- Crude oil draw of -5.068M vs. -1.35M estimate. Private API showed a draw of -1.2 million

- Gasoline draw of -0.711M vs 0.533M estimate

- distillates draw of -0.530M vs. estimate of 0.990M

- Cushing build of 0.256M vs -1.061M last week

Latest Posts

rssRussia reportedly may agree to OPEC+ compensating for its drop in oil output

This ties back to the earlier headline here, which suggests that Saudi Arabia and UAE are ready to step up to cover for Russia’s shortfall amid ongoing sanctions. If Russia is on board, that may very well finally see a significant change in stance by OPEC+ for the first time in a while now.

The source also says that any compensation could be approved gradually and that there is no guarantee that it will be approved in full later in the day. For some context, Russia is currently producing roughly 1 mil bpd below its quota.

Eurostoxx futures +0.3% in early European trading

- German DAX futures +0.2%

- Spanish IBEX futures +0.4%

I wouldn’t look too much into it as the light advance so far today comes after a poor showing yesterday. US futures are also looking fairly more tepid so risk sentiment isn’t exactly brimming with optimism to start the session.

S&P 500 futures, Nasdaq futures, and Dow futures are all up 0.1% and are keeping little changed mostly since Asia trading.

Fitch affirms China ratings at ‘A+’ with stable outlook

They affirmed China’s ratings at ‘A+’, supported by factors including the country’s robust external finances. Adding that they forecast activity to recover in 2H 2022 and for China’s economy to grow by 5.2% next year.

That said, they are seeing increasing downside risks to its forecast for the Chinese economy to be able to grow by 4.3% this year.

Swiss inflation, Eurozone producer prices on the agenda in Europe today

A bit of a reminder that London is out today (and also tomorrow) amid the spring bank holiday and Platinum Jubilee holiday. The former typically falls on the final Monday of May but has been moved to stick with the Platinum Jubilee holiday, which will take place tomorrow. With UK markets closed, that may make for thinner and quieter trading in the session ahead.

However, a return to the familiar may see markets act up a little more before we get to US trading later. For now, trading tones are more muted with little change being observed in equities, bonds, and FX.

Oil is a notable mover though, down 2% to just below $113 currently after Saudi Arabia said that they may increase output to make up for Russia’s shortfall amid sanctions. That will keep things interesting going into the OPEC+ meeting later today.

In terms of economic data, there won’t be much in Europe to really shake things up. As such, expect markets to continue to sort out their feet in the new month with the recognisable storm clouds looming large still.

0630 GMT – Switzerland May CPI figures

0900 GMT – Eurozone April PPI figures

1130 GMT – US May Challenger job cuts, layoffs

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.

Société Générale says tail risk from Russia’s war on Ukraine make EUR virtually unbuyable

- EUR/USD is undervalued relative to the current economic data and monetary policies, while the long-term outlook is clearly positive. The war in Ukraine and the coronavirus pandemic are both forcing a rethink in regards to fiscal policy -one that can break the deadlock which has left the ECB as the sole source of economic support over the past decade. A more active fiscal policy and an escape from super-low inflation could allow for a retreat from the negative rates that have anchored the currency. The real effective euro exchange rate has been almost 10%lower on average during the past decade than it was in the one prior to it,”

- “In a post-war world,EUR/USD is more likely to trade in a 1.10-35 range than the 1.03-1.26 one it has been in since the start of 2015.Despite that,we think the euro is virtually unbuyable because the tail risks from the war are so big.The EUR/USD could fall by as much in a few days if gas supplies were to be cut off,as it would rise if the war were to remain in a stalemate at the end of six months.”

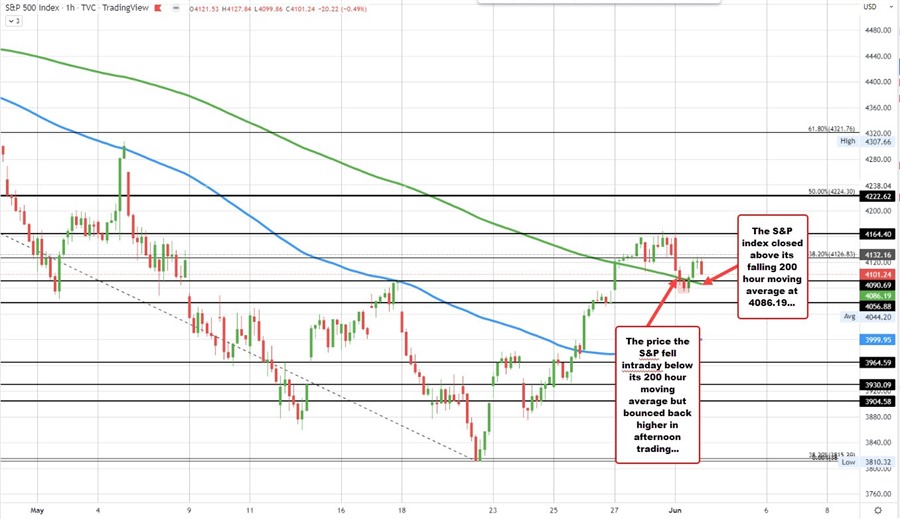

US major indices close lower for the 2nd consecutive day

The major US stock indices all moved lower for the 2nd consecutive day this week. The shortened week due to the Memorial Day holiday on Monday on pace for declines with 2 days left to go. Much will depend on Friday’s US jobs day, but for now, the sellers are trying to take more control.

Having said that, the S&P index, and the Dow industrial average both traded intraday below their respective 200 hour moving averages, but are closing above those levels after a US afternoon rebound. For the S&P index, the 200 hour moving average comes in at 4086.19. The closing price is at 4101.24.

The Dow industrial average’s 200 hour moving average comes in at 32671.12. It’s closing price is up at 32813.22.

A look at the final numbers are showing:

- Dow industrial average -176.91 points or -0.54% at 32813.22

- S&P index -30.92 points or -0.75% at 4101.24

- NASDAQ index -86.92 points or -0.72% at 11994.47

- Russell 2000-9.218 points or -0.49% at 1854.82

Within the S&P index 10 of the 11 sectors were lower.

- Financials fell -1.7%.

- Healthcare was down -1.42%.

- Consumer stable’s fell -1.32%

- Real estate fell -1.1%

- Materials fell -1.03%

The only sector with a gain was energy which rose 1.76%

Thought For A Day

European equity close: UK stocks drop 1% ahead of the holiday

- UK FTSE 100 -1.0%

- Stoxx 600 -1.0%

- German DAX -0.3%

- French CAC -0.8%

- Italy MIB -0.9%

- Spain IBEX -0.7%

Stocks in Europe opened in positive territory and briefly returned there a couple hours ago but the final two hours of trade were met with relentless selling. That’s not a promising sign for the new month.

US dollar loses ground against the commodity currencies

The US dollar has been under some broad pressure since New York rolled in. There’s a bid in bonds and S&P 500 futures are up 20 points so the backdrop is conducive to USD selling.

Taking advantage are the commodity currencies with both AUD and CAD at session highs.

AUD/USD is up 43 pips to start the new month. I noted earlier this week that June is a positive seasonal month for the Australian dollar. The gains today to 0.7219 mark the best levels since May 4.

CAD is benefiting from a rebound in oil above $116. Crude was knocked through $114 yesterday on a report of fracturing or a potential removal of Russia from OPEC+. Today a report said OPEC’s technical committee had trimmed the 2022 oil market surplus forecast, which could be a precursor to pumping more. Though with a surplus forecast, you’d still expect them to show restraint.

In any case, the loonie is benefiting now but it’s all about the Bank of Canada decision at 10 am ET.