Latest Posts

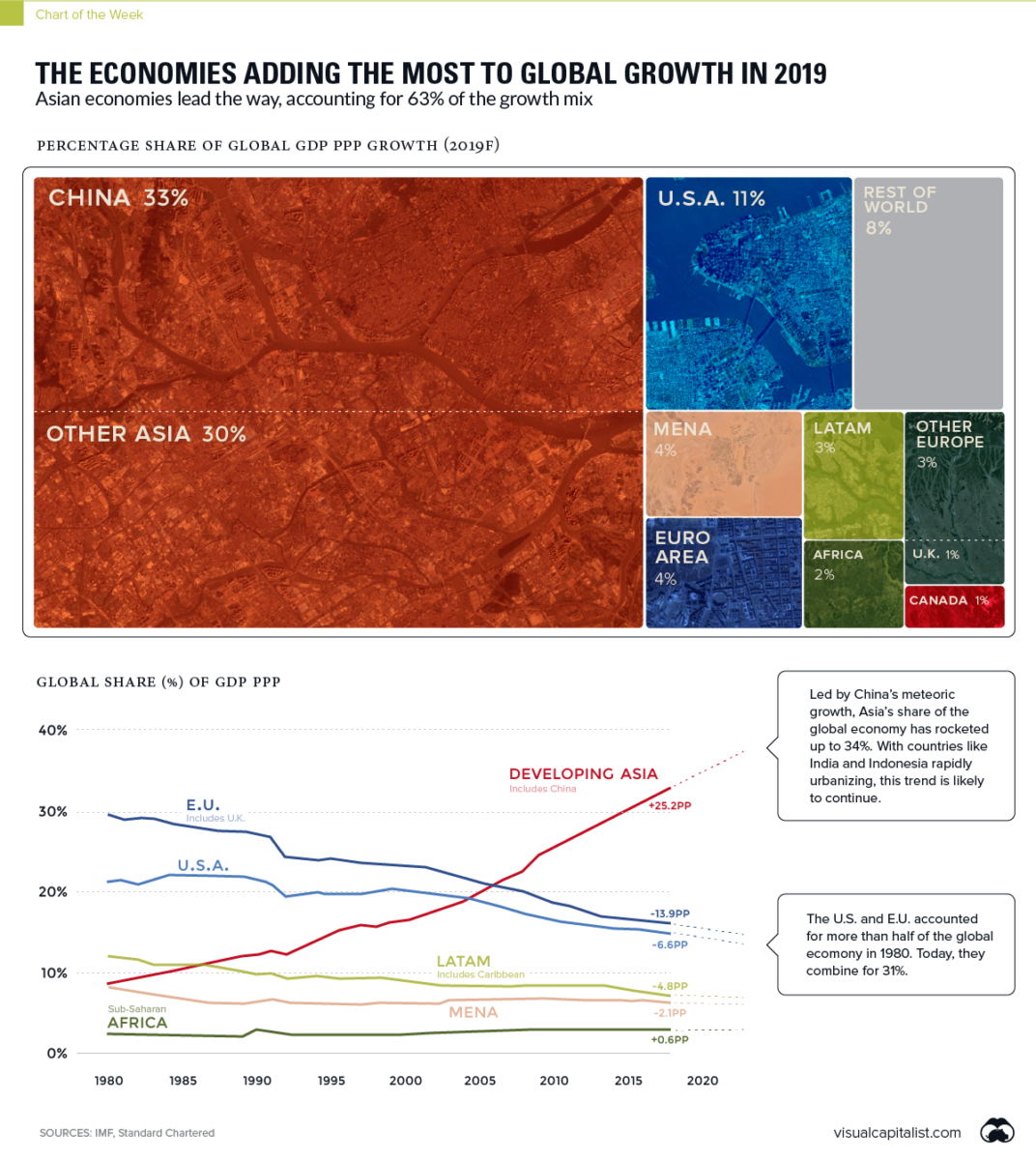

rssEconomies Adding the Most to Global Growth in 2019

US Dollar Index finished lower for the 9th day in a row, tied for longest streak in history (data back to 1973). First close below 200-day moving avg since May 2018

The psychology of a market cycle

US press: President Trump just sidelined his own top negotiator on North Korea

Time reports that Trump has taken increased control of negotiations over North Korea’s nuclear weapons program,

- sidelining his own top negotiator and dismissing the warnings of top intelligence and foreign policy advisors in the wake of last month’s failed summit in Vietnam, officials familiar with the developments tell TIME.

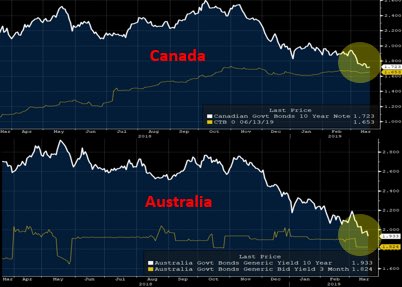

Bond markets are sniffing out a global recession… Canada & Australia just a bps away from full inversion

The US yield curve almost inverted as investors price out any prospect of a rate hike for the next decade….

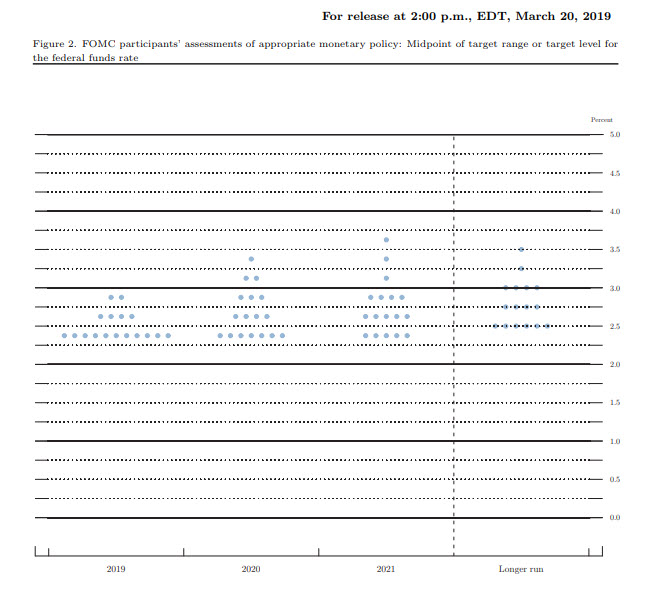

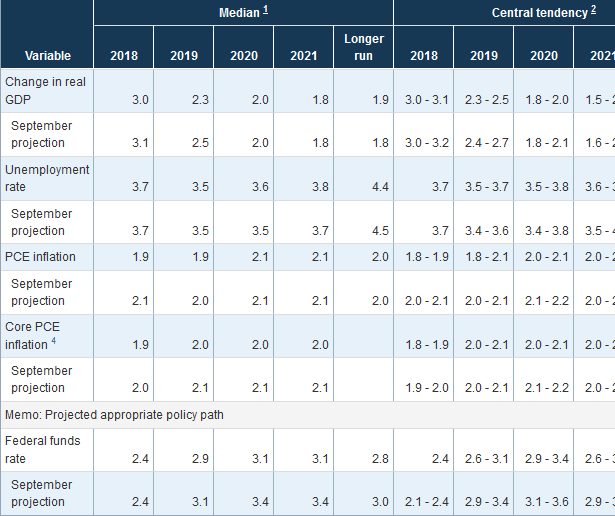

FOMC dot plot shows no hikes in 2019. One hike in 2020

Dot plot from March 2019 statement

- No hikes projected in 2019. 2.4% vs 2.9% previous

- 1 hike in 2020. 2.6% vs 3.1% previous

- No hikes in 2021. 2.6% vs 3.1% previous

- Sees longer run rate at 2.8% . Unchanged from previous forecast.

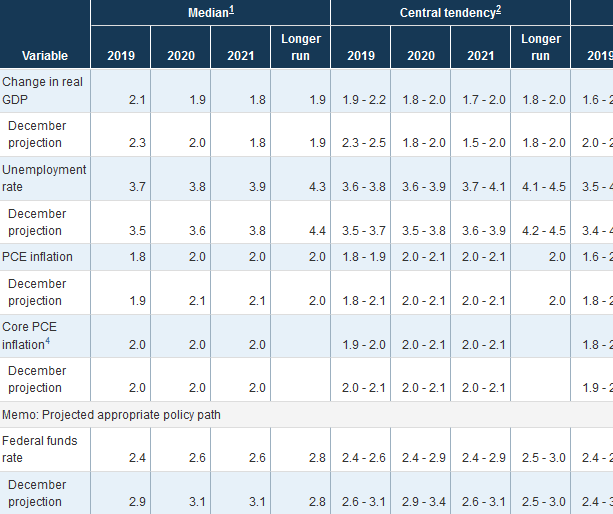

Federal Reserve cuts 2019 GDP forecast to 2.1% vs 2.3% in December

The latest median Federal Reserve forecasts

- 2019 GDP vs 2.3% in December

- 2020 GDP 1.9% vs 2.0% in Dec

- 2021 GDP 1.8% vs 1.8% in Dec

The full statement from the FOMC for March 2019 Wed 20 Mar 2019 18:00:18 GMT

FOMC full statement for March 2019

Information received since the Federal Open Market Committee met in January indicates that the labor market remains strong but that growth of economic activity has slowed from its solid rate in the fourth quarter. Payroll employment was little changed in February, but job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Recent indicators point to slower growth of household spending and business fixed investment in the first quarter. On a 12-month basis, overall inflation has declined, largely as a result of lower energy prices; inflation for items other than food and energy remains near 2 percent. On balance, market-based measures of inflation compensation have remained low in recent months, and survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent. The Committee continues to view sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective as the most likely outcomes. In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; Esther L. George; Randal K. Quarles; and Eric S. Rosengren.