Thought For A Day

People’s Bank of China benchmark rates setting.

The LPRs are benchmark lending rates, set on the 20th of each month. 18 commercial banks in China submit their proposed rates to the People’s Bank of China. The LPRs are based on the current rate charged for the PBOC Medium-term Lending Facility (MLF).

Bloomberg (link is gated) carry a report with comments from Eisuke Sakakibara, who was Japan’s vice finance minister from 1997-1999 and thus directed multiple rounds of yen FX intervention. He was gvien the nickname Mr Yen.

Sakakibara is now a professor at Tokyo’s Aoyama Gakuin University. He spoke in an interview on Bloomberg TV:

The report goes on:

Deutsche Bank with their latest SP500 forecast, says it’ll fall to 3,650

DB citing:

DB says that if the labour market can hold up and growth is not hit too hard then they see a year-end rally to 4,700 / 4,800

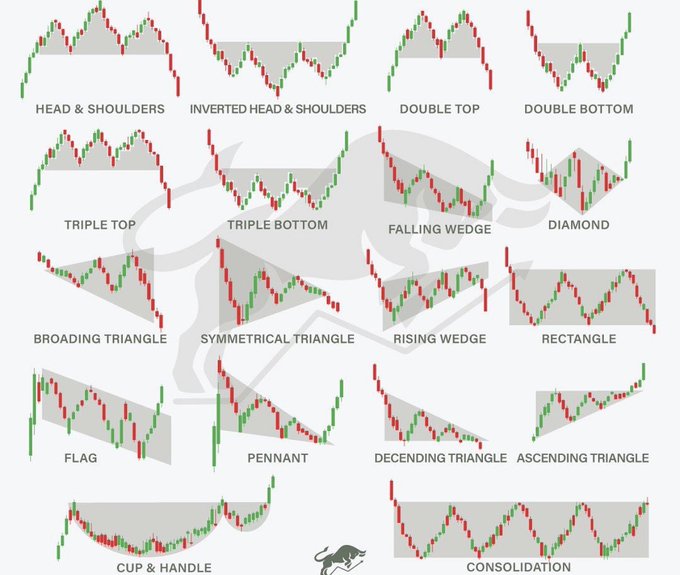

Weekly S&P500 candles:

The major US indices are all closing sharply lower as concerns about the economy and inflation way on values.

Target announced earnings before the open and they came in much weaker than expected as higher costs are starting to eat into the margins. The stock is ending the day down -$53.55 or -24.87%. Ouch.

Share of Target are down 24.5% in the pre-market after missing badly on earnings despite growing revenue and traffic. The story is rising costs.

“Throughout the quarter, we faced unexpectedly high costs, driven by a number of factors, resulting in profitability that came in well below our expectations, and well below where we expect to operate over time,” said CEO Brian Cornell in the earnings release.

They cited costs related to freight, supply chain disruptions, and increased compensation and headcount in distribution centers.

The company can now either try to tame those costs, and some of them are out of their control like fuel. Or they can raise prices to boost margins.

It’s a competitive marketplace so hiking prices could drive consumers to the competition but Wal-Mart is facing the same issue. Its shares fell 11% yesterday on earnings and are down another 1.6% in the pre-market.

Some will point to inventories and the product mix on shelves but seeing as it happened to both TGT and WMT, that’s tough to swallow.

There’s also this from Wal-Mart CEO Doug McMillon:

“The rate of inflation in food pulled more dollars away from [general merchandise] than we expected as customers needed to pay for the inflation in food.”

Food inflation isn’t improving and I strongly suspect that general merchandise prices are going higher. So while overall revenues held up this quarter, it’s not tough to see a further squeeze ahead.

In the bigger picture

This is increasingly looking like a stagflationary environment. The two largest retailers in the US will be raising prices and consumers will increasingly shift to low-margin purchases like food and fuel.

As those price rises filter through it will keep CPI inflation elevated. Yesterday, Fed Chair Jerome Powell laid out his strategy and that can be summed up as “we need to see inflation coming down in a convincing way” before the hiking abates.

To me, these results from WMT and TGT highlight a longer timeline for high inflation and greater risks of a wage-price spiral. The odds that the Fed pauses at 2.5% are dwindling and the chance of 4% Fed funds is rising.