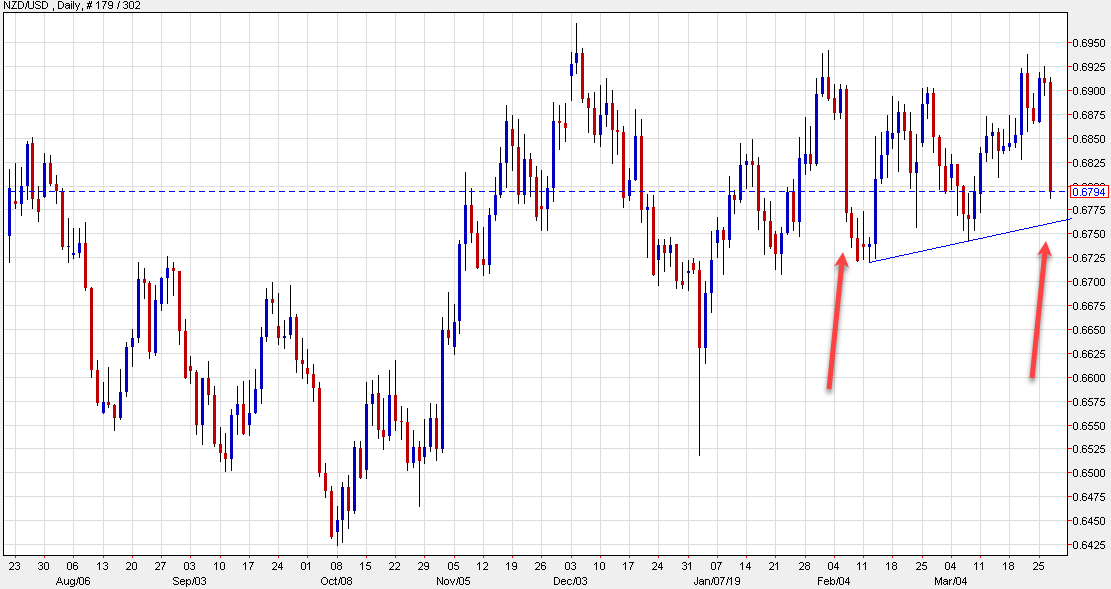

NZD/USD hits a session low

The New Zealand dollar was cut down in Asia-Pacific trading after the RBNZ surprised markets by shifting to an outright dovish bias.

” Given the weaker global economic outlook and reduced momentum in domestic spending, the more likely direction of our next OCR move is down,” the statement said, warning that the global economic outlook had weakened.

NZD/USD immediately fell 100 pips to 0.6810 and has mostly chopped sideways from there but with a negative bias. It has grinded to a fresh low of 0.6787.

Looking at the chart, today’s decline mimics a similar drop on February 6. That was a day when the RBA shifted to neutral from hawkish. Note that NZD continued to fall for a couple more days before finding support at 0.6725, just above the previous low.

It will need to do something similar to halt the decline this time.