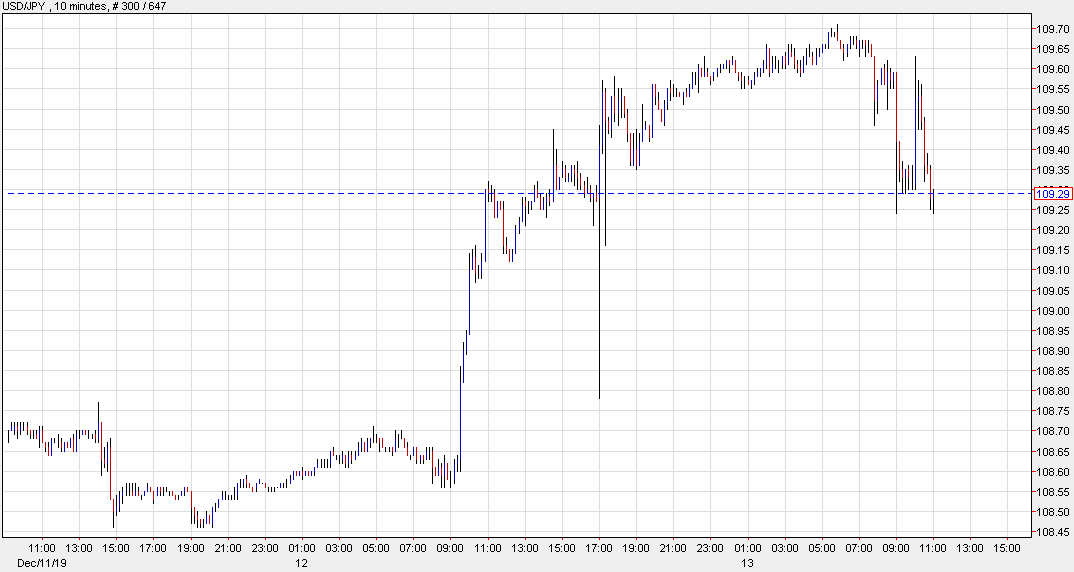

GBP/USD climbs above 1.34 and is perhaps looking at the 1.35 level now

The pound has surged ahead with a jump of nearly 300 pips on the headline earlier and is now possibly looking towards the 1.3500 level against the dollar next.

Looking at the chart, price is running into some resistance from the 61.8 retracement level @ 1.3453 though so perhaps that may help to limit gains for now.

Going into the exit poll, my bias was that an overwhelming majority should see cable run up the March highs of 1.3381 and the 1.3400 level. I reckon perhaps we could see price action consolidate around these levels amid some retracements over the next hour.

But if anything, keep an eye on resistance at 1.3453 and the key psychological level – 1.3500.

The exit poll has had a prescient track record in recent years but do be reminded that this year the election may be one of the tightest ones yet. As such, we’ll see how the actual results compare and if there is more potential for further moves in the coming hours.

Just remember, it is not over until the fat lady sings (actual results declared).

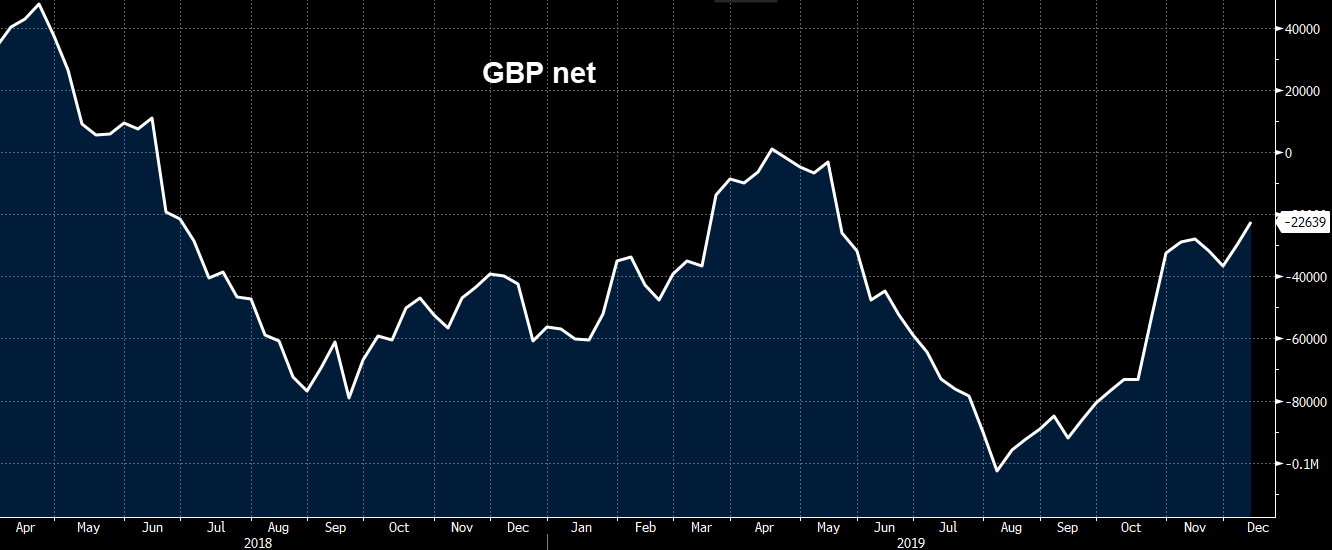

Early bids have helped push the pound to a high of 1.3181, closing in on the May high of 1.3185 as we get into what will be a crucial week for the pound.

Early bids have helped push the pound to a high of 1.3181, closing in on the May high of 1.3185 as we get into what will be a crucial week for the pound. We can see that buyers are looking poised for a key upside break after closing last week above the 100 and 200-week moving averages. This week, the 50.0 retracement level @ 1.3168 will be a key level to watch out for but it all depends on the election outcome.

We can see that buyers are looking poised for a key upside break after closing last week above the 100 and 200-week moving averages. This week, the 50.0 retracement level @ 1.3168 will be a key level to watch out for but it all depends on the election outcome.