A rough day for Japanese stocks amid holidays elsewhere in Asia

The drop reflects the softer mood in Wall Street yesterday, and also sentiment from US futures in trading so far today. E-minis are down by about 1.4% currently.

It is very much light trading on the day, with markets in China, Hong Kong, and Singapore among those that are closed. The same will apply to most parts of Europe with only London being the notable center that is open for business in the session ahead.

In the major currencies space, the aussie and kiwi are still keeping on the defensive with the dollar trading more mixed against the rest of the bloc.

AUD/USD is down by 0.8% to 0.6460, backing further away from its 100-day moving average.

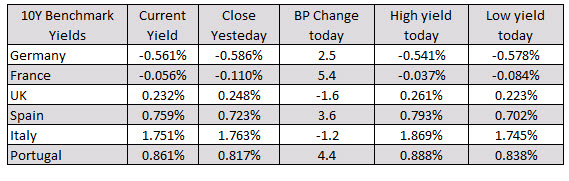

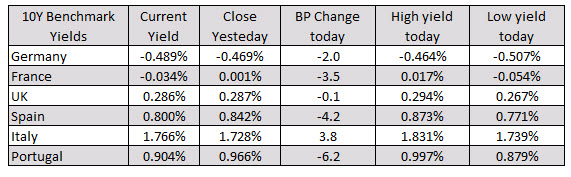

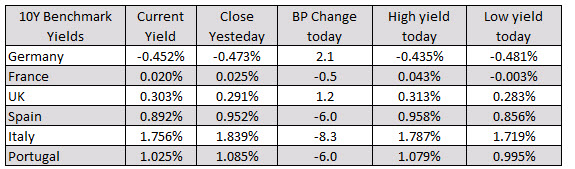

In the European debt market, the the benchmark 10 year yields were mixed with Germany and UK yields up while France, Spain, Italy, and Portugal yields lower.

In the European debt market, the the benchmark 10 year yields were mixed with Germany and UK yields up while France, Spain, Italy, and Portugal yields lower.

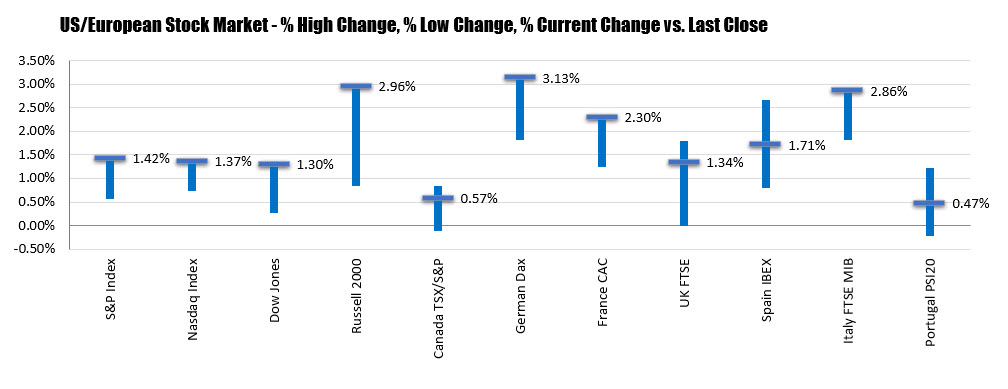

In other markets:

In other markets: