Archives of “US Market” category

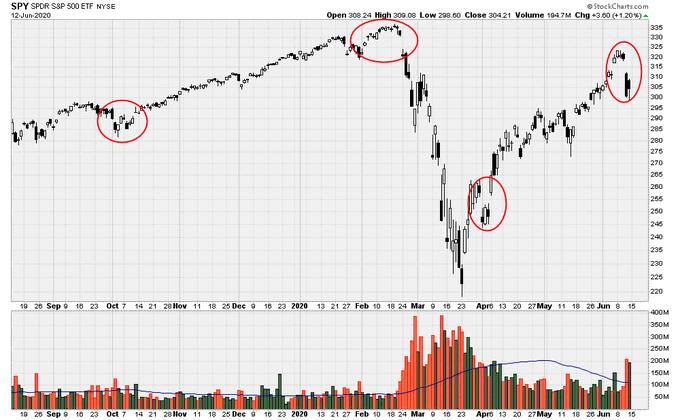

rssThe S&P 500 formed an island reversal this week.

Notice that every other island formed this year led to a major reversal.

Stocks rally into the close but still off highest levels

Stocks have worst week in 3 months

The major stock indices rallied into the close but are still selling off the highest levels.

- The stocks have the worst week in 3 months

- Dow and S&P have their 1st positive day after 4 days down

- stocks rebounded after the plunge on Thursday

a snapshot of the major indices at the close shows:

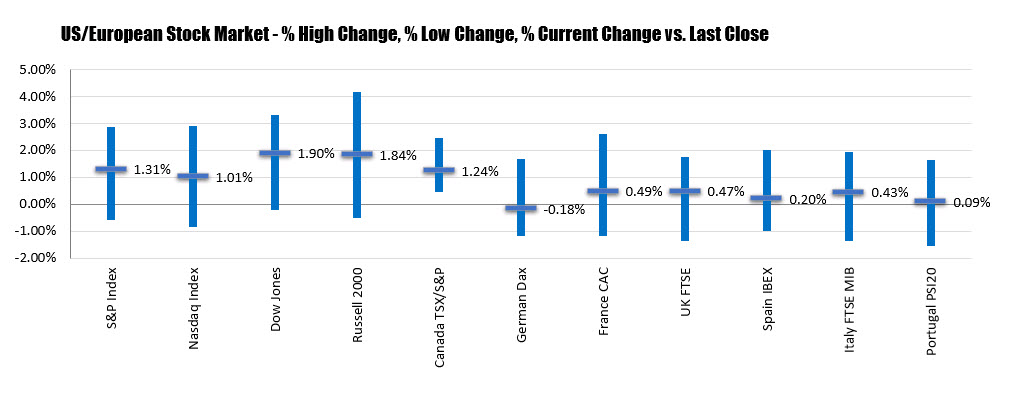

- S&P index +39.21 points or 1.31% at 3041.31

- NASDAQ index rose 96.02 points or 1.01% at 9588.80

- Dow rose 477.37 points or 1.9% at 25605.54.

Although higher, the gains were well off the highs but also well off the lows (closing around mid range).

- S&P index was up as much as 2.88% but was as low as -0.59%

- Nasdaq index was up as much as 2.91% but was as low as -0.83%

- Dow was up as much as 3.33% but was as low as -0.20%.

Below are the % high, low and closes for the major NA and European indices for today.

For the week, the major indices all fell with the Dow the weakest.

For the week, the major indices all fell with the Dow the weakest.- S&P, -4.78%

- Nasdaq, -2.3%

- Dow, -5.55%

Nasdaq trading volume (50 DMA)

Major indices have worst day since March 16th.

Dow and S&P down for the 3rd day in a row

The major indices had there worst day since March 16 as concerns about the growth prospects and increases in coronavirus cases weigh on equities. Initial jobless claims should another 1.5 million increase which certainly did not help.

- The Dow is closing at the lowest level since May 27.

- The Dow and S&P are down for the 3rd day in a row

- all 30 of the Dow stocks close lower with Boeing the weakest at -16.42%

- worst day since March 16 for the major indices

- The NASDAQ index snapped it’s a 4 day win streak

- Dow and S&P on track for its worst week in 3 months

- S&P index closes below its 200 day moving average at 3013

- the Dow industrial average is within 300 points of a 10% decline from the high (24824 is the level)

- the Dow industrial average fell back below its 100 day moving average at 25123.55, but is closing just above that level at 25128.13

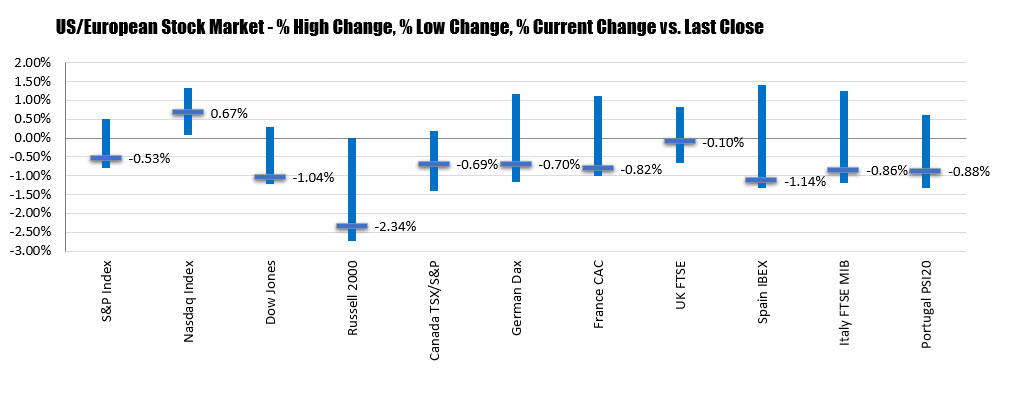

The final numbers are showing:

- S&P index -188.04 points or -5.89% up 3002.10. The low for the day reached 2999.49. The high was way up at 3123.53

- NASDAQ index fell -527.62 points or -5.27% to 9492.72. That was just above the low for the day at 9491.30. The high was up at 9868.02

- The Dow industrial average fell 1861.82 points or -6.9% to 25128.13. The low for the day reached 25082.72. The high was up at 26294.08

big losers today included:

- Boeing, -16.42%

- United Airlines, -16.09%

- Delta Air Lines, -14.01%

- Citigroup, -13.37%

- Schlumberger, -11.60%

- Southwest Airlines, -11.58%

- Marriott, -10.91%

- Fiat Chrysler, -10.10%

- Bank of America, -10.0%

- Ford Motor, -9.9%

- Wells Fargo, -9.83%

- PNC financial, -9.62%

- Goldman Sachs, -9.14%

- IBM, -9.12%

- J.P. Morgan, -8.37%

The pattern of airlines and financials are chief among the biggest decliners today.

The biggest gainer in the Dow 30 today was Walmart which only fell by -0.87%. Procter & Gamble was the next best performer with a -2.41% decline.

Were there any winners today?

- Zoom increase by 0.54%

US stocks close mixed but off highs

NASDAQ index closes at a record level

The US stocks are closing the session with mixed results and well off the highs for the day. Both the S&P index and the Dow industrial average is closing near their session lows.

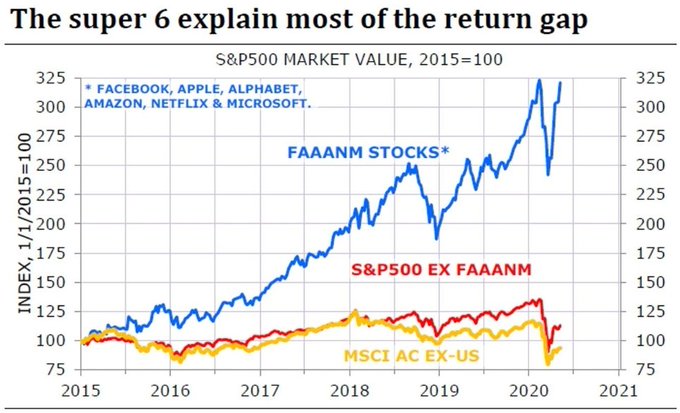

The NASDAQ index led the way and was the only major indices in Europe or the US to close higher. It also closed at a new all-time record high. Amazon, Microsoft, and Apple all closed at record high levels.

The S&P index and the Dow industrial average fell as financial slumped. Boeing shares were lower once again falling by 6.14% on the day.

The final numbers are showing:

- S&P index minus 17.04.4 -0.53% at 3190.14

- NASDAQ index up 66.595 points or 0.67% at 10020.34

- Dow industrial average fell -282.31 points or -1.04% at 26989.95/

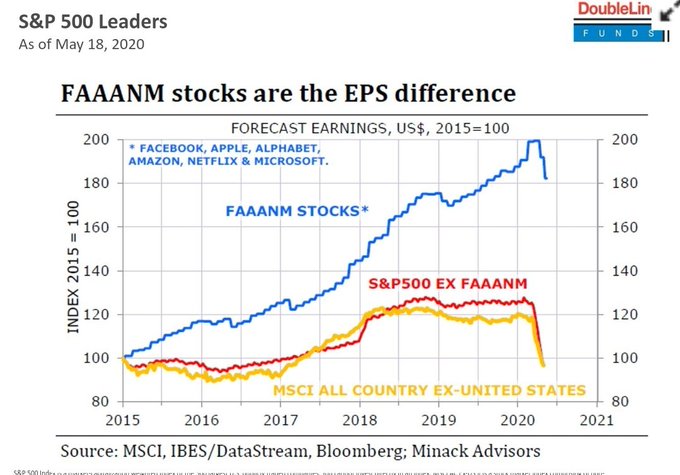

FAAANM benefits have sustained the S&P 500 for the past several years.

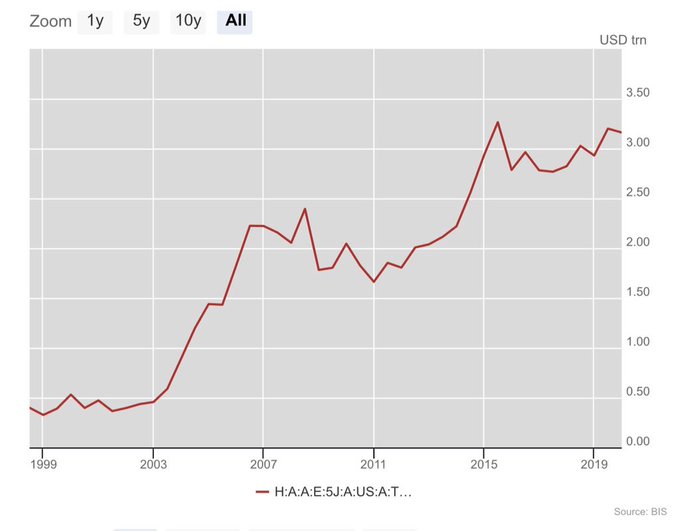

$3 trillion dollars in US equity-linked derivatives (Q4 2019)

Mixed day for the US indices today. NASDAQ trades at 10000 for the 1st time

S&P and Dow stay negative all day. Nasdaq closes at new record and trades 10K

The US major indices close mixed today with the Nasdaq leading the way. The S&P index and the Dow ended lower and never generated enough upside momentum to get above the closes from yesterday. Recall the S&P closed in the black for the year for the 1st time since the tumble in February. That momentum could not be sustained today

The Dow closed down for the 1st time after 6 straight trading days higher (most and 9 months).

S&P closed down for the 2nd time in 8 days.

The NASDAQ index closed at a record level and surpassed the 10,000 level for the 1st time.

Amazon and Apple closed at record levels.

A look at the final numbers shows:

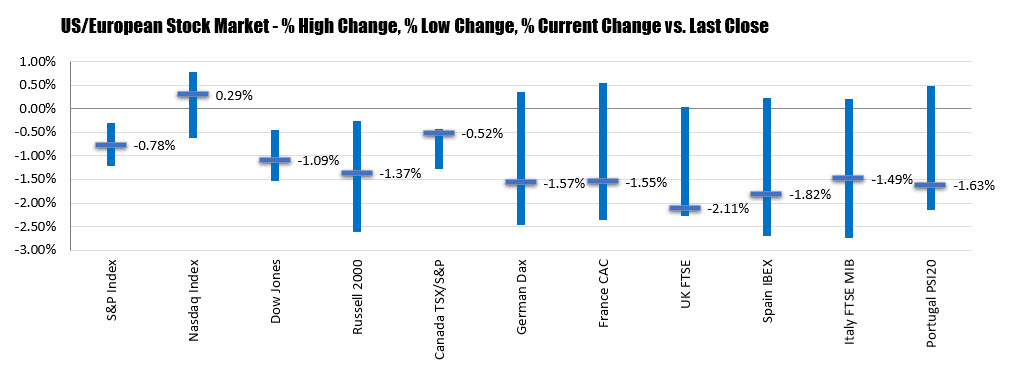

- S&P index fell by -25.21 points or -0.78% at 3207.18

- NASDAQ index rose by 29.009 points or 0.29% at 9953.75

- Dow industrial average fell by -300.14 points or -1.09% at 27272.38

Below are the percentage changes and percentage closing levels for not only the North American indices, but also European indices. The European indices all closed sharply lower with the UK FTSE falling by -2.11%.

US stocks finish at the highs of the day as the euphoria continues

The gains continue as the S&P 500 erases the losses for the year

- S&P 500 up 38 points, or 1.2%, to 3232

- DJIA up 445 points, or 1.65%, to 27,512

- Nasdaq up 110 points, or 1.1%, to 9924

The expanding the Main Street program is another sign that they’re not even thinking about taking away the punch bowl. Powell’s pedal is on the floor and equity markets are falling in love.

What’s utterly crazy is that retail has led this rally with hedge funds on the sidelines. Now they’re forced to FOMO.

With the S&P 500 now in positive territory for the year, the next stop is the February all-time high near 3400.