The Nikkei posts its lowest close since October last year

Asian stocks are mostly following Wall Street’s lead lower today but the losses have been managed by the calmer mood in Chinese equities and US futures so far on the day.

The Shanghai Composite is keeping near flat levels as Chinese stocks are somewhat holding up amid hopes for more stimulus measures to bolster the economy. Meanwhile, US futures are up by ~0.4% on the day and that is easing the pressure on risk.

USD/JPY has also crept higher towards 110.38 currently but the near-term bias continues to favour sellers for now as price sits under the 200-hour moving average @ 110.68.

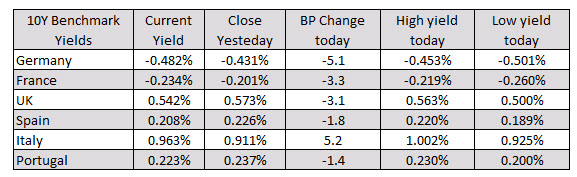

The overall risk mood is somewhat mixed going into European trading, with Treasury yields mixed across the board near flat levels mostly. 10-year yields are at 1.355%, just a hiccup away from potentially falling below 1.30%.