- we should be cautious about fallouts from Russia/Ukraine conflicts

- need to guard against risks of earlier-than-expected normalisation of monetary policy, supply-chain disruptions and rising inflation pressure

- we remain committed to continue with support measures to maintain financial stability and long-term fiscal sustainability

- downside risks to regional economies could cause volatility in financial markets and capital flows

Latest Posts

rssBOJ Summary of April meeting – “yen’s depreciation works positively”

Bank of Japan summary, Headlines via Reuters:

- weak yen is positive for economy when output gap is still big, trend inflation is very low

- must be vigilant to chance of unexpected tail risk triggered by Ukraine crisis

- Japan’s inflation excluding energy remains very low, situation different from US, Europe

- Japan’s consumer inflation likely to move around 2% for time being from April, but price rise exceeding 2% won’t be sustainable

- hard to achieve the BOJ 2% inflation target as the expected rise in inflation is driven by temporary factors

- its crucial that wage hikes, being seen at present by big firms, to spread to small firms in order for broader wages & inflation to rise sustainably

- this is a risk prices may come under downward pressure if medium & long term inflation expectations do not rise sufficiently

- the Bank of Japan much continue to support the economy with its current powerful monetary easing

JP Morgan still appears to be unwavering on liking equities

JPM are not jumping in all bullish on stocks, but they don’t appear to be overly bearish either. This snippet conveying thoughts from their recent ‘Global Markets Confernce’ (held in Paris):

- A majority of investors is not looking to add risk

- but they appear to have already largely de-risked to neutral or short positions

- Only 29% are long and looking to stay long while 18% of those who are long are looking to reduce risk further.

‘Twas another perturbing day for stock market bulls:

Thought For A Day

50 COGNITIVE BIASES

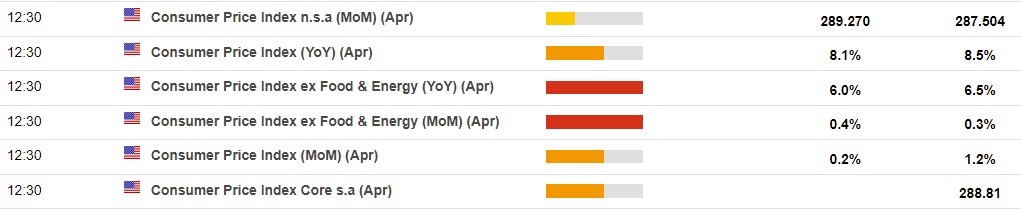

US inflation data is the focus for Wednesday 11 May 2022

US CPI data due today, 1230 GMT:

- This snapshot from the ForexLive economic data calendar, access it here.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the ‘prior’ (previous month) result.

- The number in the column next to that, where is a number, is the consensus median expected.

Some relief is the consensus expectations, snippets from analysts:

Société Générale:

- Seasonally-adjusted gasoline prices are expected to have dropped roughly 5% in April. Home heating and electrical costs should dampen the overall energy price boost to the CPI, but the energy component is key to the 0.2% MoM forecast increase.

- If this is the case, the YoY measure would fall to 8% from 8.5% in March and raise hopes that the CPI peak pace was set last month.

- The unknowns regarding energy price pressures linger, however, so we are calling the peak at 8.5%, noting that conviction rests on oil and gas price developments.

- Core CPI is still expected up 0.4% MoM (5.9% YoY), as rent and shelter components contribute a large share of the index, and they are set for a 0.4% increase.

BNZ:

- The US CPI is the key release tonight. Monthly headline inflation is expected to moderate to 0.2% which, combined with more favourable base effects, is expected to see the annual rate decelerate to 8.1% (from 8.5% previously). Core inflation is expected to increase 0.4% on the month (still too high for comfort for the Fed) but, likewise, base effects are expected to see the annual rate drop to 6% y/y.

NAB:

- consensus expecting little change in inflationary pressure. The Core CPI reading is seen at 0.4% m/m, up from the 0.3% print in March taking the yoy reading to 6.0%, down from 6.5% previously.

ING:

- Consumer price inflation should hopefully show inflation has passed the peak with the YoY rate slowing from 8.5% to 8.3%, and core inflation edging down to 6.1% from 6.5%.

- Lower gasoline prices will be a big help, as will a drop in second-hand car prices as heralded by data from the Mannheim car auctions.

- However, it will be a long slow descent to get to the 2% target. As such, the Fed will continue to hike rates swiftly with 50bp rate hikes expected in June, July and September.

The biggest bubbles in history all popped when the upper channel support was breached… *1929 *2000 *2022?

Fitch – Shanghai lockdown will exacerbate global supply-chain pressure, inflation concerns

An ICYMI from Fitch rating agency overnight, with comments that will take no one by surprise.

In brief:

- The lockdown in Shanghai will exacerbate global supply-chain pressures and inflation concerns

- Restrictions imposed as part of China’s zero-Covid-19 policy have led to a plunge in Shanghai freight traffic volume in April and early May. With fewer trucks operating and Shanghai’s port staff unable to load and unload ships at their usual pace, significant backlogs have built up at the Port of Shanghai.

- Much of this disruption, however, is yet to be reflected in hard global macro data

- As supply-chain disruptions persist, container freight rates could remain elevated or increase. With Shanghai handling around a fifth of China’s port volume and China accounting for 15% of world merchandise exports, shortages of manufactured goods could intensify, adding to existing global inflationary pressures. This channel is likely to outweigh the effect of slower growth in China on global inflation through a weakening of commodity demand and prices.

US major indices closing the day with mixed results NASDAQ rebounds. Dow down. S&P up modestly

The major US indices are ending the day mixed results. The Dow industrial average is down. The S&P index is modestly higher, while the NASDAQ is up nearly 1%. Yesterday the major indices all fell sharply to start the trading week.

A look at the final numbers shows:

- Dow industrial average down -84.986 points or -0.26% at 32160.75

- S&P index up 9.82 points or 0.25% at 4001.05

- NASDAQ index up 114.43 points or 0.98% at 11737.68

- Russell 2000 down -0.29 points or -0.02% at 1761.78

All the major indices had their share of ups and downs today as the market consolidated the sharp declines from yesterday’s trade. The NASDAQ index did trade to a new year low at 11566.28. That took out the low price from yesterday at 11574.94.

The S&P and Dow industrial average also made new 2022 lows. For the S&P, it reached 3958.17 taking out the low price from yesterday at 3975.48. For the Dow industrial average traded to a new low of 31887.89, after trading to a low yesterday of 32121.9.

In after-hours trading Coinbase reporting much worse than expected earnings of -$1.98 vs. expectations of +$0.18. Revenues came in at $1.17 billion vs. expectations of $1.48 billion. Monthly transacting users came in at 9.2 million vs. 9.5 million expected.

The stock is currently trading at $65.07 down -$7.92 or -10.85%. That comes after trading down -$10.52 or -12.6% in the normal trading hours today. Yesterday the stock closed at $83.51.

Year-to-date COIN is down 70.93%. The high for the year was the 1st day of the year at $251.

Thought For A Day