Client note from GS overnight, in summary:

- A global recession is likely to see falling US yields alongside falling US stocks

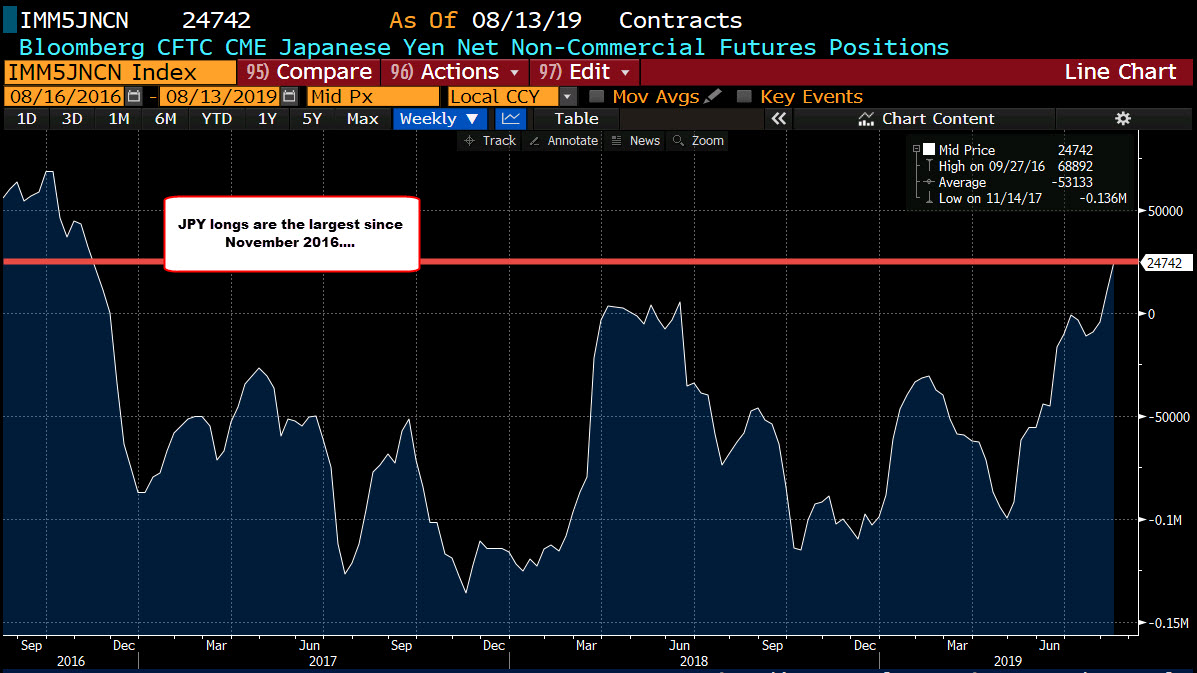

- USD/JPY the most likely pair to weaken

GS cite

- US/yen falls during risk-off periods as investors move into the safe-haven yen

- BOJ yield curve control policy fixes nominal yields in Japan, thus a US yield fall makes a more favourable Japan / US differential

(hmmmm …. the BOJ have allowed JGB yields to drift lower …. and regardless, while the differential might improve as GS suggest its still positive for US assets. Anyway, back to GS … )

- not expecting a global recession in the near term

- but do not a a drop in activity ex-US

Other trades GS like in the event of a global recession when US stocks drop:

- long AUD/CLP, EUR/PLN,

- short NOK/SEK, EUR/CZK and EUR/CAD