A hoped-for summit to wrap up a U.S.-China trade deal has been postponed from this month to April or later as Beijing bristles at Washington’s demands for a one-way enforcement framework.

China’s Ministry of Foreign Affairs on Monday announced the schedule for President Xi Jinping’s trip to Europe later this month. Not included in the itinerary was a stopover in the U.S. for talks with President Donald Trump, which Beijing had considered as an occasion to close the trade deal. The absence essentially eliminates any chance for the two leaders to meet before the end of March.

The delay reflects a continuing conflict over enforcement. Even as negotiations enter the final stages, Washington and Beijing still have differences over a framework that verifies China’s adherence to the eventual deal and punishes the country for failing to follow it, a U.S.-China diplomatic source said. The rift has stretched out the timeline for talks, pushing the wrap-up summit to April or even as late as June.

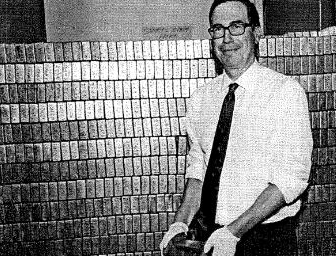

“There’s still a lot of work to do,” U.S. Treasury Secretary Steven Mnuchin said Thursday, acknowledging that the summit would not happen by the end of March as previously discussed.

Mnuchin and U.S. Trade Representative Robert Lighthizer spoke by phone twice last week with Chinese Vice Premier Liu He to hammer out the text of a trade agreement. Chinese state-run news agency Xinhua reported Friday that the two sides made substantive progress.

Chinese President Xi Jinping and U.S. President Donald Trump have not had a face-to-face meeting since they met in Buenos Aires in December. © AP

Chinese President Xi Jinping and U.S. President Donald Trump have not had a face-to-face meeting since they met in Buenos Aires in December. © APTrump said Thursday that the talks are going “very well,” but warned that “if it’s not a deal that’s a great deal for us, we’re not going to make it.”

Chinese Premier Li Keqiang told reporters on Friday that he wants a “win-win” result that benefits both sides.

Beijing and Washington have agreed to continue holding regular ministerial and vice ministerial meetings for enforcement, but the U.S. wants the right to impose punitive tariffs if it determines that China is not holding up its end of the deal.

American negotiators including Lighthizer reportedly have pressed China to promise not to respond with retaliatory duties in such cases, as Beijing did multiple times last year in response to U.S. tariffs on Chinese products.

Beijing has resisted a unilateral enforcement framework. Wang Shouwen, the Chinese vice minister of commerce, has said any such mechanism must be “fair and equal.” (more…)

‘Mmmmm, gold’

‘Mmmmm, gold’