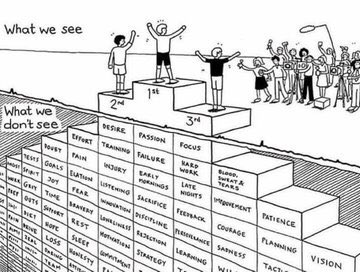

A majority of a trader’s success comes from having the proper mindset. A trader’s mindset requires an understanding of what can and cannot be controlled.

A majority of a trader’s success comes from having the proper mindset. A trader’s mindset requires an understanding of what can and cannot be controlled.

Next week the week will start s him himlowly as the US will be on holiday in observance of Memorial Day. Generally speaking, market activity is lighter on major US holidays although it does not necessarily need to be the case.

Key releases and events include:

Monday, May 30

Tuesday, May 31

Wednesday, June 1

The final numbers are showing:

For the trading week:

Hey… its a good week. The catalyst was the expectation that inflation may have peaked as a result of a slowdown in the housing market and other weaker data. Yields moved lower for 3rd week in a row. The market priced out 3 rate hikes, and are now looking for 2. Fed’s Bostic also said the Fed may look to pause in September and reevaluate.

The major European indices are ending the week with gains on Friday and gains for the week:

the final numbers are showing: