US equity performance on Friday

- S&P 500 up 13 points to 3329 or +0.4%

- DJIA +0.2%

- Nasdaq +0.3%

On the week:

- S&P 500 +1.9%

- DJIA +1.8%

- Nasdaq +2.3%

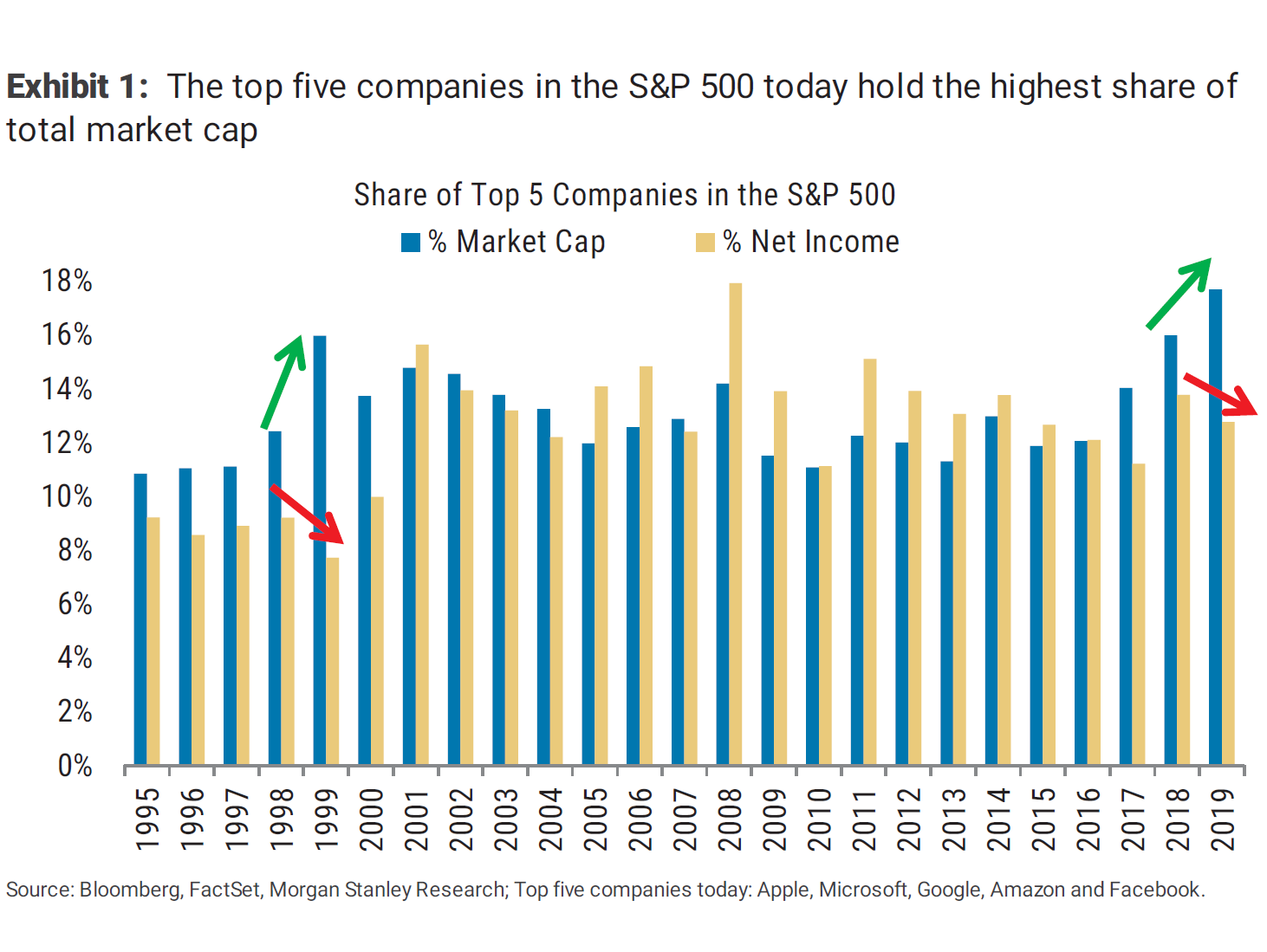

The gains have been non-stop in large caps but it hasn’t been quite the same party in small and mid-caps. I’ll be watching the Russell 2000 in the weeks ahead as it approaches resistance.