Comments by China premier Li Keqiang, via state television

- Will push forward with yuan market-based reform

- Will keep yuan basically stable within a reasonable, balanced range

Mood in Beijing about #trade deal is pessimistic, government source tells me. China troubled after Trump said no tariff rollback. (China thought both had agreed in principle.) Strategy now to talk but wait due to impeachment, US election. Also prioritize China economic support.

In a client note detailing the trends to keep an eye out for next year, strategists at the firm view that the dollar is to be hit by stronger global growth outside of the US and dwindling portfolio inflows.

.jpg)

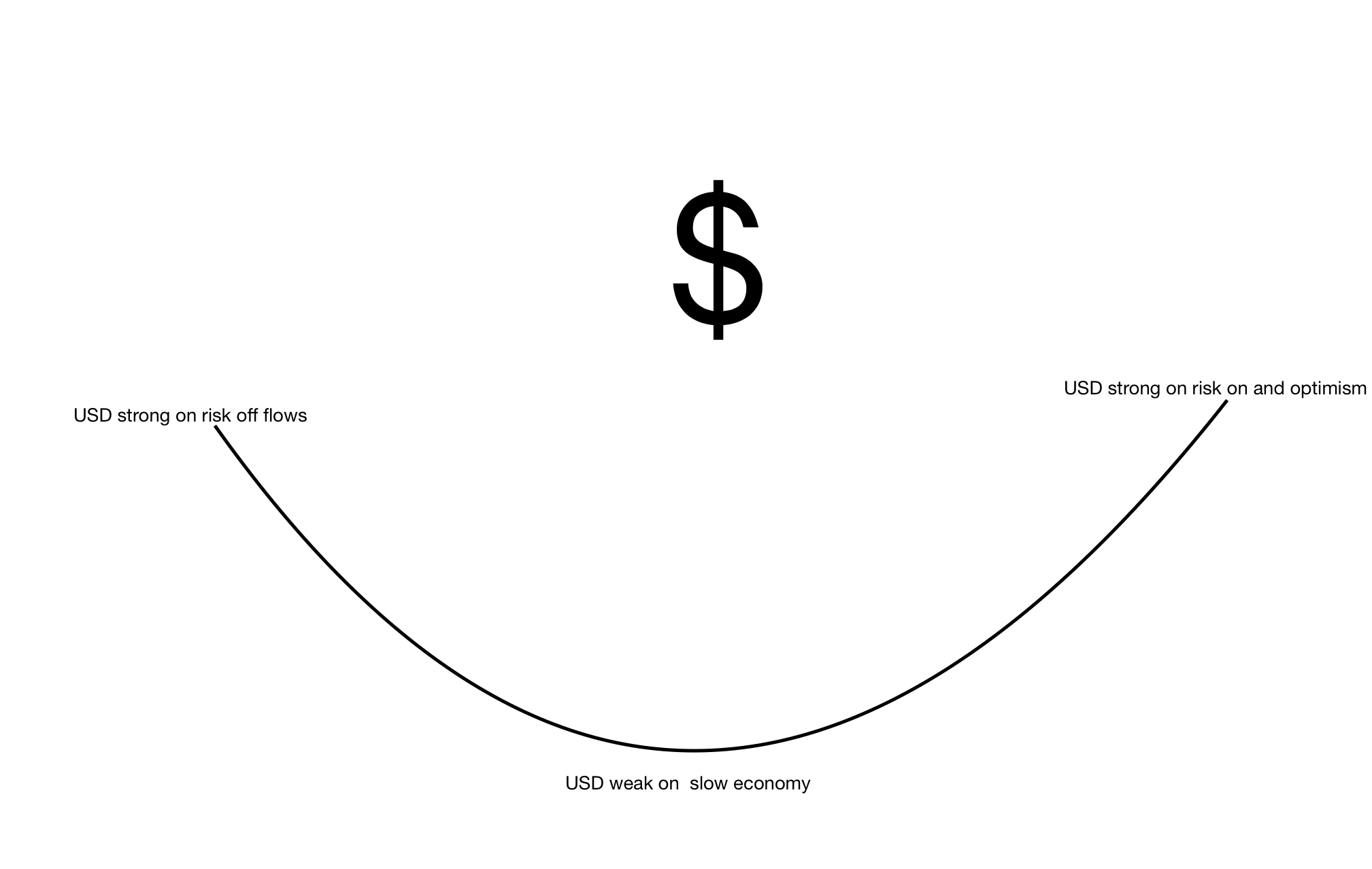

Dollar moves can be tricky to understand at times., as the USD is pushed and pulled by different forces. The dollar is the most widely traded currency, with 70% of all transactions dollar based on a day to day basis. The dollar smile theory was outlined by Stephen Jen, a former currency strategist and economist at Morgan Stanley. He said that understanding the currency movements of the dollar can be illustrated with a smile. That ‘smile’ consists of three distinct reactions:

Reaction 1: Risk off: Dollar rises

The left side of the smile shows that the U.S. dollar benefits from risk off moves. During times of global concern the USD is considered a safe haven along with the Swiss franc and the yen.

Reaction 2: Economic slowdown and recession

The middle part of the smile. When the Fed begins to reduce interest rates the USD falls. The demand for the USD is reduced and so the USD alls

Reaction 3: Economic growth and risk on

The right part of the smile is when the USD gains value on a hawkish fed and a risk on environment. In an optimistic environment investors are willing to take more risks. The USD gains on higher GDP growth and expectations that the Fed will be increasing interest rates.