Except stock markets

- Yen crosses are the lows, including USD/JPY down 42 pips to 107.60

- Gold at the highs, up $16 to $1515

- US 10-year yields down 5.4 bps to 1.73%

What seemed to be a negative catalyst for stocks was a report that a White House official commented that tariffs on China could go as high as 50 to 100%. That spooked the market and prices started to ratchet lower.

After the close FedEx is reporting weaker than expected earnings on the top and bottom lines and lowers expectations going forward. First-quarter revenues $17.05 billion versus $17.06 billion estimate. Earnings per share $3.05 versus $3.15 estimate. They see fiscal year EPS at $11-$13 versus estimates of $14.73. They cite trade tensions for the decline. FedEx after the close is trading down sharply at $160.36. That is down from the closing level of $173.55

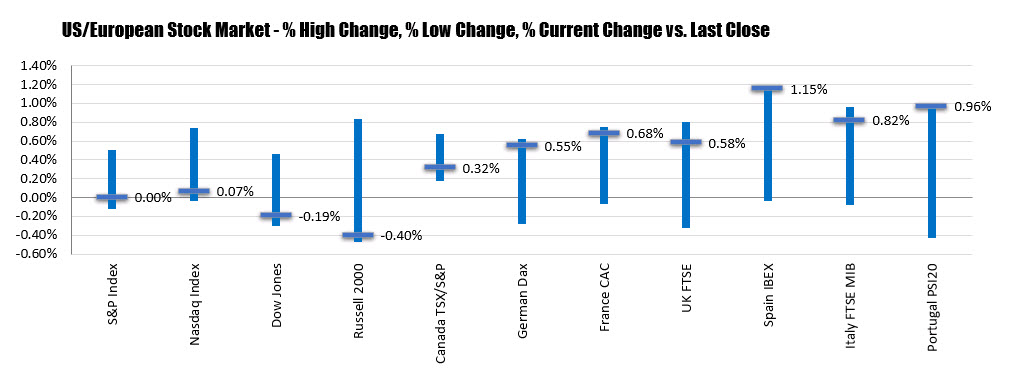

Wall Street advanced on Wednesday with the S&P 500 closing above 3,000 for the first time since late July as a rally in tech and healthcare boosted US stocks and investors kept an eye on trade developments. The S&P 500 was up 0.7 per cent, edging closer to a fresh record high, led by healthcare and tech which were both up more than 1 per cent. The Dow Jones Industrial Average rose 0.9 per cent, its sixth consecutive daily rise and its longest winning streak since June. Meanwhile, the Nasdaq Composite gained 1.1 per cent, eyeing its first advance in four days. Apple shares gained more than 3 per cent with the tech company’s market capitalisation climbing back above the $1tn mark on Wednesday as investors cheered its lower-priced iPhone 11 and Apple TV+ subscription. Investors are also looking ahead to key central bank meetings.

The European Central Bank is expected to cut interest rates and detail plans for stimulus measures when it concludes its meeting on Thursday. Next week, investors expect the Federal Reserve to deliver a 25 basis-point rate cut. President Donald Trump on Wednesday renewed his attack on the Fed, calling for the “boneheads” at the central bank to cut interest rates to zero or lower. Trade was also on the agenda as China on Wednesday moved to exempt 16 types of US-exported goods from import tariffs ahead of the latest round of trade talks. The State Council’s tax regulator will next look to further expand exemptions on US goods and release follow-up lists when they are ready, it said.

The moves in US markets followed gains in Europe, where the Stoxx 600 rose 0.9 per cent and the Frankfurt-based Dax added 0.7 per cent, while London’s FTSE 100 climbed 1 per cent. Overnight in Asia, the Topix climbed 1.7 per cent, extending the Japanese benchmark’s positive streak into a fifth day. Hong Kong’s Hang Seng gained 1.8 per cent, lifted by a strong showing from banks including HSBC and Standard Chartered and local developer stocks. In commodities markets, oil prices fell sharply after a report that Mr Trump discussed easing sanctions against Iran. Brent, the international oil marker, reversed its gains and fell 2.1 per cent to $61.08 a barrel, while West Texas Intermediate, the US benchmark, was down 2.4 per cent to $56.03 a barrel. Sovereign bonds extended their sell-off, with the yield on the US 10-year up 4.2 basis points to 1.7437 per cent. The German Bund rose 0.5 basis points to minus 0.562 per cent. Yields move inversely to price.

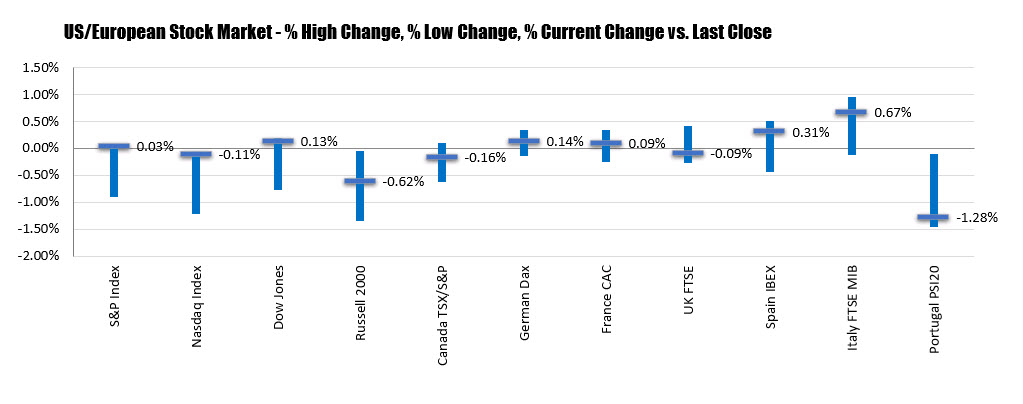

Wall Street closed mostly flat on Tuesday with a decline in tech shares weighing on stocks, as investors await updates on stimulus measures from major central banks in the coming days. The S&P 500 closed fractionally higher, erasing earlier losses in the final minutes of trading, as the tech sector fell 0.5 per cent and energy shares jumped 1.3 per cent Meanwhile, the Nasdaq Composite ticked about three points lower. Robust gains for Boeing and Caterpillar helped the Dow Jones Industrial Average notch a 0.3 per cent rise.

The decline in tech comes as investors reacted to Apple’s annual hardware event on Tuesday, where the company revealed details of its latest iPhone models and its upcoming TV+ streaming video service. Apple was up 1.2 per cent, but shares in Netflix and Roku suffered in response to a cheaper-than-expected price point for TV+. Investors sold off US government debt, sending yields higher. The yield on the benchmark 10-year Treasury note was up 11.8 basis points at 1.7402 per cent. Meanwhile, in Europe, the Stoxx 600 was up 0.1 per cent, the Xetra Dax was up 0.4 per cent, and the CAC 40 advanced 0.1 per cent. The European Central Bank is expected to cut interest rates and detail plans for stimulus measures when it concludes its meeting on Thursday. Next week, investors expect the Federal Reserve to deliver a 25 basis-point rate cut at its monetary policy meeting. In the UK, Boris Johnson lost his second attempt to hold a snap general election to break Britain’s Brexit impasse. While the prime minister has vowed not to delay Brexit beyond October 31, the anti-no-deal legislation agreed by parliament received royal assent from the Queen at her Balmoral castle retreat in Scotland on Monday. Sterling fluctuated and recently rose modestly to $1.2355, while the FTSE 100 close with a 0.4 per cent gain.