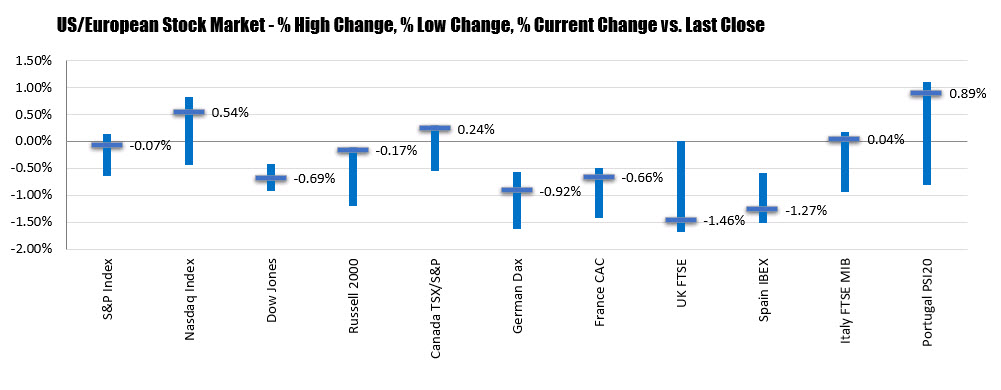

UK FTSE outperforms

- German DAX, -1.06%

- France’s CAC, -1.25%

- UK’s FTSE 100, -0.10%

- Spain’s Ibex, -1.02%

- Italy’s FTSE MIB, -0.7%

In other markets as European traders look to exit:

- spot gold is trading up $6.05 or 0.34% at $1808.82. The low extended to $1790.79. The high for the day is near current levels at $1809.74

- WTI crude oil futures are trading up $0.31 or 0.77% at $40.41 for the August contract. The September contract is also higher by $0.33 or 0.82% at $40.65

- S&P index up 12.8 points or 0.41% at 3168.16

- NASDAQ index down 2.6 points or -0.02% at 10391.16

- Dow industrial average up 288 points or 1.11% at 26374

If you take a look at the chart below you can see that the Nasdaq has a high blended forward P/E ratio just around the 10 mark compared to the other major indices listed. The forward P/E ratio uses future earnings guidance rather than trailing figures.

If you take a look at the chart below you can see that the Nasdaq has a high blended forward P/E ratio just around the 10 mark compared to the other major indices listed. The forward P/E ratio uses future earnings guidance rather than trailing figures.

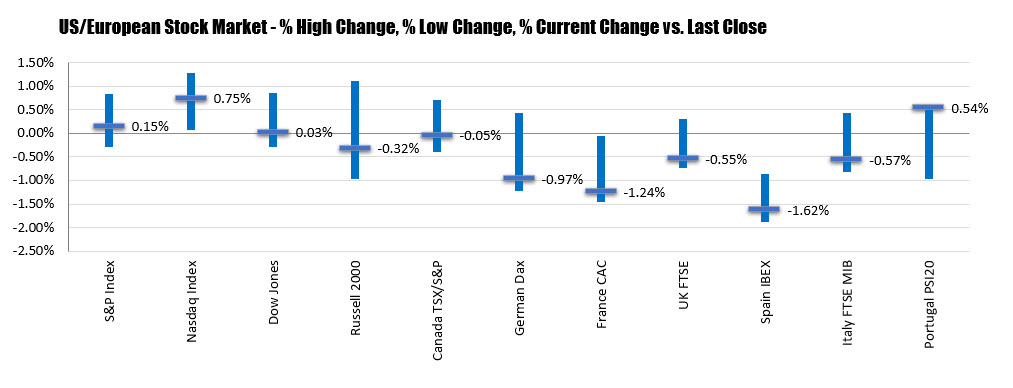

In the US market, the NASDAQ index remains higher. The S&P index did move into the black briefly, but the Dow industrial average remains negative on the day at -0.69%. The S&P index and NASDAQ index are on a 5 day winning streak.

In the US market, the NASDAQ index remains higher. The S&P index did move into the black briefly, but the Dow industrial average remains negative on the day at -0.69%. The S&P index and NASDAQ index are on a 5 day winning streak.