Major indices are all in the black

The major European stock indices are ending the day with solid gains, helped by decreased attention in Hong Kong, increasing hope for US/China relations, less no-deal risk for the UK, and more dovish Fed officials (the ECB is set to act in September too).

The provisional closes are showing:

- German DAX, +0.94%

- France’s CAC, +1.21%

- UK’s FTSE, +0.60%

- Spains Ibex, +0.61%

- Italy’s FTSE MIB, +1.58%

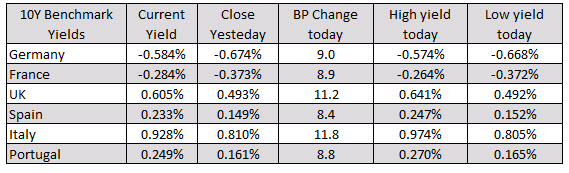

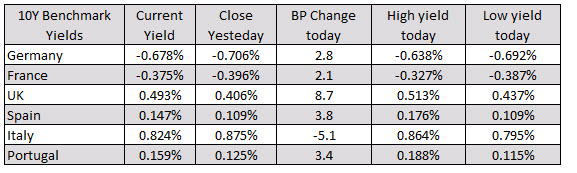

In the benchmark 10 year note sector in Europe, yields are higher as well (with the exception of Italy).

In other markets as London/European traders look to exit:

- spot gold is near unchanged at $1547. The high price reached $1550.23. The low extended to $1533.93

- WTI crude oil futures are up $2.25 or 4.17% at $56.17. That is near the high price for the day at $56.22. The US impose tighter sanctions on Iran today.

In the US stock market major indices are enjoying solid gains as well. A snapshot of the market currently shows:

- S&P index 27 points or 0.93% at 2933.22

- NASDAQ composite index is up 84 points or 1.07% at 7958.13

- Dow Jones industrial average is up 212 points or 0.81% at 26329.70

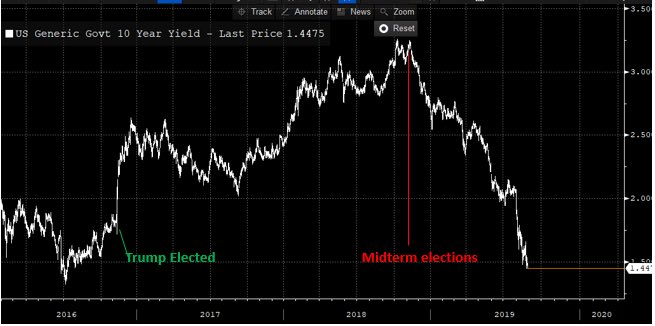

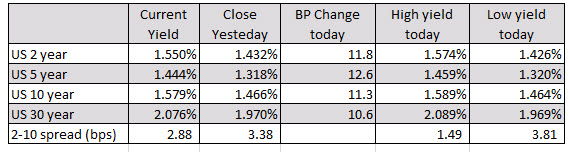

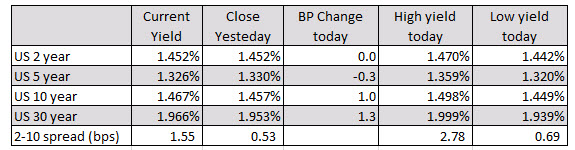

US yields have come off high levels and trade mixed with the longer and up marginally and the shorter end unchanged or down marginally:

A snapshot of the forex market shows that the GBP is still the strongest of the majors (but off earlier higher levels). The JPY and USD remain the weakest. The CAD has gotten stronger on stronger oil and a was dovish Bank of Canada statement.

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: A snapshot of the forex market shows that the GBP is still the strongest of the majors (but off earlier higher levels). The JPY and USD remain the weakest. The CAD has gotten stronger on stronger oil and a was dovish Bank of Canada statement.

A snapshot of the forex market shows that the GBP is still the strongest of the majors (but off earlier higher levels). The JPY and USD remain the weakest. The CAD has gotten stronger on stronger oil and a was dovish Bank of Canada statement.