest weekly moves since late 2018

US stocks cemented their biggest weekly gain in more than three months and Treasuries rallied following a patch of soft economic data, all against a backdrop of hopes of progress in US-China trade negotiations.

Wall Street’s S&P 500 resumed its rally, up 0.5 per cent, after a slip on Thursday interrupted a three-day winning streak. The benchmark was up 2.9 per cent this week, its biggest weekly advance since late November.

The S&P has registered a weekly decline just twice this year, as trade optimism and the Federal Reserve’s pledge to be patient on rate rises have lifted sentiment on Wall Street.

“Next week’s FOMC meeting and a potentially pending resolution to trade frictions between the U.S. and China are likely the macro drivers to watch going forward,” Anthony Saglimbene, global market strategist at Ameriprise, wrote to clients.

US Treasuries also rallied on Friday, dragging yields lower, following a batch of soft economic data, including industrial production that missed expectations and a gauge of manufacturing activity in New York falling to a 22-month low. Yields on the 2- and 10-year Treasury hit their lowest since early January.

Partly hobbled by a resurgent British pound, the US dollar shed about ¾ of 1 per cent this week for its biggest weekly drop since the first week of December.

Chinese state media on Friday reported “substantive progress” on trade talks and Beijing passed a new foreign investment law designed to smooth the way to a new trade deal with the US.

The CSI 300 index tracking Shanghai and Shenzhen stocks closed up 1.3 per cent.

There were solid moves in Europe. Frankfurt’s Xetra Dax 30 gained 0.9 per cent, gathering pace as the session developed and reaching its highest level since October. London’s FTSE 100 was up 0.6 per cent.

Thought For A Day

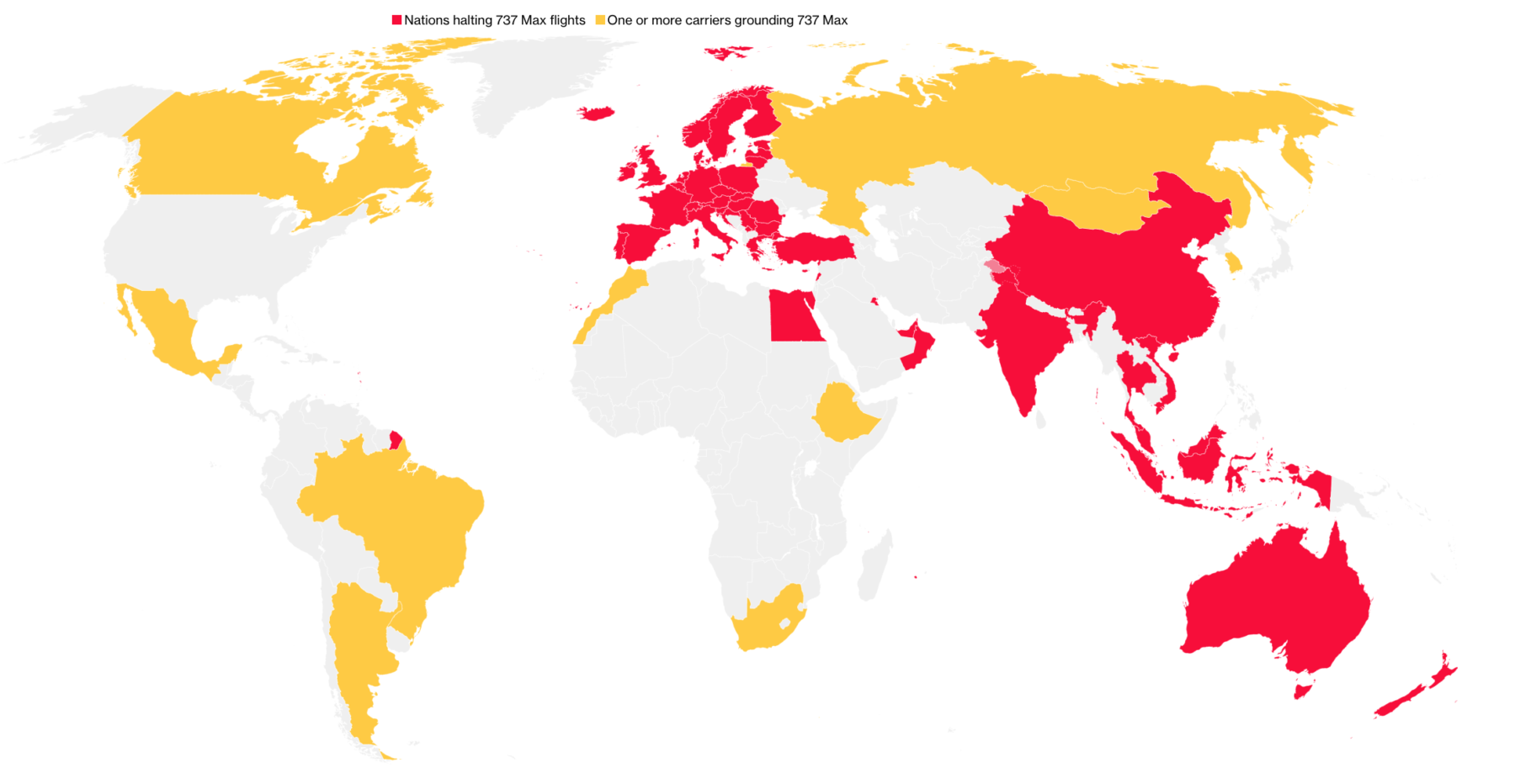

Where the Boeing 737 Max Is Grounded

BOJ’s Kuroda: Negative interest rates help to create desirable yield curve

BOJ governor Haruhiko Kuroda still on the wires

North Korea is considering suspending nuclear talks with United States

The headlines helping the yen to gain

- North Korea is considering suspending nuclear talks with United States

Tass citing Nth Korean deputy foreign minister

And:

- North Korea has no intention to yield to united states’ demands

- North Korean leader Kim set to make official announcement on his position regarding talks with united states

BOJ announce no change to monetary policy, as expected

Bank of Japan March 14 and 15 policy meeting Statement issued now

- maintains short-term interest rate target at -0.1 pct

- maintains 10-year JGB yield target around zero pct

- BOJ decision on yield curve control made by 7-2 vote, board members Harada, Kataoka dissent

- BOJ leaves unchanged pledge to buy JGBin flexible manner so its holdings increase at annual pace of around 80 trln yen

BOJ cuts assessment on exports, output

- tweaks assessment on Japan’s economy

- Says Japan’s economy expanding moderately but exports, output affected by overseas slowdown

- says overseas economies growing moderately but slowdown observed

- says exports showing some weakness recently

- says output showing some weakness but rising moderately as a trend

- says Japan economy likely to continue expanding moderately despite impact of overseas slowdown

- Says exports likely to remain weak for some time but remain on moderate rising trend

This decision and the surrounding downgrades were all expected by the market.

China’s Premier Li says the economy faces new downward pressure

Premier Li Keqiang speaking at a press conference at the end of the National people’s Congress (NPC)

- China will not allow economic growth to fall out of a reasonable range

Goldman Sachs raised its oil price forecasts – SG also raise their forecasts

- to trade 62-75 range over next 12 months

- average 67.50 in 2019

- 64 USD in Q3

- $55-$69 range over next 12 months

- $60 average in 2019

- Iran, Venezuela the biggest upside risks to oil market outlook

- Saudi Arabia unlikely to proactively increase output to make up for supply disruptions