Down day but it could have been much worse

The late recovery in US futures and equity indices in the region helped to see the Nikkei shave off the heavier losses sustained during the session, but the index still closes lower by 6% after the bloodbath seen in Wall Street overnight.

On the week, the Nikkei is down by 16% while the Hang Seng – down by 3.6% today – is down by over 10.5% on the week. Chinese equities are among the “better” performers with the CSI 300 index down by just 1.6% today and 6.1% on the week.

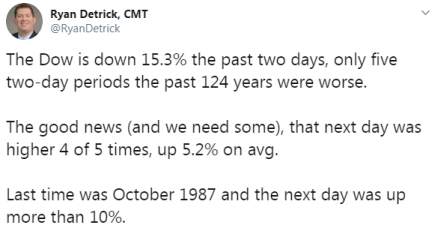

For trading today, just keep in mind that sharp moves in the market tend to be accompanied by retracements more often than not. But that doesn’t mean that the worst is over.