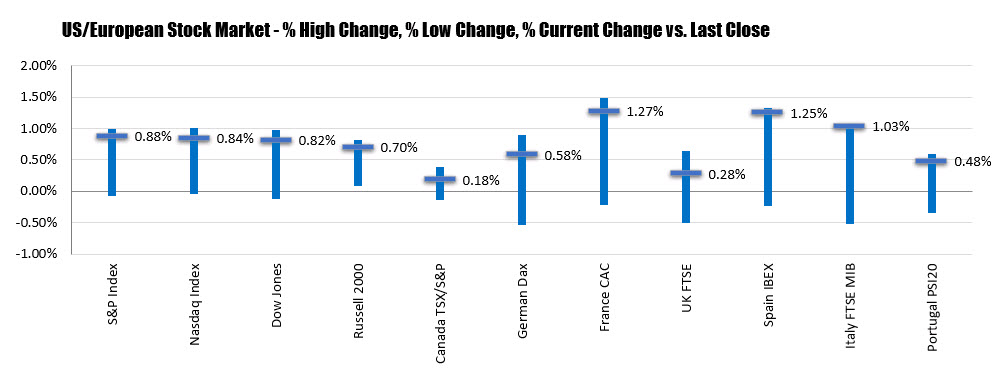

Ouch. European shares take a beating.

The European major indices are closed and the provisional closes are not looking good. The major indices are all beaten down by 2%-3% declines.

The provisional closes are showing:

- German DAX, -2.5%

- France’s CAC, -2.9%

- UK’s FTSE, -3.2%

- Spain’s Ibex, -2.7%

- Italy’s FTSE MIB, -2.8%

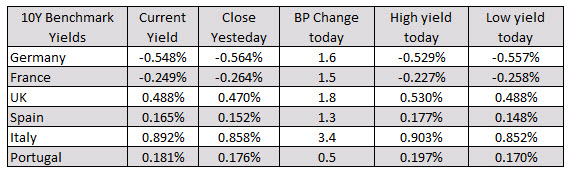

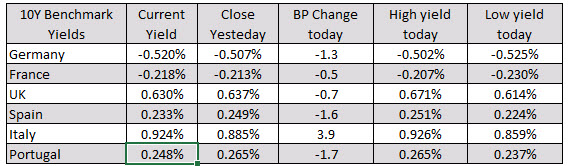

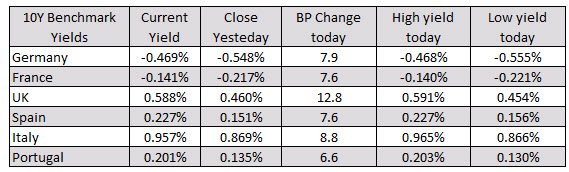

In the European debt market, the benchmark 10 year yields are ending the session higher, but off the highest levels of the day. Below is a snapshot of the current yields, changes and high low yields.

US stocks are also down sharply and trading near lows.

- S&P index, -1.91%

- NASDAQ index, -1.75%

- Dow industrial average, -2.0%

In other markets:

- spot gold is surging and back above the $1500 level. The price is up $22.34 or 1.51% at $1501.50.

- WTI crude oil futures is trading down $1.35 on expectations of slower growth. That is down 2.5% at $52.28. The inventory data showed a higher build then expectations today

In the forex, the JPY remains the strongest currency on flight to the relative safety of the JPY. The CAD has taken over as the weakest. The USDCAD is now trading back above its 200 day moving average at 1.3288.

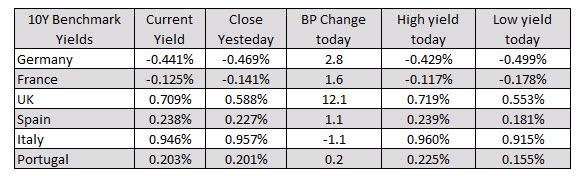

In the European debt market, yields have soared higher with the UK yield up the most at 12.8 basis points on hopes for a successful Brexit deal. The German yield is up 7.9 basis points. France’s yields are up 7.6 basis points.

In the European debt market, yields have soared higher with the UK yield up the most at 12.8 basis points on hopes for a successful Brexit deal. The German yield is up 7.9 basis points. France’s yields are up 7.6 basis points.

.jpg)