Erase yesterday’s modest gains

The major US indices are ending the day lower, erasing the modest gains from yesterday:

- German DAX, -0.4%

- France’s CAC, -0.2%

- UK’s FTSE 100 -0.3%

- Spain’s ibex -0.9%

- Italy’s FTSE MIB -0.7%

in other markets as London/European traders look to exit for the day:

- Spot gold is up $4.50 or 0.23% $1794.56

- spot silver is down $0.24 or -1.04%

- WTI crude oil futures are down -1.13% at $67.58

- The price of bitcoin is down over $2100 at $46,892

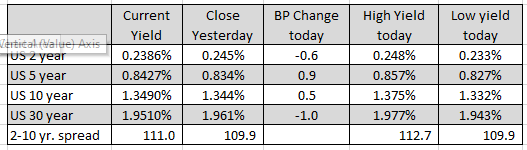

In the US debt market, yields remain tied to the unchanged to plus or -1 basis point:

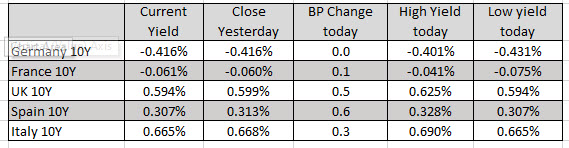

In the European debt market, the benchmark 10 year yields are also modestly changed with gains of less than one basis point across the board: