Nasdaq up over 35% on year

- S&P index rose 9.41 points or 0.29% to 3230.70

- NASDAQ index rose 26.611 points or 0.30% to 8972.60

- Dow rose 76.1 points or 0.27% to 28538.24

In other markets as European traders exit:

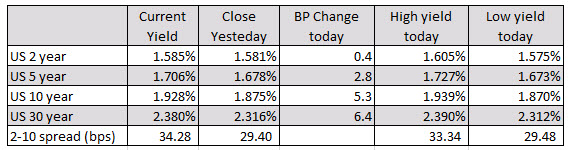

In other markets as European traders exit:US yields are also higher with the yield curve steepening. The 2 – 10 year spread has widened out to 34.28 basis points from 29.4 basis points on Friday.

For the week the major indices are also closing higher:

Japanese stocks continued to retreat on the week as investors continue to stay more cautious amid fading trade optimism with little else to go on in the new year.

German DAX -0.9%. UK’s FTSE near unchanged. Italy’s FTSE MIB +0.4%

The major European shares are ending the day with mixed results:

The provisional closes are showing:

German DAX, -0.9%

France CAC, -0.4%

UK’s FTSE 100, unchanged

Spain’s Ibex, -1.1%

Italy’s FTSE MIB, +0.4%

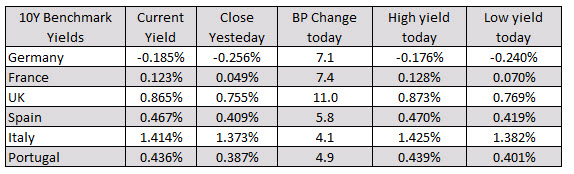

In the European 10 year note sector, the benchmark yields are lower with the UK 10 year leading the way to the downside at -5.8 basis points. France’s 10 year is trading just above the 0.0% level.

German DAX -0.9%. UK’s FTSE near unchanged. Italy’s FTSE MIB +0.4%_

In other markets:

Spot gold is little changed at $1476.40, plus $0.22

WTI crude oil futures are up $0.74 or 1.23% at $60.95

In the US stock market the Dow has turned back positive as Boeing has recovered from earlier losses and is trading up on the day.

Boeing has the largest weighting in the Dow at 7.85%. As a result, it can have a material impact on the fortunes of the index. Boeing shares are up 0.78% currently. Although Boeing shares are higher the European supplier shares are sharply lower in trading today.

S&P index is up 1.32 points or 0.04% at 3192.84

NASDAQ index trading down -2.7 points or -0.03% at 8811.34

The Dow is up 38 points or 0.13% at 28274.

In the US debt market, the yields are mixed with the shorter and lower and the longer and higher (the yield curve steepening)

US yields are mixed with the yield curve steepening

In the forex market, the CHF is the strongest of the majors, while the GBP remains the weakest. The GBP has extended its decline to the downside against the major currencies since the start of the New York session.